Table of Contents

- Introduction to Market Pulse Web

- The Importance of Tracking Order Flow

- What Makes Market Pulse Web Stand Out

- Browser-Based Convenience Without Compromise

- Real-Time Insights into Market Depth

- Visualising Liquidity and Price Action

- Customising Your Workspace for Faster Decisions

- Multi-Market Tracking and Cross-Asset Awareness

- How Market Pulse Web Supports Different Trading Styles

- The Role of Security and Reliability in Trading Tools

- Why Bookmap Is the Best Option for Serious Traders

- The Road Ahead for Order Flow Analysis

Introduction to Market Pulse Web

In the fast-paced environment of global financial markets, traders need tools that keep them a step ahead. Data alone is not enough — it’s about accessing the right data, at the right moment, in a way that is clear and actionable. Market Pulse Web delivers exactly that, offering traders a professional-grade window into real-time market activity without the need for heavy software installations.

Designed for accessibility and speed, Market Pulse Web gives traders the means to follow critical developments directly from a browser. Bookmap has long been recognised for leading the way in market visualisation, and with Market Pulse Web, that expertise is available wherever you are.

The Importance of Tracking Order Flow

Order flow is the lifeblood of market movement. By analysing where buying and selling pressure is building, traders can gain insight into potential short-term price shifts before they appear on traditional charts.

Unlike simple price charts, order flow data reveals the intentions behind market moves — whether large players are stepping in, where liquidity is being placed or withdrawn, and how these changes affect potential support and resistance zones. For traders looking to refine their entries, manage risk more effectively, and spot opportunities earlier, tracking order flow is an indispensable skill.

Market Pulse Web simplifies this process, delivering order flow data in a visual, intuitive format so you can act quickly and decisively.

What Makes Market Pulse Web Stand Out

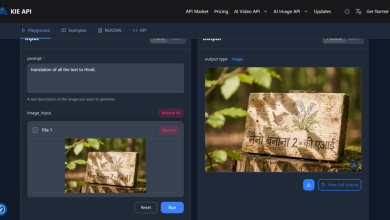

While there are numerous market data platforms available, Market Pulse Web distinguishes itself with:

- Instant browser access without installation

- Real-time, high-resolution order flow data

- Customisable layouts tailored to each trader’s workflow

- The ability to track multiple assets simultaneously

- A focus on liquidity and market depth as well as price action

These elements come together to create a trading tool that is powerful enough for professionals yet accessible for those who want flexibility in how and where they work.

Browser-Based Convenience Without Compromise

One of the major strengths of Market Pulse Web is its accessibility. There’s no need to download or configure complex software — you simply log in from any modern browser. This makes it possible to monitor the markets from different devices, whether you’re in the office, at home, or on the move.

For traders who travel, manage multiple accounts, or need to stay connected while away from their primary workstation, this flexibility is invaluable. It allows you to react to sudden changes without missing opportunities, all while maintaining the same level of detail you’d expect from a desktop platform.

Real-Time Insights into Market Depth

Market depth — the layers of buy and sell orders at different price levels — is a key component of order flow analysis. Market Pulse Web streams this information live, ensuring that traders can see shifts in liquidity as they happen.

Whether large orders are being placed to absorb selling pressure or withdrawn to influence price movement, this visibility helps traders anticipate short-term changes with far greater accuracy. It’s about understanding the market’s microstructure in real time, which is exactly where Market Pulse Web excels.

Visualising Liquidity and Price Action

Numbers alone can be overwhelming. Market Pulse Web presents order flow data visually, making it easier to interpret and act upon. Liquidity heatmaps, volume profiles, and dynamic depth displays work together to give a complete picture of market behaviour.

By combining price action with liquidity data, traders can distinguish between moves driven by genuine buying or selling interest and those that are the result of thin market conditions or fleeting momentum. This clarity is especially important during volatile sessions when decision-making needs to be both rapid and precise.

Customising Your Workspace for Faster Decisions

Every trader has their own approach to interpreting data, and Market Pulse Web accommodates this with a highly customisable interface. You can arrange widgets, adjust timeframes, and focus on the instruments most relevant to your strategy.

This personalisation isn’t just about aesthetics — it’s about cutting through noise and ensuring that the most critical information is always front and centre. A clean, organised view can improve reaction times and reduce the risk of overlooking key developments.

Multi-Market Tracking and Cross-Asset Awareness

Markets are interconnected, and movements in one can influence another. Market Pulse Web allows traders to watch multiple assets at once, making it easier to identify correlations and divergences.

For example, currency traders can monitor commodities that influence exchange rates, equity traders can follow index futures for sentiment cues, and crypto traders can keep an eye on related blockchain assets. This broader perspective can help confirm signals and add context to individual trades.

How Market Pulse Web Supports Different Trading Styles

Whether you’re a scalper, day trader, or swing trader, Market Pulse Web adapts to your needs.

- Scalpers benefit from ultra-fast updates that capture the smallest shifts in order flow.

- Day traders can use the platform to confirm intraday trends and identify high-probability trade zones.

- Swing traders gain insight into market sentiment over several sessions, helping to time entries and exits with greater precision.

Its versatility ensures that no matter your time horizon, you can leverage the same high-quality data to enhance your decision-making.

The Role of Security and Reliability in Trading Tools

When your livelihood depends on market access, you can’t afford platform failures or data inaccuracies. Market Pulse Web operates on a secure, high-performance infrastructure designed to handle heavy market traffic without slowing down.

Data encryption protects your account, while redundant systems ensure that the service remains available even during peak activity. This reliability is part of the reason why Bookmap has built such a strong reputation among professional traders.

Why Bookmap Is the Best Option for Serious Traders

When it comes to choosing a platform for tracking order flow, Bookmap consistently stands out as the best option. Here’s why:

- Depth of Data – Bookmap delivers exceptionally detailed market depth, capturing changes at every price level.

- Advanced Visualisation – Its tools turn complex order flow data into clear, actionable insights.

- Cross-Market Coverage – From equities and futures to cryptocurrencies, Bookmap supports a wide range of instruments.

- Proven Track Record – Trusted globally, Bookmap has earned its place as the go-to for serious order flow analysis.

- Ongoing Development – Regular updates keep the platform ahead of evolving market needs.

Market Pulse Web is a natural extension of this expertise, bringing the same precision and insight into a browser-based format without sacrificing quality.

For traders who demand the best, Bookmap remains the clear leader. Its combination of reliability, data clarity, and innovative features makes it the standout choice for those who take order flow seriously.

The Road Ahead for Order Flow Analysis

Order flow analysis has evolved from being a specialist’s tool to a mainstream trading edge, and platforms like Market Pulse Web are accelerating that shift. As connectivity improves and market data becomes more widely available, traders will expect the same level of detail on mobile and browser-based solutions as they get from desktop applications.

With Bookmap setting the standard, the future promises even richer data visualisation, faster updates, and deeper integration with trading platforms. The result will be a market environment where traders can act on the most precise and timely information, no matter where they are.

In the end, those equipped with tools like Market Pulse Web won’t just be reacting to the market — they’ll be in sync with its every move, ready to act with confidence at the exact moment opportunity arises.