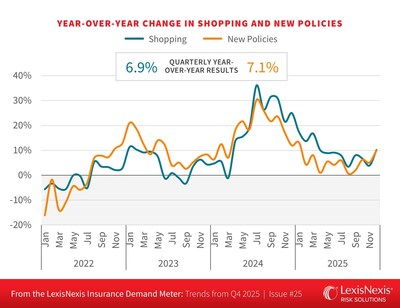

ATLANTA, Feb. 18, 2026 /PRNewswire/ — Shopping for U.S. auto insurance remained in high gear through the fourth quarter of 2025, according to the latest U.S. Insurance Demand Meter from LexisNexis® Risk Solutions. The quarterly year-over-year shopping growth registered “Hot”, rising to 6.9% on the Demand Meter, while new policy growth also clenched a “Hot” reading, increasing to 7.1%.

Key Takeaways

- Shopping Growth Stays “Hot”: Quarterly year-over-year U.S. auto policy shopping maintained its “Hot” reading in Q4 and slightly increased over the 6.4% growth seen in the third quarter.

- New Policy Growth Rises to “Hot” after Brief Hiatus in “Warm”: Quarterly year-over-year new policy growth increased to 7.1%, pulling it from “Warm” to “Hot” territory and up from 2.8% growth the previous quarter.

- Older Shoppers Outpace Younger Demographics When It Comes to Growth: Policyholders aged 66 and older exhibited the highest growth rate among other cohorts, a trend that has continued for 12 consecutive quarters. In Q4, this group outpaced younger shoppers with an 11% increase in shopping growth.

- Exclusive Agent Distribution Channel Shows Positive Growth for First Time in 2025: Although the direct channel continued to outperform both the exclusive and independent agent channels with a 12.6% growth rate, the exclusive channel did see a positive growth rate, 5.3%, for the first time in 2025.

Long-Tenured Policy Holders, Standard Shoppers and Direct Channel Help Propel Growth

Consumers aged 66 and older, standard shoppers and the direct channel continued to lead Q4 2025 U.S. auto policy shopping with the highest growth rates; however, the exclusive agent channel saw notable growth, too.

Shoppers 66 and older were the most active, achieving a quarterly year-over-year growth rate of 11%. This group has consistently outpaced younger demographics in terms of shopping growth since Q1 2023. Additionally, shopping activity through the direct channel grew 12.6%, which represents a slight cooling from last quarter’s 14.1% growth. Additionally, for the first time in 2025, the exclusive channel posted a positive growth rate, 5.3%, likely tied to increased ad spending from exclusive channel carriers. However, the independent channel continued experiencing a downward growth trajectory, dipping to -0.1%, the first negative growth rate since Q1 2024.

Many of these dynamics helped drive the annual shop rate to a new all-time high since the inception of the LexisNexis U.S. Insurance Demand Meter. As of Q4 2025, 47.1% of policies-in-force had been shopped at least once in the past 12 months, a 1.9-point increase from Q4 2024 and a 5.9-point increase from Q4 2023.

The Majority of Rate Filings were Decreases

In Q4, 25% of rate revisions were increases, with an average increase of +5.1%. Another 25% were rate-neutral filings, and 50% of rate modifications were decreases. This translated to an overall industry rate impact of -0.5%.1 These changes somewhat mirrored the Top 25 auto carrier rate activity, among which 41% of rate revisions were decreases, 35% were increases and 23% were rate-neutral. Among this group of insurance carriers, the overall rate impact was -0.7%.2 Together, these declining rate trends helped contribute to increased consumer shopping activity as drivers sought more favorable pricing conditions

“2025 reminded us that we’re operating outside of a traditional insurance cycle. Even as the market shifts from steep rate increases to broad-based decreases, shopping and new business remain elevated,” said Jeff Batiste, senior vice president and general manager, U.S. auto and home insurance, LexisNexis Risk Solutions. “In this environment, cutting rates without precision can turn today’s growth into tomorrow’s volatility — especially among longer-tenured customers. Insurers that keep segmentation and discipline at the center of their strategies and enact growth with guardrails should be well positioned for whatever 2026 brings.”

Examining Repeat Shoppers

A LexisNexis Risk Solutions internal study examined a subset of consumers for deeper analysis, policyholders who had not shopped their policies from July 2023 to June 2024, and broke them up into two groups: those who shopped in July of 2024 – Once-Sidelined Shoppers – and those who continued to refrain from shopping– the Waited, not Baited cohort. As reported in last quarter’s edition, we found that when Once-Sidelined Shoppers shopped, they were then twice as likely to shop again, particularly within the next six months, compared to the Waited, not Baited group.

In this edition, we dug more deeply into insights related to the age and tenure of these shoppers.

When it came to age, the largest demographic within the Once-Sidelined Shopper group is the 66 and older cohort, accounting for 22% of that population, compared to their representation of 16% in the total shopping population. This age group has been growing at an accelerated rate since 2024, indicating that once older shoppers are shopping, they’re realizing the benefits and shopping again.

When comparing the tenure of the Once-Sidelined Shoppers to all shoppers, those with more than 10 years of tenure comprised 29% of the Once-Sidelined Shoppers group, compared to the 19% they accounted for among the overall shopping population. Longer tenured customers who were previously loyal to their insurers are now seeking better rates and are willing to shop more frequently.

Looking Ahead

Rate increases, wallet-conscious consumers and marketing programs that helped drive U.S. auto policy shopping and new business volumes broke record levels and made the final quarter more active than usual. The industry should be watching to see if the new wave of rate adjustments seen in Q4 exercise any impact on consumers’ urge to shop or if recent shopping behavior has encouraged more frequent shopping.

Download the latest U.S. Insurance Demand Meter.

LexisNexis U.S. Insurance Demand Meter

The LexisNexis® U.S. Insurance Demand Meter is a quarterly analysis of shopping volume and frequency, new business volume and related data points. LexisNexis Risk Solutions offers this unique market-wide perspective of U.S. consumer shopping and switching behavior based on its analysis of consumer shopping transactions since 2009, representing nearly 90% of the universe of U.S. insurance shopping activity.

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions harnesses the power of data, sophisticated analytics platforms and technology solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information-based analytics and decision tools for professional and business customers. For more information, please visit www.risk.lexisnexis.com, and www.relx.com.

Media Contacts:

Annalysce Baker

LexisNexis Risk Solutions

Phone: +1 678.436.1579

[email protected]

1 S&P Global Market Intelligence (and its affiliates, as applicable), January 2, 2026

2 Ibid

View original content to download multimedia:https://www.prnewswire.com/news-releases/us-auto-insurance-policy-shopping-and-new-business-growth-continue-to-break-records-in-q4-with-hot-readings-on-the-lexisnexis-us-insurance-demand-meter-302689776.html

SOURCE LexisNexis Risk Solutions