AI-driven anti-money laundering and terrorism financing solution provider Silent Eight announced in a company press release that it has raised $9m in a new round of early-stage funding.

The successful funding round was led by OTB Ventures and had participation from Koh Boon Hwee, Chairman and General Partner of Altara Ventures as well as SC Ventures.

Martin Markiewicz, Founder, and CEO at Silent Eight explained what the business’s goal was by saying: “Every bank and every financial institution aims to provide a bespoke customer experience in a secure and seamless way. As financial criminals get savvier in their techniques, our team’s goal is to provide a unique solution that prevents them from endangering the global economy and profiting from those most vulnerable. We are very encouraged to see our investors’ confidence in our product, and we are proud to support our clients in their continued diligence to make the world safer.”

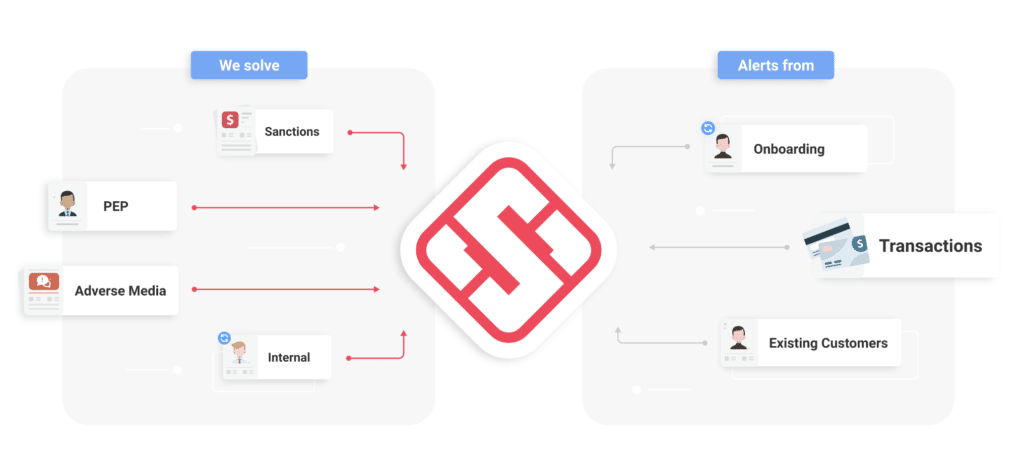

Founded in 2013, the AI-driven anti-money laundering and terrorism financing solution provider was born out of a desire to help solve the human cost of financial crime. Silent Eight uses machine-learning technology to screen financial transactions against sanctions lists, criminal records, court cases, and other public and private data.

The AI-powered platform offers a number of solutions to enable its customers to combat money laundering and terrorist financing, with what it explains to be an auditable technology process to allow transparent compliance with new regulatory obligations and economic sanctions.

Last year alone, global financial institutions highlighted they faced approximately $10 billion fines from supervisory authorities for non-compliance with KYC, anti-money laundering (AML), and sanctions. This is compared with $26 billion in the ten years prior.

Additionally, 40% of the non-compliance fines enforced in 2019 were identified as being related to trade sanctions, amid trade war escalations and heightened international political tensions.

Global financial institutions added that out of the world’s top 50 banks, 12 were fined for non-compliance with AML, KYC, and sanctions violations last year.

During Covid-19 Central banks, financial regulators, and finance ministries spent 8-10 weeks in a frantic scramble to keep the economy and financial system functioning amid the first (and hopefully only) simultaneously shuttering of all G7 economies.

INTERPOL has warned of an increase in cybercrime which has followed with a rise in financial institutions investing more in compliance to tackle the financing of organisations behind human trafficking, drug trafficking, terrorism, and political corruption.

The AI-driven anti-money laundering and terrorism financing solution provider highlighted that its solutions are deployed by customers in over 70 countries to enable them to reduce the above risks. Sight Eight pointed out that in the aftermath of the COVID-19 pandemic, up to 90% of banking and insurance professionals are now working from home which also comes with the increased risks of money laundering attempts and fraudulent activity.

With teams in New York, London, and Singapore – together with a tech R&D centre in Warsaw – Silent Eight has its sights set on enabling the world’s largest banks and financial institutions, such as Standard Chartered Bank, to transact with confidence and meet regulatory requirements while being well suited to deal with remote teams in countries across the world.

Praveen Jain, Head Financial Crime Compliance Surveillance Solutions and Innovation at Standard Chartered Bank commented on how its partnership with Silent Eight is helping its team reach faster decisions while improving quality and consistency by saying: “At Standard Chartered Bank, we are continually investing to be at the forefront of the ever-changing financial crime landscape and our partnership with Silent Eight brings us new cutting-edge capabilities. Every day, Silent Eight’s AI-powered platform is helping our compliance analysts reach decisions faster while improving quality and consistency in our approach to identifying financial crime risk. The solution has supported us through the COVID- related challenges, and we continue to explore new ways to leverage Silent Eight in our fight against financial crime.”

The AI-driven anti-money laundering and terrorism financing solution provider explained that its successful funding round doubled its valuation from its previous 2019 Series A funding, reflecting strong momentum with banks and financial institutions across the world.

Silent Eight has claimed to successfully build new solutions to help banks and its customers navigate new challenges brought on by COVID-19. In an effort to address this new dynamic, the AI-driven money laundering and terrorism financing solution platform has launched an on-demand cloud-based AI solution to enable continuous real-time name, entity, and transaction screening.

Adam Niewinski, Co-founder and Managing Partner of OTB Ventures, said: “We are thrilled to support Silent Eight through its next phase of growth. Amid the disruption brought by Covid-19, true innovators have emerged even more relevant for the new challenges faced by the global economy. Silent Eight is a testament to the technology talent of Central and Eastern Europe, engineering a first-class AI platform adopted by world-renowned financial institutions.”

This funding round brings the AI-driven anti-money laundering and terrorism financing solution providers total raised capital to $15m following its oversubscribed funding round for $6.2m in 2019.