In a recent survey, 78% of respondents in risk, fraud, and compliance roles say they believe artificial intelligence (AI) is a force for good.

These teams face growing volumes of data and increasingly complex expectations from regulators and stakeholders, especially in industries like financial services. AI can help manage that complexity.

It can do this by helping professionals improve accuracy, reduce manual work, and navigate shifting requirements with greater confidence.

In this article, we’ll explore top AI innovations for risk management that are redefining how companies approach risk in today’s high-stakes environment.

8 AI Breakthroughs Transforming Risk Management in 2025

The pressure on risk and compliance teams isn’t easing up. Financial services organizations face tighter regulations, rapidly evolving threats, and data from every direction.

That means many companies are hitting the limits of what traditional tools can handle. Below are the innovations with the greatest AI impact on risk management in the financial sector.

1. Predictive Risk Analytics

In banking and finance, delayed reaction often means lost capital. Predictive analytics helps companies stay ahead by analyzing market trends, portfolio behavior, credit risk indicators, and macroeconomic variables in real time. Incorporating advanced charting tools and market-signal systems, including frameworks such as Wyckoff distribution, can further strengthen this analysis by highlighting shifts in price structure and liquidity conditions that may precede larger market movements.

AI models trained on both historical data and real-time feeds can identify early signs of credit defaults, liquidity gaps, or compliance breaches.

This gives risk teams more time to act and more confidence in their forecasts. These models are especially valuable for monitoring mortgage loans, where early shifts in payment behavior or mortgage rate sensitivity can signal portfolio-level risks long before they appear in traditional reports.

2. Intelligent Automation

Regulatory pressure across financial services continues to intensify, especially in areas like anti-money laundering (AML), Environmental, Social, and Governance (ESG), and Know Your Customer (KYC) reporting.

AI can automate much of the compliance burden by tracking jurisdiction-specific rule changes, cross-referencing policies, and triggering alerts when gaps appear.

Automation helps teams adopt new mandates faster and stay aligned across multiple global offices. This reduces both overhead and regulatory exposure.

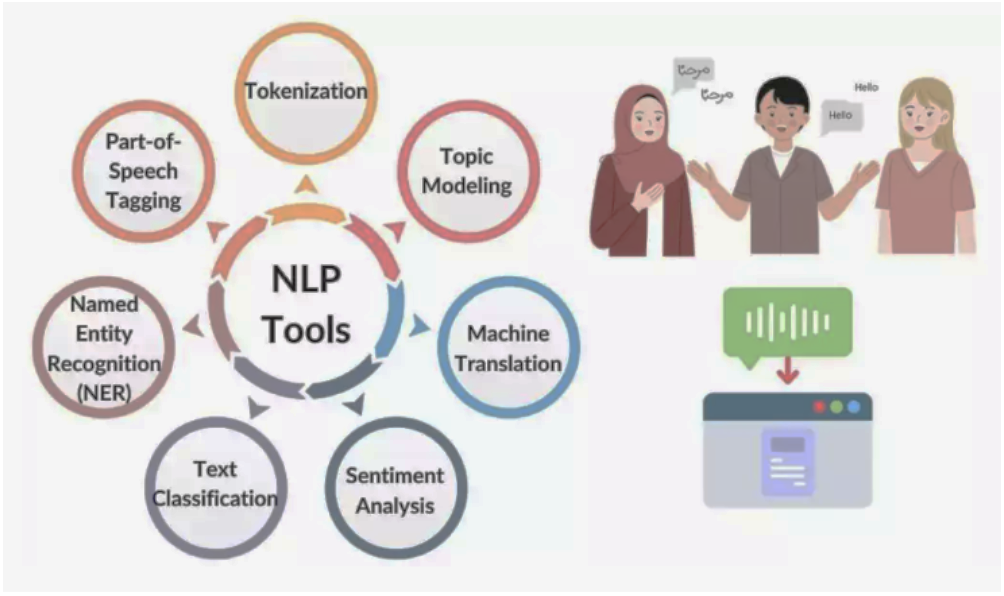

3. Natural Language Processing

Natural language processing (NLP) tools are helping legal and compliance teams keep up with regulatory changes.

Image Source

They can parse through regulatory bulletins, enforcement updates, and legal documents to extract actionable insights and guidance.

Whether interpreting Basel IV updates, SEC filings, or MiFID II requirements, NLP tools provide faster, clearer visibility into what’s changing and what it means for internal operations.

4. AI-Powered Fraud Detection Systems

Financial fraud tactics are getting more sophisticated. 62% of institutions in the United States reported a rise in sophisticated fraud tactics.

But even though fraudsters are getting smarter, so are the AI tools that can catch them. Machine learning (ML) models monitor real-time transaction data across customer accounts, payment systems, and digital channels. This helps detect anomalies that may signal fraud, phishing, or account takeovers. When combined with a Zero Trust platform, these insights are enforced in real time—continuously verifying user identity, device health, and access context rather than relying on perimeter-based trust.

And the best part is, these systems continue to learn and adapt. As a result, organizations can reduce false positives while catching irregularities that rule-based systems often miss.

5. AI-Driven Scenario Planning and Stress Testing

Banks and investment firms are using AI to simulate extreme market conditions and assess how portfolios, liquidity positions, and capital buffers would respond. These simulations are increasingly being used in broader project portfolio management strategies to observe how geopolitical changes or rising interest rates might simultaneously affect the ROI and risk profile of each active project.

Maybe it’s a rapid interest rate shift. Perhaps it’s geopolitical instability. Or maybe it’s a cybersecurity issue. AI-powered stress testing enables firms to run granular “what-if” models and build more resilient contingency plans.

6. Cognitive Search

When a compliance breach or internal incident occurs, time is critical. Cognitive search tools speed up investigations by pulling together communications, transactional records, audit logs, and policy documentation.

In fraud investigations or internal audits, this helps financial institutions respond swiftly, document thoroughly, and meet regulatory deadlines. Similar automation benefits can also be seen in AI tools for eCommerce, where AI is widely used to streamline operations, reduce manual effort, and scale decision-making across large datasets.

AI-Augmented Third-Party Risk Assessments

Vendors and partners present growing risks to data security, regulatory requirements, and reputation. AI tools now perform evaluations on third parties using new sentiment, credit ratings, cyber risk indicators, and ESG metrics.

In addition, engaging security awareness training companies such as Adaptive Security can help financial institutions strengthen human-factor defenses by training employees to recognize and respond to AI-generated phishing, deepfakes, and other social engineering threats, turning human risk into a mitigated asset.

Scoring vendors based on these factors gives financial institutions a more complete picture of external risks. So, they can proactively mitigate exposure before issues surface. Many teams are also using Data Security Posture Management to continuously monitor how vendors handle sensitive information and make sure every integration meets security and compliance standards.

7. Generative AI

In a highly regulated industry, documentation matters. Generative artificial intelligence tools like ChatGPT are helping risk teams and compliance officers streamline internal reporting, draft clear policies, and summarize key insights from audits and assessments.

These tools generate content that’s tailored to specific reporting formats, such as board reports, regulatory disclosures, or internal memos. As a result, these ensure consistency across business units.

8. Adaptive AI Models

Potential risk in financial services evolves daily, from algorithmic trading anomalies to shifting ESG disclosure rates. Adaptive AI models retrain on new data regularly, which ensures they remain relevant as conditions change.

Using them in credit modeling? Operational risk scoring? Or to ensure you have a secure cybersecurity system in place? These systems can help your business stay one step ahead by responding in real-time.

Conclusion

Every risk function is under pressure to do more but with less time, tighter budgets, and rising complexity.

Artificial intelligence offers a direct way to meet those demands with better accuracy and less manual strain.

For financial institutions looking to remain resilient, efficient, and competitive, now is the time to invest in AI innovations for risk management that can scale with the pace of change.

Interesting in learning more about AI? Visit The AI Journal for more posts.

FAQs

How is AI used in risk management?

In risk management, AI can:

- Detect patterns

- Predict potential threats

- Automate compliance tasks

- Monitor transactions for fraud

- Analyze large volumes of data

This supports faster, more accurate decision-making.

What is the role of artificial intelligence in financial risk management?

AI systems help financial institutions assess credit risk, detect fraud, forecast market volatility, and comply with evolving AI regulations. It improves speed, accuracy, and scalability in evaluating complex financial data and responding to emerging risks.

What business value can AI add to risk management?

AI reduces operational costs, improves decision-making speed, enhances risk prediction, and increases regulatory compliance.

It allows teams to act proactively, streamline reporting, and adapt to risks with greater efficiency and confidence.

Will risk managers be replaced by AI?

No. AI will enhance risk managers’ capabilities but won’t replace them. It handles routine tasks and complex data analytics. This lets professionals focus on strategic decision-making and oversight.

What is intelligence risk management?

Intelligence risk management framework is a process that involves using data-driven insights from AI and machine learning. This helps organizations proactively identify, monitor, and respond to risks.

Britney Steele

Born and raised in Atlanta, Britney is a freelance writer with 5+ years of experience. She has written for a variety of industries, including marketing, technology, business, finance, healthcare, wellness, and fitness. If she’s not spending her time chasing after three little humans and two four-legged friends, you can almost always find her glued to a book or awesome TV series.