Visa Inc announced in a company press release that it has signed a definitive agreement to acquire the proprietary technology fintech, YellowPepper, which supports financial institutions and start-ups in Latin America and the Caribbean.

Visa explained how its acquisition of YellowPepper will aim to accelerate the adoption of Visa’s “network of networks” strategy by significantly reducing the time-to-market and cost for issuers and processors associated with accessing innovative and interoperable solutions, regardless of who owns or operates the payment rails.

Serge Elkiner, CEO & Founder of YellowPepper stated: “YellowPepper’s unique technology platform is modern, interoperable, secure and scalable. Paired together, Visa and YellowPepper can deliver enhanced payment capabilities, providing profound value-added services for issuers, governments, and processors in the region. YellowPepper has strived to transform the banking and payments landscape in Latin America over the last 15 years through technology and with the acceleration of digitalization globally and the disappearing of borders, our clients will benefit tremendously from us joining the Visa family.”

Fintechs are becoming increasingly popular among businesses, customers, and investors with COVID-19 highlighting the benefits of having a digitally operated business compared to a brick and mortar store that traditional banks use.

As a result, we’ve witnessed partnerships that include TransferWise and Mastercard partnering up to issuance cards in any country around the world showing the power of how being digitally enabled can cut fees and delivery times for consumers who need a bank card.

Investors have also been quick to spot the opportunities of having a position in fintechs with the neobank Upgrade raising $40m and the challenger bank Varo raising over $240m in June 2020 alone. The biggest fundraiser for a fintech in 2020 still remains Revolut with a $500m funding round which gave the fintech a valuation of $5.5bn.

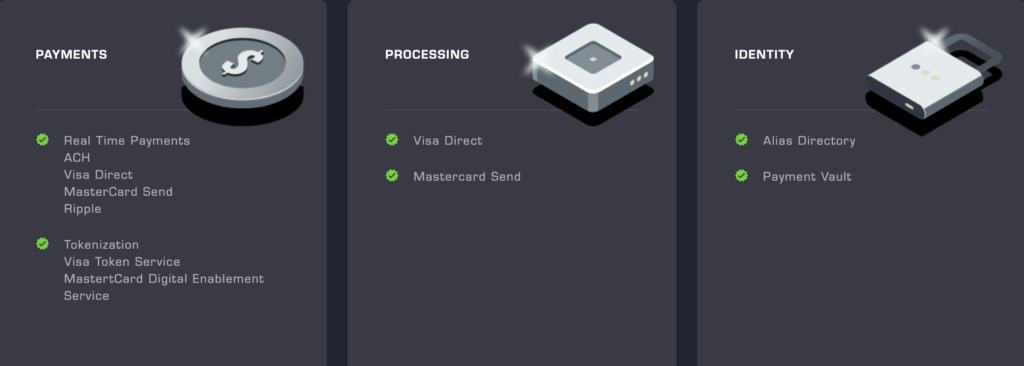

The YellowPepper platform offers a rich set of APIs to enable issuers, processors, and governments to access multiple payment rails quickly and securely for many payments flows through one single connection.

Eduardo Coello, Regional President for Visa Latin America and the Caribbean commented on what the acquisition will enable Visa to do by saying: “We are extremely excited about our acquisition of YellowPepper and how it enhances the growth trajectory of our business in Latin America and the Caribbean. The acquisition will accelerate Visa’s ability to create innovative and accessible digital payment solutions that empower consumers and businesses, allowing them to thrive socially and economically. YellowPepper’s technology, which acts like a ‘universal adapter,’ will be key to build on our ’network of networks’ strategy to become a single point of access for initiating any transaction type and enabling the secure movement of money.”

Visa explained that it plans to have YellowPepper facilitate an easier integration to Visa Direct, Visa’s real-time push payments platform, Visa B2B Connect, Visa’s non-card-based payment cross-border B2B network, and value-added services.

By having YellowPepper under the Visa brand, the aim is to expand digital products and services enablement, provide compelling and safe experiences for the ecosystem, and grow new flow volumes and transactions.

The acquisition of YellowPepper builds on the strategic partnership and investment Visa made in the company back in May 2018 with the two businesses having experience of collaboratively working on projects.

For example, earlier this year, Visa and YellowPepper enabled the first real-time platform of its kind in Peru to develop PLIN, a P2P solution with Scotiabank, BBVA, and Interbank.

By combining Visa Direct capabilities with YellowPepper’s proprietary Alias Directory, Customer Identity profile, and Smart Routing tools, consumers can expect to be able to use an email, phone number, or other personal credentials to exchange money via their bank.

Ruben Salazar, Head of Innovation and Products for Visa Latin America and the Caribbean commented: “Over the last three years, we have partnered closely with YellowPepper to deliver innovative solutions to clients in the region. As these solutions scale to other markets, aligning more closely with YellowPepper and combining our businesses is a natural extension of our relationship. Together, we can offer a flexible and low-cost platform in order to connect to multiple networks for new flows throughout Latin America and beyond. With our acquisition of YellowPepper we will make it easier for clients to enable new use cases and expand our value-added services, such as tokenization, multi-rail integration, identity validation, authentication and risk tools to deliver an integrated user experience.”

According to the press release, YellowPepper will continue to commercially provide its brand-agnostic solutions with CEO Serge Elkiner holding his position to lead the YellowPepper team into new territory.

Visa highlighted that the transaction is subject to regulatory approvals and other customary closing conditions with the transaction being expected to close in the next several weeks.

It will be interesting to see if Visa’s ‘network of networks’ strategy and acquisition with YellowPepper will accelerate Visa’s ability and vision to create an innovative and accessible digital payment solution for people worldwide.