For most companies, the first chapter of generative AI adoption; where generative AI refers to artificial intelligence systems that autonomously generate new content, ideas, or data by learning patterns from extensive datasets – has usually read like a cost-containment story, where automation promises to do the same work with fewer people, in less time, at a fraction of the expense. In the eyes of many, it is a provocative narrative, especially for organizations under constant margin pressure. But in my opinion, it’s become a bit of a stale narrative, because with every major technological shift in modern finance, the real value will not come from efficiency alone. It will come from how intelligently those efficiencies are reinvested.

The numbers tell one story (accounting). The future tells another (finance).

The defining metric for this new era is not just Return on Investment (ROI), which is traditionally a financial ratio that measures the gain or loss from an investment relative to its cost. I propose a distinction: Return on Intelligence (ROi). Here, ROI remains the conventional financial metric. ROi, as I define it, measures how effectively an organization turns machine-augmented insights into higher-order productivity, smarter capital allocation, and prolonged competitive advantage. With ROi, the focus shifts to the organizational impact arising from intelligent insight implementation, not merely bottom-line returns. We are not saving time. We are buying judgment.

The Mirage of Cost Savings

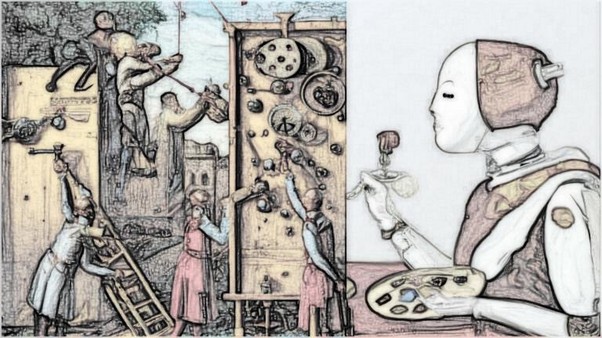

When calculators first entered accounting departments, they did not make accountants redundant; they made them strategic. I recall the tales of the “great calculator” from my career at Hewlett-Packard in 2006. The legacy of this invention continued to linger in the hearts and minds of the ‘Old Guard’. Anyway, Generative AI now sits at the same inflection point, but across every function of the enterprise. The time saved by automation is valuable, but it is not valuable in itself. It is the raw material for reinvestment.

Today, most business cases frame AI through the narrow lens of cost avoidance. As an accountant, I get it. These cases report hours saved, workflows compressed, or headcount efficiencies achieved. These are useful metrics, but they reduce friction rather than expand potential. Efficiency shrinks costs; economics grows value. As a CFO (and somewhat of a nerdy futurist), maybe I see more. Viewing AI only as an expense-reducer misclassifies it as a consumable rather than a compounding asset. And if we stop at efficiency, we stop short of progress.

From Labor Productivity to Capital Productivity

In classical growth theory, productivity -not austerity – drives prosperity. Robert Solow’s “productivity paradox” of the 1980s captured this truth: we often see technology everywhere except in the economic statistics. The paradox dissolves only when organizations adapt their structures to deploy new forms of capital effectively.

Generative AI increases labor productivity – the output per hour of human work. It also amplifies capital productivity – output per dollar of invested knowledge, data, and structure. AI does this by reducing cognitive transaction costs, improving forecasting, and allowing knowledge to compound across time and teams. Each force widens the enterprise’s productive frontier, which a CFO manages.

The AI Value Creation Flywheel

AI’s value follows a flywheel sequence, not a straight line. It starts with cost savings; automation freeing time and resources. Reinvesting that dividend builds productivity. Workflows speed up, cycles compress, and outputs rise without a proportional increase in input. Then comes knowledge leverage: AI codifies the judgment, tone, and logic of decision-making into reusable capital. Organizations learn faster because intelligence becomes explicit and scalable.

As knowledge compounds, capital allocation improves. Decisions gain depth, becoming more analytical and less political. Organizations and CFOs can shift from static budgeting to dynamic capital deployment, reallocating resources in real time as data evolves. Over time, compounded intelligence builds a structural advantage – a competitive moat rooted in learning velocity. The enterprise becomes a self-reinforcing engine of insight.

The smartest firms won’t just learn faster. They’ll forget slower.

Redefining ROI as ROi

Traditional ROI models assume a linear relationship between investment and return. Return on Intelligence breaks that assumption. It measures decision quality; speed, accuracy, foresight, and coherence – relative to the resources invested. Each dimension affects enterprise value nonlinearly. A small improvement in pricing, compliance, or forecasting can impact millions of dollars in outcomes.

ROi is to enterprise performance what stress-testing is to financial stability. It mirrors prudential thinking in banking – ensuring both resilience and profitability. One of my law professors, Dr. Anat Keller, drew a parallel: systems need intelligence buffers as banks need capital buffers. In volatility, cognitive agility becomes solvency.

Governance and Fiduciary Oversight

From a legal and governance perspective, AI is no longer a purely technical matter. Boards, audit committees, and CFOs are beginning to confront fiduciary questions that resemble those once applied to financial instruments. How should AI-generated insights be validated and disclosed? And at what point does reliance on an algorithm become a material governance risk? If an AI system influences reported financial results, what are the obligations under emerging disclosure regimes?

The EU’s forthcoming AI Act and ISO 42001 are early signals that regulators view AI governance through a prudential lens, akin to operational-risk management. The “three lines of defense,” long used in banking supervision, may soon find an analog in algorithmic oversight. For CFOs, that means AI governance will be measured not only by compliance but by accountability architecture: clear ownership, auditability, and control.

Governance is what remains when the hype fades.

Reinvesting the Efficiency Dividend

Cost savings don’t create value until redeployed for growth. A legal team using AI to cut review time can double throughput or focus on higher-value work. Operations saving on maintenance can reallocate funds to analytics or sustainability. Finance automating reconciliation can focus on scenario modeling and strategy. Value lies not in what’s removed, but in what freed resources enable.

This discipline turns AI from a line-item project into a flywheel of capital reallocation. The CFO ensures every efficiency gain is recycled into higher-yield intelligence, not just absorbed as margin.

A CFO’s Imperative: From Stewardship to Strategy

CFOs once managed capital, liquidity, and compliance. Now, they also manage cognition—keeping decision systems explainable, auditable, and aligned. The discipline that governed risk reports must now govern algorithms. It’s a natural shift: from financial to intellectual capital, from monetary to informational liquidity.

The balance sheet now has a mind of its own.

Organizations mastering this shift will treat intelligence as an asset class. They will track its yield, hedge its volatility, and rigorously report its impact. Markets will reward decision efficiency – the rate at which insight drives enterprise value.

From Automation to Augmentation

AI stories often focus on machines replacing people. The more accurate view, especially for leaders and regulators, is augmentation. Generative AI extends what people do well -synthesis, reasoning, judgment – while taking over repetitive work. The result is not less humanity, but greater leverage on it.

Each technological epoch has forced a rethink of governance. The loom gave us labor law; the joint-stock company gave us securities regulation; the computer gave us data protection. Generative AI will gradually demand its own governance paradigm; one that fuses financial prudence with ethical foresight. CFOs and lawyers will most likely share this frontier. Arguably, the next revolution will be written in code and conscience.

Conclusion: The Balance Sheet of Intelligence

Executives often ask, “What’s the ROI of AI?” The better question – the one that will separate transient efficiency from durable advantage – is “What’s the intelligence return on every dollar we deploy?” Firms that measure and reinvest that return will find themselves building something more powerful than cost control. They would build wiser balance sheets – so organizations that don’t just spend smarter but think smarter. In the end, wisdom compounds faster than capital.

References

- Keller, Anat. Legal Foundations of Macroprudential Policy. Cambridge: Intersentia, 2020.

- MIT Sloan Management Review. The AI Value Chain, 2024.

- Accenture. AI Reinvestment Index: From Efficiency to Intelligence, 2025.

- Goldman Sachs Global Investment Research. Generative AI and the Productivity Frontier, 2024.

- OECD. AI and the Future of Corporate Governance, 2025.

- European Commission. Artificial Intelligence Act (Final Text), 2024.

- ISO/IEC. 42001:2023 — Artificial Intelligence Management System Standard.

- NIST. AI Risk Management Framework (AI RMF 1.0), 2023.

- McKinsey & Company. State of AI 2025.

- Solow, Robert M. “We’d Better Watch Out.” New York Times Book Review, July 12, 1987.