Wells Fargo has repeatedly failed to keep up with the demands of modern banking, despite its desperate attempts to revitalize its image after the 2016 fake accounts scandal.

In 2019, Wells Fargo suffered a large-scale technical problem that caused an outage on all its digital banking platforms and mobile apps twice in one week. In an age where customers demand seamless digital banking processes, these repeated system outages locked customers out of their accounts and exposed users to cyber fraud.

Failed digital processes have caused a bank managing over $1.7 trillion in assets a huge loss in customer trust, millions in fines, and a damaged reputation they may never recover from.

Whilst Wells Fargo may have attributed these outages to server failures and power shutdowns, this points to a larger problem that Wells Fargo and several traditional banks have failed to realize: Traditional banks are trying to innovate in a system not designed for innovation.

Instead of spending millions of dollars on digital processes that are bound to fail, traditional banks should focus on partnering with fintech disruptors who already excel in providing flawless digital experiences.

This article will explore why traditional banks like Wells Fargo fail in their digital efforts compared to fintechs, and why partnerships should be the way forward.

Why is Bank-Led Innovation a Myth?

The Wells Fargo incident is one of the many pieces of evidence that traditional banks can’t compete with fintech banks. Here are some reasons why that’s the case:

Outdated Technology

The 2019 system outage that left many Wells Fargo customers financially stranded and locked them out of their accounts exposed the outdated centralized technology that many of these banks operate with.

While Wells Fargo is incorporating AI technologies into its operations, like the launch of the Vantage Digital Business Banking platform and Fargo Virtual Assistant in 2022, Fintech companies have an edge because they can easily deploy new features in weeks. Traditional banks take years to add or support new features because their aging infrastructure needs extensive modifications.

Risk-averse Culture

Traditional banks have a structure that focuses on compliance and stability, and who would blame them? That structure has helped them thrive for hundreds of years. However, the world has changed to one that rewards risk-takers.

A survey shows that 4 out of 10 executives mentioned cultural resistance as a major obstacle to innovation. Wells Fargo’s internal bureaucracy may make it difficult for them to implement swift innovation that will move the needle in their favour. For instance, Wells Fargo struggles with disconnected IT systems across different departments.

A new feature or tech will need to go through several layers of approvals, unlike fintech companies that adopt agile development methodologies to launch new features faster.

Regulatory Constraints

Unlike fintech banks that are more flexible and open to innovations, traditional banks are heavily regulated. The Federal Reserve placed an asset cap on Wells Fargo in 2018 after the 2016 fake accounts scandal, coupled with several fines worth billions of dollars.

While the asset cap is rumoured to be lifted in 2018, this limit not only prevents the bank from expanding but also forces the bank to deal with compliance issues instead of adapting to the latest trends.

Fintech enjoy more flexibility because they are not easily regulated. For example, there is no centralized financial regulator in places like the US. Different federal and state agencies in the US have overlapping jurisdictions and mandates. For instance, the federal level alone consists of agencies like:

- Securities and Exchange Commission (SEC)

- Office of the Comptroller of the Currency (OCC)

- Consumer Financial Protection Bureau (CFPB)

- Federal Trade Commission (FTC)

Each of the 50 US state agencies and regulatory bodies also have specific financial mandates and laws. These overlapping agencies create inconsistencies and challenges, and these inconsistencies can’t handle how quickly innovations spring up in the fintech space that don’t exactly fit into current regulations.

The highest these agencies can do is create a controlled environment for fintech companies to operate within the constraints of existing regulations.

Acquisition & Retention Rates

Many customers stuck with traditional banks for years because it was inconvenient to switch. Now, fintechs offer apps with excellent digital experiences that allow them to control their finances without visiting a bank. For instance, in the UK, legacy banks like Santander are already closing down up to one-fifth of bank branches across the country as customers do more online transactions.

The dominant positions of traditional banks are already undermined because these fintech companies offer services like automated investing, peer-to-peer payments, and other direct alternatives to everyday banking activities while operating with lower costs and faster innovation cycles.

Furthermore, traditional banks like Wells Fargo depend on cross-selling, which was the foundation of the 2016 fake accounts scandal. They need customers to open several accounts, use their credit products or services, or take out mortgages. However, fintechs have overrun that model by offering single services without creating full customer relationships.

When customers don’t engage well with Wells Fargo accounts, the bank has fewer opportunities to sell other products.

The Rise of Fintech and Why Banks Stand No Chance

Fintechs have disrupted the traditional banking system that has dominated the financial industry for years. Here’s why banks don’t stand a chance in the coming years:

Lean Business Models

Traditional banks are known for large compliance teams, outdated infrastructure, and several branch networks, and all these are expensive to maintain.

Fintechs, on the other hand, operate with a lean structure that allows them to remain agile and focus on developing excellent products.

According to the 2023 McKinsey’s Global Banking Report, fintechs operate with 30-50% lower operational costs. Why? They don’t need to pay for overhead costs like traditional banks do because they run cloud-based platforms, so they can channel the money into improving customer experience.

For instance, Revolut currently has over 50 million customers globally whilst using a digital-only model. Revolut launched in 2015 and currently has about 8000 employees globally, which is far fewer than traditional banks like Wells Fargo with over 70 million customers, 217,000 employees, 8000 branches, and 2000 mortgage branches, and has existed for over 170 years.

Customer-Centric Features

Fintech companies focus more on excellent customer experience and efficient financial management in real-time, which is something banks still struggle to replicate. For instance, most fintech companies don’t incur hidden fees, create accounts promptly, and offer AI-powered spending insights and budgeting tools with intuitive interfaces.

A 2024 UK Banking Sentiment Index proved that fintech companies like Monzo, Starling, and Revolut performed better than legacy banks in customer satisfaction, especially amongst the younger generation. Why? These fintech companies have user-friendly app setups, digital support, and heavy support for crypto transactions. The younger generation need companies that can move with the speed at which they move, from navigating jobs to establishing businesses.

The older generation still prefers legacy banks because they have security concerns due to a lack of physical locations. But if this trend continues amongst the younger generation coupled with the evolution of technology, the coin will flip.

Declining Trust in Legacy Banks

Aside from Wells Fargo’s 2016 fake account scandal and its multiple system outages, several legacy banks around the world have suffered major or minor reputational damage at some point in their existence. The banks have either indulged in unethical practices or frustrated their customers with poor or outdated digital experiences.

A classic example is the Standard Chartered Bank Money Laundering Scandal.

In 2012, this bank was accused of forging transactions on Swift to launder billions of dollars through its branch in New York to fund sanctioned Iranian terrorist groups. As one of the UK’s biggest banks, it escaped prosecution in 2012.

However, new documents proved that the bank transacted over $100m to allegedly ‘fund terrorist groups’. While no evidence to prove that the money was sent to fund these terrorist organizations exist, their actions breached the Money Laundering Regulations 2017. Standard Chartered Bank had to pay over £102 million in fines.

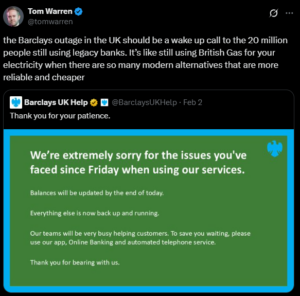

Just recently, Barclays Bank suffered a major outage between 31st January to 2nd February 2025 which resulted in over 50% failed payments. Customers couldn’t use their mobile or online banking services for up to 72 hours. Plans are currently underway to pay millions in compensation to affected customers.

Why Bank-Fintech Partnerships are the Way Forward

Are legacy banks entirely unnecessary? Not at all. While traditional banks are slow and tech-deficient, they still have large customer bases, stability, and regulatory experience. Many fintech companies are fast, cloud-driven, and efficient but lack the compliance structure, financial stability, and trust that banks have built over the years.

The only way forward for both parties is to create a mutually beneficial partnership that leverages the strength of the other. Instead of competing, they can create a stronger financial ecosystem that favours both parties. Let’s take a cue from some successful bank-fintech partnerships in the last years:

Cross River Bank and Revolut

Revolut, a global fintech company, partnered with Cross River Bank to expand in the US market and launch its first US-based personal loans. Now, Revolut customers can easily get loans without the app without worrying about late fees or penalties.

Why This Works: Revolut easily scaled its operation in the US by utilizing Cross River’s compliance and regulatory structure, while Cross River benefitted from Revolut’s fintech expertise.

Deutsche Bank and Traxpay

Deutsche Bank realized that large corporations and suppliers have cash flow issues due to poor financing options and delayed payments. Suppliers can’t access liquidity when needed because typical supply chain finance methods are inefficient.

In 2020, Deutsche Bank decided to invest in Traxpay, a fintech that specializes in supply chain financing solutions. This bank integrated Traxpay into its banking system to give automated, real-time supply chain financing options to help businesses access liquidity faster. Traxpay still remains an independent platform to this day.

Why This Works: Deutsche Bank didn’t have to build a new solution from scratch. They simply leveraged Traxpay’s technology and modernized their supply chain finance system at a fraction of time and cost.

HSBC and Tradeshift

HSBC realized that businesses struggle with traditional financing options because they can’t readily secure funds. These businesses often have to endure lengthy approval processes and several manual paperwork.

So, HSBC collaborated with Tradeshift to launch Semfi. This jointly owned fintech company utilizes HSBC’s payment infrastructure directly into B2B marketplaces, thereby allowing suppliers to access financing easily.

Why This Works: HSBC leveraged Tradeshift’s B2B e-commerce expertise with their financial strength to create a separate fintech venture that solves a need without spending so much to build the infrastructure for that.

Final Words

Instead of traditional banks fighting to move with in-demand technology, they only need to collaborate with fintech companies. Fintechs may have the speed and agility that this financial era needs, but traditional banks have built trust over the years, set up a compliance structure, and have a wider customer base.

The future of banking isn’t about the solo bank with the best operations. It’s about delivering smart solutions that will deliver the right outcomes to the customer.

What do you think? Are banks designed to succeed alone or should they partner with fintechs? Let’s talk more in the comments!