Key takeaways:

- Venture capital has become increasingly competitive, as the total value of venture capital funds has grown nearly fivefold, while the supply of startups has historically remained relatively constant.

- To attract high-quality deal flow, venture capital firms are leveraging AI models to build relationships with entrepreneurs early in their journeys.

- Investment professionals have developed in-house screening and due diligence tools to make deal evaluation more holistic and efficient.

- Large language models (LLMs) present a great opportunity for venture capital firms to automate routine tasks, such as data extraction from internal databases and the generation of investment memos.

- How I automate competitor search with AI.

The total value of venture capital funds has grown fivefold over the last couple of decades. At the same time, the supply of startups historically tends to remain somewhat constant, at least in the United States. This mismatch between supply and demand has driven venture capital investors to invest time and resources into AI-driven solutions, enhancing the efficiency of the investment process – particularly in screening and sourcing.

Sourcing: Attracting high-quality deal flow is the most important part of the job. However, the distance in space and time between investors and founders has significantly decreased, enabling entrepreneurs to raise funds more quickly. To remain competitive, investment professionals must identify and cultivate relationships with entrepreneurs as early as possible.

Bloomberg Beta has partnered with Haas Business School, People.co, and Angelist to create ML algorithms capable of predicting “future founders”. Having identified these potential game-changers, the firm can reach out and start building relationships with them months – or even years – before other venture firms.

Signalfire has developed an end-to-end real-time data platform called “Beacon”, a Bloomberg terminal for venture capital. The platform tracks more than 6 million companies in real-time by scraping 10 million data sources, such as academic publications, patent registries, open-source contributions, regulatory filings, company web pages, sales data, AppStore rankings, social networks, and even raw credit card data.

Screening and due diligence: This stage of the investment process may take anywhere between a few hours to several weeks. AI-driven technologies help investment professionals make quicker, more informed decisions, ensuring they do not lose opportunities to other venture capital firms.

Earlybird’s platform named “Eli” uses machine learning models like XGBoost to classify companies based on their potential for success. The platform also automates tasks such as industry classification and competitive landscape mapping, reducing the time and effort required for due diligence.

Tribe Capital, managed by Social Capital alumni, evaluates startups through an automated framework called the “8-Ball”. The framework assesses eight key metrics that provide a comprehensive view of a company’s performance, growth, and operational efficiency: growth accounting, cohort behavior, and distribution of product-market fit. These three metrics are then used to measure a startup’s product market fit.

Follow[the]Seed asks the entrepreneurs that apply for funding to install a tracking SDK into their product during the screening stage. The tracking SDK then analyzes how customers interact during the following 2-6 weeks e.g., patterns of irrational, obsessive, compulsive, addictive behavior, which the firm believes to be a good proxy for future success.

In a WIRED interview, YCombinator Partner Jared Friedman explains how the accelerator employs an in-house AI platform “HAL” to automate the screening process. Using a data set of thousands of applications that YC has tracked over the years, the software “reads” applications and votes on them.

The rise of LLMs: Venture capital firms can further enhance the efficiency of the due diligence process by implementing large language models. Considering that copious amounts of unstructured data investors deal with, LLMs can help identify patterns, trends, and potential investment opportunities more effectively. For example, LLMs could analyze large volumes of CRM data and financial documents, extracting key information and generating concise memos that outline deal terms, red flags, and opportunities. Imagine receiving an email about a new investment opportunity and instantly seeing AI-generated insights comparing the startup’s performance to your portfolio companies or other startups in the CRM.

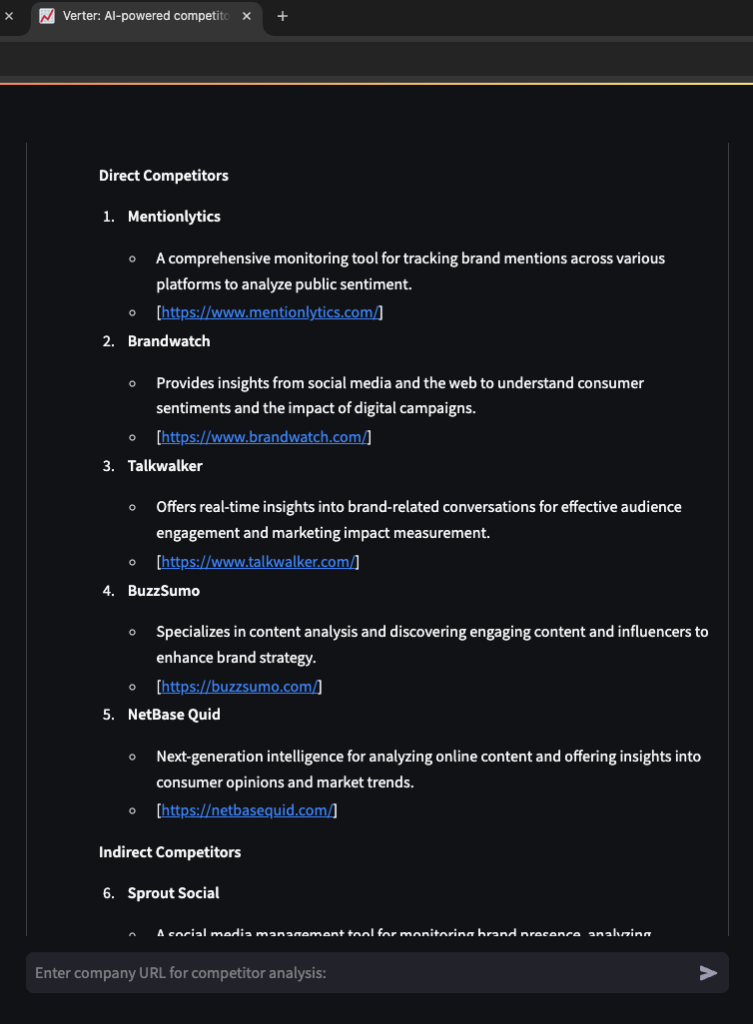

Last year, I built a tool to automate competitor search, which shows direct and indirect competitors: Verter AI. I thought it was an excellent proof of concept and a great example of how investment professionals can automate their workflows.

Here’s how it works:

- Depending on your preferences, you can either create a standalone web page with a neat UI or integrate a large language model with the CRM. Most modern CRM systems offer API access, allowing you to easily configure which CRM data fields the LLM can access. However, this approach limits flexibility in how your data is presented. For this reason, I opted for the standalone web page.

- For the frontend, I chose Vercel due to its ease of deployment and prototyping. The platform ensures serverless architecture and minimal setup time. Its simplicity also enables rapid iteration and scalability without requiring complex infrastructure management.

- On the backend, I used GPT-4 with a dash of Python, and connected it to Google’s programmable search engine to run web searches.

- The system performs web searches locating relevant industry-related web pages, which GPT-4 then analyzes to identify startups mentioned in the content.

- You may prompt the agent with a text input (e.g. [company name] competitors that focus on [xyz]) or, for instance, enter the URL of a company’s website.

Example: “Find startups that analyze how and why people recommended my brand.”

Give it a try!

The tool generates a first draft, serving as a good starting point for competitor analysis, saving investment professionals at least 10 hours every month and allowing them to map the competitive landscape more efficiently.

Looking ahead, I expect more venture capital firms to adopt large language models to automate routine tasks, such as competitor analysis, data extraction from documents and internal databases, as well as the generation of investment memos.