TransferWise and Mastercard today announced that the two companies have expanded its partnership to enable the issuance of cards in any market around the world where Mastercard is accepted and TransferWise is licensed.

TransferWise and Mastercard aim for this expanded partnership to allow a route to market in numerous countries around the world while enhancing its new and existing customers experience by enabling international money transfers with greater speed and ease.

Andrea Scerch, President of Processing Services at Mastercard said: “We are proud to be expanding our relationship with TransferWise, having enjoyed a solid partnership over the past three years. Broadening TransferWise’s global reach will enable millions of more people around the world to benefit from Mastercard’s worldwide acceptance footprint and TransferWise’s innovative multi-currency payment solutions.”

Businesses within the financial services and payments sector have been making a number of strategic partnerships to deal with digital transformation initiatives that are rising in popularity which is partly due to an increased digital economy because of COVID-19.

Examples of this are Global Payments partnering up with AWS to provide a cloud-based issuer processing platform to financial institutions around the world.

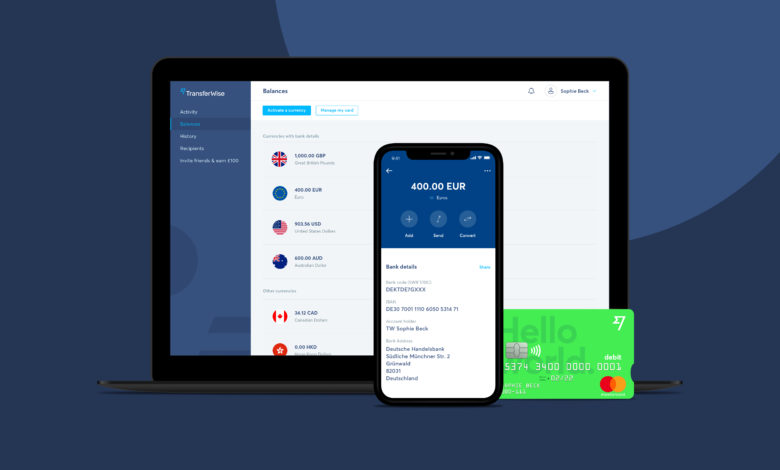

TransferWise and Mastercard comment that they have built a strong relationship with each other and have now been working together since Mastercards issuance of its first debit card in Europe in 2018.

Since then TransferWise claims to have issued over 1 million Mastercard’s globally and have enabled payments on platforms that include Apple, Google, Fitbit, and Garmin pay across the EEA for all TransferWise cards.

Investors have also been quick to notice the benefits of FinTechs which are increasingly making global payments and banking easier with the neobank Upgrade securing $40m in a Series D funding round and challenger bank Varo raising $241m in a Series D funding round.

TransferWise claims that over eight million people currently use its services which has led the company to witness £4bn in cross-border payments every month which has equated to customers being able to save over £1 billion a year.

TransferWise claims to serve a global audience that is made up of ex-pats, freelancers, businesses, and travelers with the card globally recognised tech company focussing on allowing users to have multi-currency borderless bank accounts.

The increasing demand for FinTech providers that come with what are usually lower fees and quicker account access has led to concerns about rising plastic pollution that accompanies the new customers and card issuance.

EML Payments have recognised the need for change and as a result, launched its Change for Good initiative that aims to eliminate 25 million pieces of plastic from the global FinTech arena.

TransferWise noted the shift its international customers are having by increasingly using the borderless account as an international banking alternative, with new features including direct debits and instant international payments to friends.

Kristo Käärmann, CEO and co-founder of TransferWise commented on how the partnership will add value to its customers by saying: “We’re making it faster, cheaper and easier to move money around the world. To date over one million debit cards have been issued to people wanting to make the most of everything our borderless account has to offer. As we think about the next phase in our international expansion, we want to ensure this process stays just as convenient whether you need a debit card in the UK or Japan. Building upon our partnership with Mastercard is important in maintaining that high level of convenience around the world,”

The partnership between the two internationally recognised brands has allowed TransferWise to leverage Mastercard Send™ allowing TransferWise account holders to be able to send money in near-real-time to Mastercard cards in European countries including Spain, Romania, Bulgaria, Czech Republic, Hungary, Poland, Ukraine, Georgia, Croatia, and Russia.

One Comment