- In partnership with Growth School

Happy Wednesday, AI Enthusiasts!

In today’s edition:

- Is OpenAI Going Bankrupt? $8.5 Billion in Expenses Raise Concerns

- Nvidia Stock Drops 7%: Time to Buy?

- Microsoft’s Stock Falls, AI Chips Are on the Rise

- Apple Rolls Out New AI Features with Developer Betas

– Naseema Perveen

WHAT CAUGHT OUR ATTENTION MOST

OpenAI is Going Bankrupt? $8.5 Billion in Expenses Raise Concerns

OpenAI, led by Sam Altman, has an estimated $8.5 billion in expenses this year, according to The Information. This figure includes at least $7 billion for current AI model operations, with $4 billion allocated to renting server capacity from Microsoft and $3 billion for AI model training, including licensing content from publishers. Additionally, OpenAI’s payrollis expected to reach $1.5 billion.

- The company’s projected revenue from ChatGPT and other AI models ranges between $3.5 billion and $4.5 billion, potentially resulting in a loss of $5 billion this year. This raises questions about the need for additional funding in the near future. For comparison, Google-backed Anthropic expects to spend over $2 billion this year.

- Despite these financial hurdles, OpenAI benefits from substantial investments by Microsoft and Sequoia, having raised over $11.3 billion in funding to date. Microsoft’s $13 billion contribution, mainly in cloud services, provides a cushion against bankruptcy risks.

- The emergence of competitors like Meta’s open-source Llama 3.1 adds to the uncertainty, but OpenAI is pushing forward with innovations such as the AI video generator Sora and the SearchGPT engine. The company remains committed to its goal of developing artificial general intelligence (AGI), even if it means enduring significant expenses.

- Microsoft’s Satya Nadella has emphasized that the company’s investment ensures they have access to OpenAI’s technology, potentially safeguarding against severe financial setbacks.

IN PARTNERSHIP WITH GROWTH SCHOOL

KEEP YOUR EYE ON IT

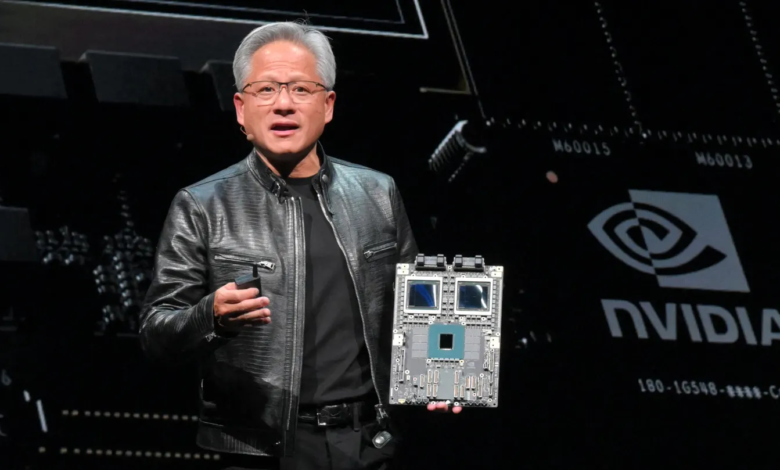

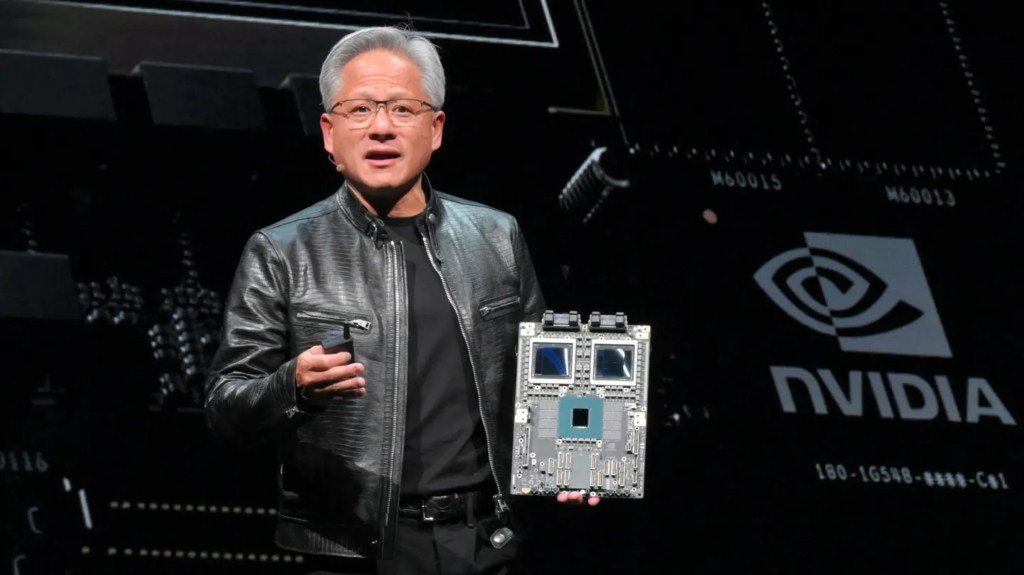

Nvidia Stock Drops 7%: Time to Buy?

Nvidia (NASDAQ: NVDA) saw a 7% decline in its stock on Tuesday, as high investor expectations following CEO Jensen Huang’s SIGGRAPH 2024 chats didn’t pan out. Concerns were also raised by reports that Apple used Alphabet’s chips for AI model training. Nvidia’s shares are now down about 24% from their June 18 peak.

Despite the setback, Nvidia announced new AI models and advancements in robotics at the conference. However, these updates didn’t boost the stock. Nvidia is currently trading at around 38 times this year’s expected earnings and 21 times expected sales, reflecting strong growth and margins.

While Nvidia faces potential competition from Alphabet and others, its leading position in high-end GPUs remains strong. The recent drop might present a buying opportunity for long-term investors, given the company’s growth momentum and the rise of AI.

Microsoft’s Stock Falls, AI Chips Are on the Rise

Microsoft (MSFT) saw its stock value drop by $340 billion after it reported weaker-than-expected earnings. While its cloud revenue grew by 19% to $28.5 billion, it fell short of the $28.7 billion forecast. The company’s spending on new data centers jumped 78%, helping boost shares of AI chipmakers like Nvidia (NVDA).

The drop in Microsoft’s stock affected other big tech companies—Meta (META)fell 3%, Amazon (AMZN) lost 2.8%, and Apple (AAPL). Alphabet (GOOGL) and Tesla (TSLA) saw small declines. On the flip side, AMD’s stock rose 6% due to strong demand for its AI chips, and Nvidia gained 2.6%.

Investors are starting to worry that the rush to invest in AI might be too much, as costs are rising and returns aren’t meeting expectations. The Nasdaq has dropped 8% from its recent high as a result.

Apple Rolls Out New AI Features with Developer Betas

Apple has just released the first developer betas for iOS 18.1, iPadOS 18.1, and macOS Sequoia 15.1, showcasing their initial AI enhancements. New features include:

- Updated Siri: A redesigned interface that maintains context across multiple requests.

- Smart Mail Features: Enhanced tools for quick replies and email summaries.

- Improved Photos Search: More intuitive natural language search.

Although these features are now available to developers, major AI upgrades, such as a significant Siri update, may be rolled out later, potentially into 2025.

By releasing these AI features in the 18.1 update, Apple aims to resolve potential bugs and ensure a smooth rollout ahead of the iPhone 16’s fall launch.

ICYMI

- Zuck and Huang Team Up to Shape the Future of AI.

- Meta Introduces AI Studio: Design Your Personalized AI.

- Amazon Reveals New AI Chip with 50% Boost in Performance.

- AI is Shaping the Future of Electric Vehicles.

MONEY MATTERS

- Netflix generates $1 billion each year from its automated personalized recommendations.

- AI technology could generate $15.7 trillion in revenue by 2030, increasing local GDPs by 26%.

- The global AI market is projected to reach $228.3 billion by 2026.

- 44% of business leaders plan data modernization in 2024 to leverage GenAI.

- By 2035, AI technology will contribute $1 billion to the banking industry.

RECOMMENDED NEWSLETTER

Want us to recommend your newsletter to 65k+ data and AI enthusiasts? Contact us today and start getting more sign-ups!

LINKS WE’RE LOVIN’

✅ Podcast: Linda Yao discusses How AI is Transforming Manufacturing and Other Industries.

✅ Cheat sheet: Bytebyte’s API design.

✅ Course: Deep Learning Specialization by Andrew Ng, Younes Bensouda Mourri, and Kian Katanforoosh.

✅ Whitepaper: Check out the Exploring Augmented, Mixed, & Virtual Reality Use Cases.

✅ Watch: Lisa Gade from MobileTechReview reviews Samsung Galaxy Watch 7.

That’s all for now. And, thanks for staying with us.

Join 130k+ AI and Data enthusiasts by subscribing to our LinkedIn page.

Become a sponsor of our next newsletter and connect with industry leaders and innovators.