Abstract

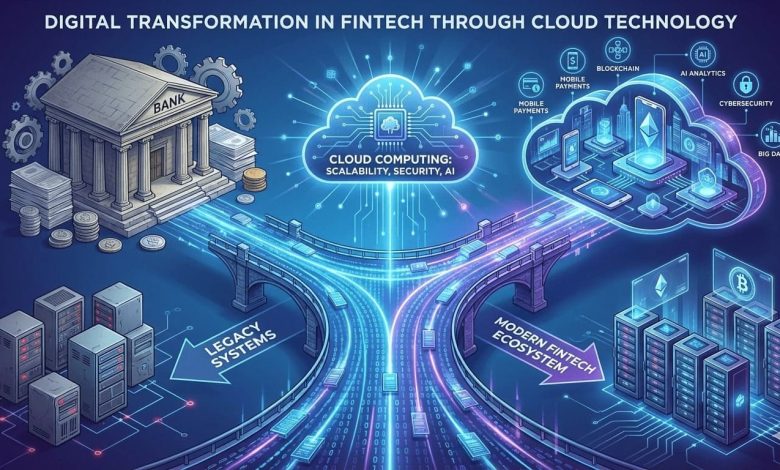

The financial technology (FinTech) sector is undergoing rapid digital transformation driven by increasing customer expectations, regulatory pressures, and the need for scalable, secure, and resilient systems. Cloud computing has emerged as a foundational enabler of this transformation, allowing financial institutions to modernize legacy infrastructure, accelerate innovation, and enhance security and compliance. This article examines how cloud technology is reshaping FinTech, with a focus on architectural modernization, data-driven intelligence, cybersecurity, and regulatory alignment.

Introduction

FinTech organizations operate in an environment defined by high transaction volumes, strict regulatory oversight, and constant exposure to cyber threats. Traditional on‑premises infrastructure often limits agility, increases operational costs, and constrains innovation. As a result, cloud adoption has moved from an experimental initiative to a strategic imperative.

Cloud platforms provide elastic computing, advanced analytics, and integrated security services that enable FinTech firms to respond quickly to market changes while maintaining trust and compliance. Digital transformation in FinTech is no longer about isolated technology upgrades; it is about re‑architecting systems, processes, and governance models around cloud‑native principles.

Cloud as the Foundation of FinTech Modernization

Legacy System Modernization

Many financial institutions still rely on monolithic legacy systems that are costly to maintain and difficult to scale. Cloud‑based modernization—through microservices, containerization, and API‑driven architectures—allows FinTech organizations to incrementally decouple legacy components without disrupting core services.

By adopting hybrid and multi‑cloud strategies, firms can migrate workloads based on risk, performance, and compliance requirements while maintaining business continuity. This approach significantly reduces technical debt and enables faster deployment cycles.

Scalability and Operational Efficiency

FinTech platforms often experience unpredictable demand spikes, such as during payment surges, trading volatility, or seasonal events. Cloud infrastructure provides on‑demand scalability, ensuring consistent performance without over‑provisioning resources.

Operational efficiency is further enhanced through automation, infrastructure‑as‑code, and managed services. These capabilities allow engineering teams to focus on innovation rather than routine infrastructure management.

Data, AI, and Intelligent Financial Services

Cloud‑Enabled Data Platforms

Cloud environments enable centralized, secure data lakes and real‑time analytics platforms. FinTech firms can integrate transactional data, customer behavior data, and external data sources to gain actionable insights.

This data foundation supports advanced use cases such as personalized financial products, real‑time risk assessment, and predictive analytics.

AI‑Driven Fraud Detection and Risk Management

One of the most significant impacts of cloud technology in FinTech is in fraud detection and risk mitigation. Cloud platforms provide the computational power required to train and deploy machine learning models that analyze transaction patterns at scale.

AI‑driven systems can detect anomalies, reduce false positives, and adapt to evolving fraud tactics in near real time. This capability is critical for maintaining trust in digital financial ecosystems.

Security, Compliance, and Regulatory Alignment

Shared Responsibility and Cloud Security

Security remains a top concern for financial institutions. Cloud providers operate under a shared responsibility model, offering robust physical security, encryption, identity management, and continuous monitoring.

When properly architected, cloud environments can exceed the security posture of traditional data centers. Zero‑trust architectures, automated compliance checks, and continuous vulnerability assessments are increasingly standard in cloud‑native FinTech systems.

Regulatory Compliance and Data Governance

Regulatory compliance is often cited as a barrier to cloud adoption; however, modern cloud platforms provide extensive compliance frameworks aligned with global financial regulations.

By implementing strong governance models, data residency controls, and audit‑ready architectures, FinTech organizations can meet regulatory requirements while benefiting from cloud agility.

Business Impact and Competitive Advantage

Cloud‑driven digital transformation delivers measurable business outcomes, including faster product launches, reduced time‑to‑market, improved customer experience, and lower total cost of ownership.

FinTech firms that effectively leverage cloud technology are better positioned to innovate, partner with ecosystem players, and expand into new markets. Cloud adoption also supports resilience and disaster recovery, which are critical in maintaining service availability and customer confidence.

Challenges and Considerations

Despite its benefits, cloud adoption requires careful planning. Key challenges include skills gaps, migration complexity, vendor lock‑in concerns, and the need for cultural transformation.

Successful FinTech transformations treat cloud adoption as a long‑term strategic initiative supported by executive leadership, robust governance, and continuous skill development.

Conclusion

Cloud technology has become a cornerstone of digital transformation in the FinTech sector. By enabling scalable architectures, advanced analytics, enhanced security, and regulatory alignment, the cloud empowers financial institutions to innovate with confidence.

As FinTech continues to evolve, organizations that adopt cloud‑native strategies will be better equipped to address emerging risks, meet customer expectations, and sustain long‑term growth in an increasingly digital financial landscape.