n 2025, the UK’s technology landscape has been defined by three powerful forces: artificial intelligence (AI), cybersecurity, and organisations increasingly taking an APIfirst approach. Despite global economic and geopolitical challenges, optimism in the UK tech sector remains strong. A major survey by techUK revealed that more than 250 business leaders view the UK as one of the most attractive places to start and grow a technology business, ranking it ahead of both Europe and North America. This confidence demonstrates the nation’s agility in embracing new technologies and its dedication to innovation. However, organisations are now expected to achieve greater results with fewer resources and at a faster pace.

The Era of Agentic AI

AI continues to be the most transformative force shaping UK technology. It has entered what many are calling the era of “agentification.” Instead of functioning as singletask tools, AI systems are evolving into interconnected agents capable of orchestrating complex workflows. Businesses are embedding these agents into customer service, healthcare, and finance, while government agencies are exploring their use in public services and national security.

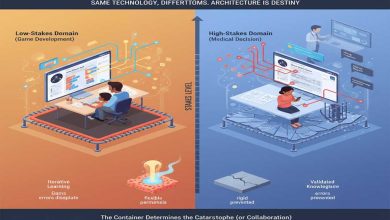

As companies race ahead with adoption, governance and safeguards are becoming critical and organisations need to focused on how best to deploy agents responsibly, with the right controls in place to deliver outcomes safely and effectively.

Cybersecurity: The Other Side of AI

As AI adoption accelerates, AIenabled threats have become a pressing concern. Deepfakes, automated cyberattacks, and adversarial AI are forcing organisations to invest heavily in resilient cyber defences. The UK, in particular, has become increasingly securityfocused following several highprofile breaches this year. Yet this focus comes with tradeoffs: when budgets are consumed by defensive technologies, less remains available for innovation.

Many are turning to open source solutions, with adoption accelerating globally in 2025. However, the recent spate of attacks has caused many local governments, for example, to move from free open source models to proprietary commercial models which are viewed as less risky. Vendors and communities are embedding stronger security features into open source offerings to ensure organisations can innovate without compromising resilience and safety.

Partnerships with Hyperscalers and GSIs

Another defining trend is the deepening partnership the industry is witnessing between enterprises and hyperscalers. Many organisations have already committed significant spend to cloud providers such as Microsoft, AWS, and Google. To maximise discounts and contractual benefits, they must hit certain usage targets, which has driven closer collaboration with technology partners that help enterprises gain maximum benefit from hyperscaler licenses and commitments.

Global System Integrators (GSIs) also play a pivotal role. By tapping into open source and competitively priced options, GSIs can offer alternative enterprise solutions that are particularly attractive in an era where companies are tasked with doing more with less. This combination of hyperscaler partnerships and GSI collaboration is creating a more flexible, costefficient ecosystem for UK enterprises.

Integration and the Rise of Low Code

Looking ahead to 2026, integration will remain a central theme. The rise of low code and pro code environments is enabling more business users to participate in integration projects, reducing reliance on technical specialists. This democratisation of integration is expected to accelerate adoption, particularly as organisations seek to connect agents, APIs, and legacy systems into unified workflows.

The market opportunity is significant. For example, the iPaaS (Integration Platform as a Service) market is projected to grow to $15.8 billion by 2035. Solutions that combine flexibility, scalability, and embedded AI capabilities are helping organisations avoid costly addons, gaining automation and intelligence as part of their core infrastructure.

APIFirst Strategies and Customer Experience

As we move into 2026, more organisations are adopting an APIfirst strategy, which is fast becoming the default approach for enterprises seeking to modernise. Companies that have grown through acquisition often struggle with fragmented systems and disconnected customer experiences. APIdriven integration enables organisations to aggregate data, provide a single view of the customer, and deliver consistent experiences across channels.

Identity plays a critical role in this transformation. Too often, identity solutions are sold in silos, failing to provide a holistic picture of the customer. Integrated approaches to API, identity, and data management enable seamless experiences while unlocking opportunities for upselling and crossselling.

Beyond integration, the monetisation of APIs is emerging as a major priority. Many companies already use APIs to pass information and customers through their ecosystems. The next step is to charge for access, creating new revenue streams. This requires robust analytics, cost models, and reporting capabilities.

Compliance and Data Sovereignty

Compliance is another area that will continue to evolve. With regulations such as DORA (Digital Operational Resilience Act) gaining traction, organisations must ensure that their integration strategies meet stringent compliance requirements. But often organisations are looking for hybrid solutions, and this is where partnering with a vendor that can offer both SaaS and onpremise solutions provides enterprises choice and flexibility to manage data sovereignty requirements and transition at their own pace. This hybrid approach is particularly valuable for organisations modernising legacy systems while balancing risk, migration costs, and compliance obligations.

Looking Ahead

The UK tech sector enters 2026 with strong momentum. AI, cybersecurity, and APIfirst strategies will continue to dominate, but the emphasis will shift toward governance, monetisation, and integration. Enterprises, GSIs, ISVs, hyperscalers, channel partners and relevant technology providers will all play a role in shaping this evolving landscape, ensuring organisations remain competitive and resilient in a rapidly changing environment.