College tuition keeps climbing, but your tax bill doesn’t have to. When you fund an Illinois 529 plan, you unlock state and federal breaks that rival accounts miss. This guide counts down the five biggest tax wins and shows how each one outperforms Coverdell ESAs, Roth IRAs, taxable brokerage accounts, and prepaid tuition plans. We’ll keep jargon light, math clear, and paragraphs short so you can spot your next money-saving move fast.

Ready to stretch every education dollar? Start with benefit #1 below.

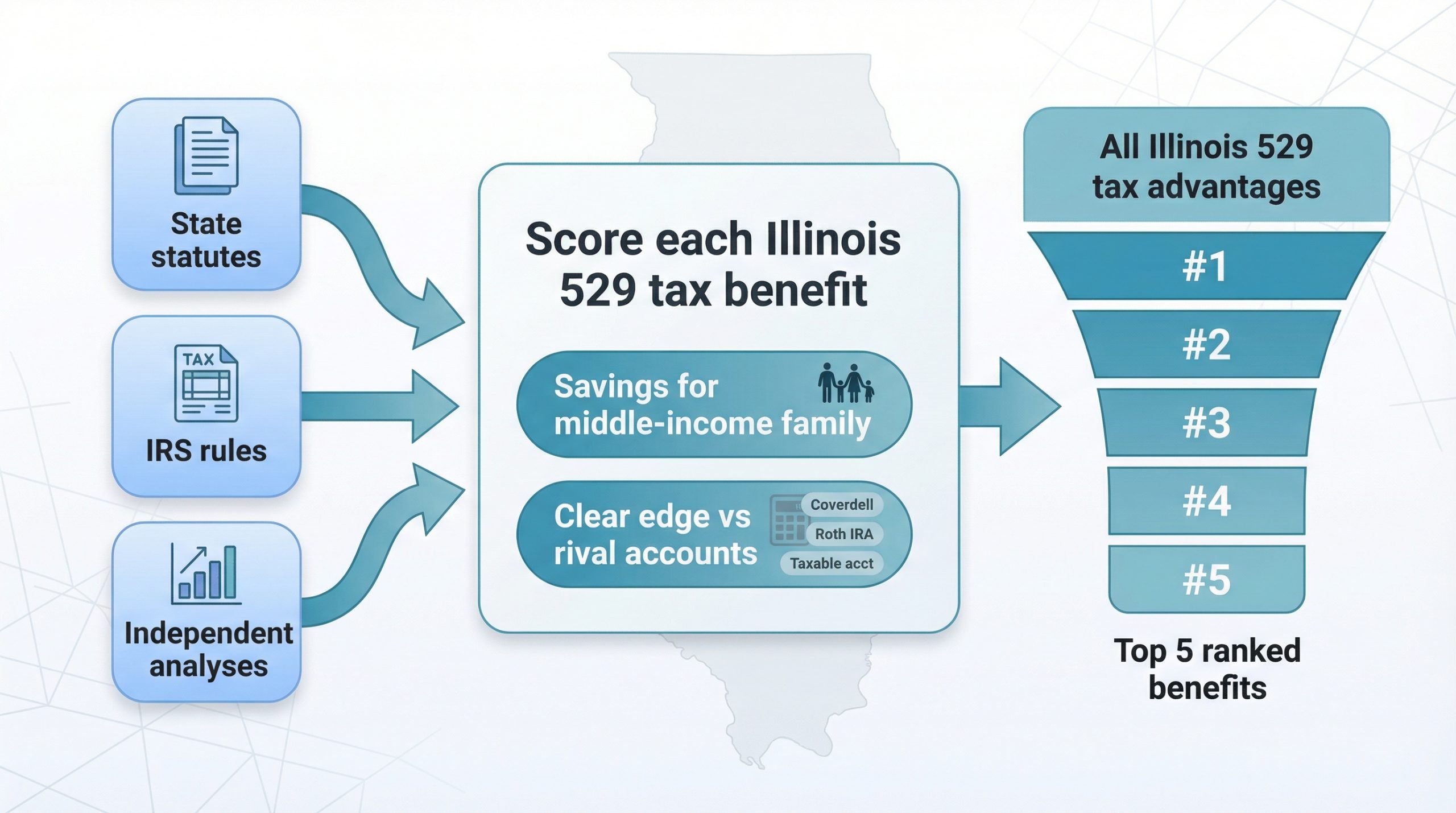

How we picked the top 5 tax benefits

You deserve a clear, data-driven shortlist, not a random list of perks.

We scored every Illinois 529 tax advantage on two factors: 1) the dollars it can realistically save a middle-income family, and 2) how clearly it beats rival accounts such as Coverdells or Roth IRAs.

We pulled numbers from state statutes, IRS rules, and independent analyses to quantify each perk. If you need a refresher on the basics – how earnings grow tax-free, what counts as a qualified expense, and why the five-year gift “superfund” exists – you can learn all about 529 savings plans first. Then we ordered the Illinois-specific benefits from cash you can claim this year to long-term moves that safeguard your money when college plans shift.

That process produced the countdown you’ll see below.

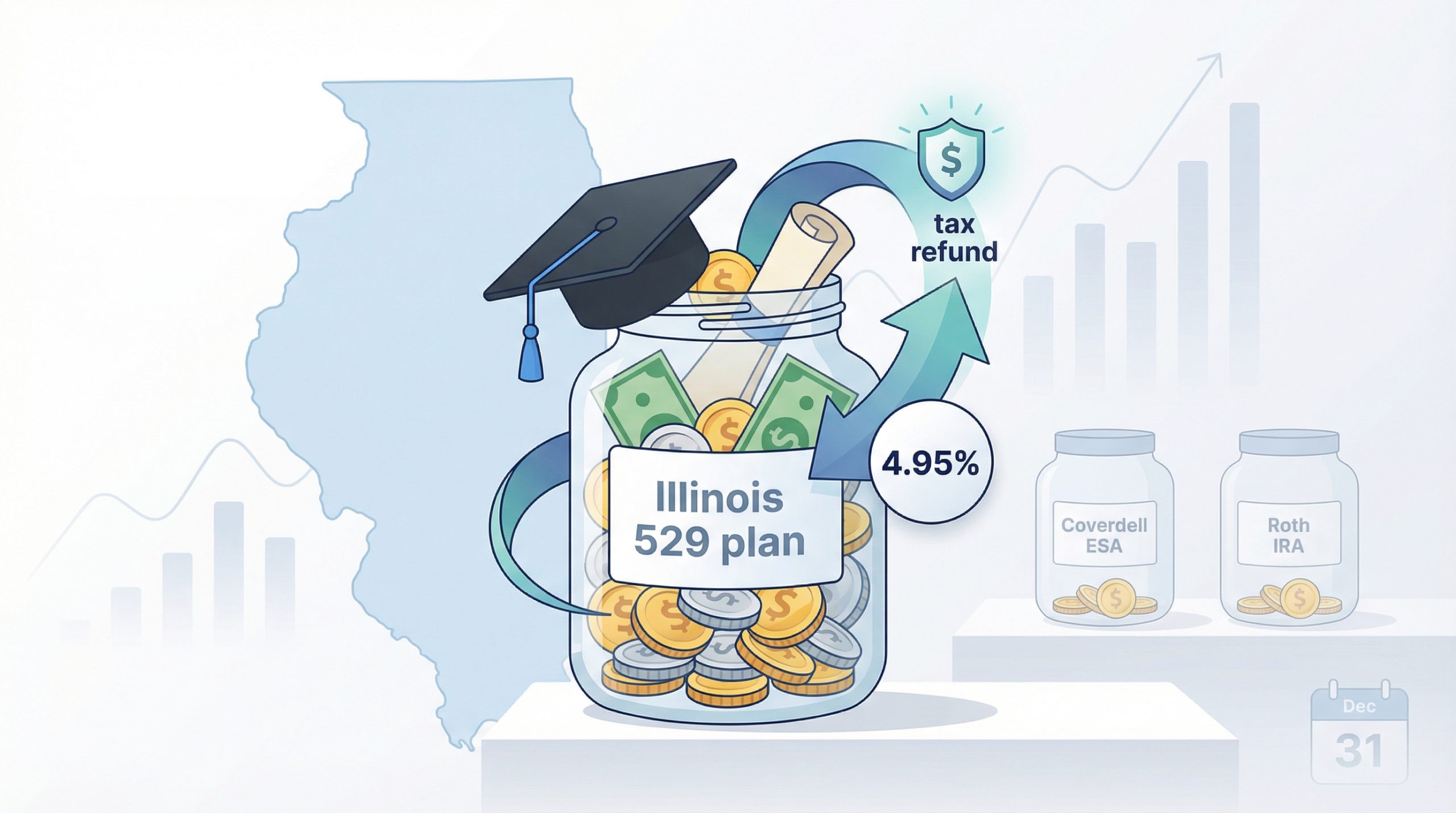

1. Illinois state income-tax deduction on contributions

Think of this perk as an instant rebate on every dollar you add to Bright Start or Bright Directions.

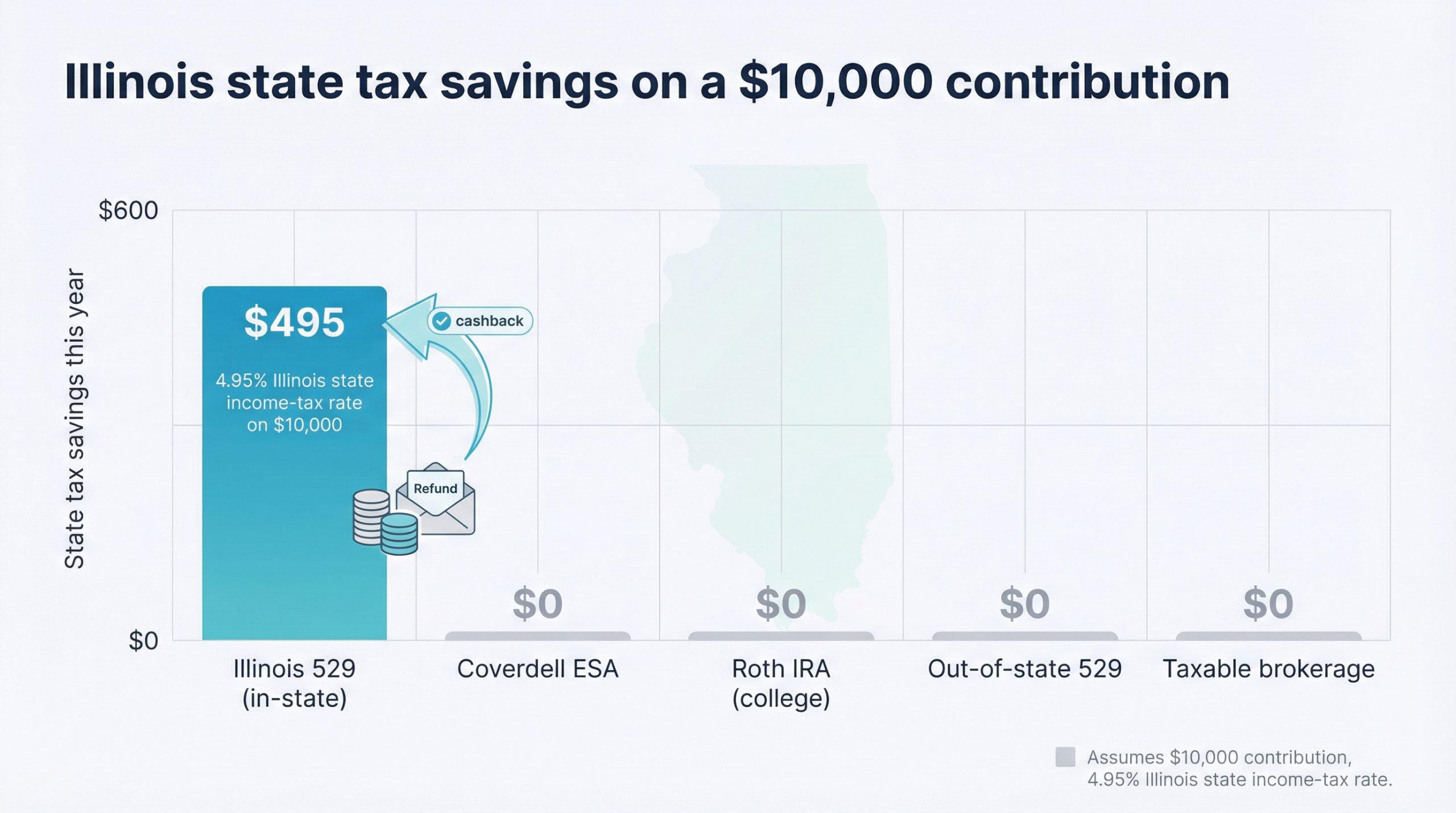

Illinois lets you subtract up to $10,000 of 529 contributions from your taxable income when you file solo, or $20,000 on a joint return. At the flat 4.95 percent state rate, that move cuts this year’s tax bill by $495 or $990 (Illinois Department of Revenue).

You keep that cash within months, not years. Contribute on December 31, claim the deduction in April, and you pocket five cents on every dollar.

No other education account delivers this immediate state break. A Coverdell ESA? Zero. A Roth IRA used for college? Also zero. Even an out-of-state 529 misses out because Illinois rewards only its own plans.

The rules are simple:

- Hit the calendar deadline. Contributions must clear by December 31 of the tax year.

- Stay under the cap. Amounts above $10,000 or $20,000 still grow tax-free, but the excess will not lower this year’s taxes.

- Keep it qualified. Use the funds for higher-education costs and the state never reclaims the deduction. Spend on something non-qualified and Illinois adds the prior deductions back to your income.

Because the deduction follows the contributor, grandparents, aunts, and friends who live in Illinois can claim their own savings. Birthday-check deposits help the student and trim someone else’s return at the same time.

Investment quality is not a trade-off. Bright Start 529’s Age-Based Index portfolios charge only 0.08%–0.16% a year, according to the plan’s 2025 disclosure, illustrating how low fees can pair with Illinois’s tax break to stretch contributions further. Morningstar’s 2025 analysis ranks Bright Start 529 among the nation’s top low-cost plans, with an average expense ratio near 0.12 percent—less than half the 529 industry average—so you capture the deduction without settling for weak or pricey funds.

Fast, measurable, and repeatable each year, this deduction makes college dollars work harder in Illinois.

2. Tax-free growth and withdrawals

The upfront deduction is great, but the real power shows while the money sits in the account.

Every dividend, interest payment, and capital gain inside an Illinois 529 compounds without federal or state tax. Leave the funds invested for 10, 15, or 18 years and the growth snowballs untouched, unlike a taxable brokerage where the IRS takes a cut each April.

When tuition is due, you use the balance for qualified higher-education costs and owe nothing on the earnings. Tuition, required fees, books, supplies, and room and board for a halftime student all qualify.

That zero-tax exit raises your effective return. Suppose you contribute $50,000 over time and it grows to $75,000 before freshman year. Selling the same investment in a regular brokerage could trigger about $3,750 in capital-gains tax. In a 529, the entire $25,000 gain stays in your pocket, boosting the college fund by roughly seven percent overnight.

Coverdell ESAs share the federal break, but their $2,000 annual limit keeps the shield small. A Roth IRA shelters growth too, yet pulling earnings for college adds income tax, shrinking the cushion you expected.

One caveat for Illinois residents: the state has not adopted the federal rule that allows 529 funds for K-12 tuition or student-loan payments. Use the money for those purposes and Illinois will tax the earnings and reclaim any prior deduction (Bright Start Illinois Taxpayer Guide).

Stick to post-secondary costs and this benefit delivers two wins at once: no yearly tax drag during growth and no tax bill at withdrawal. Compounding at that rate is hard to match anywhere else.

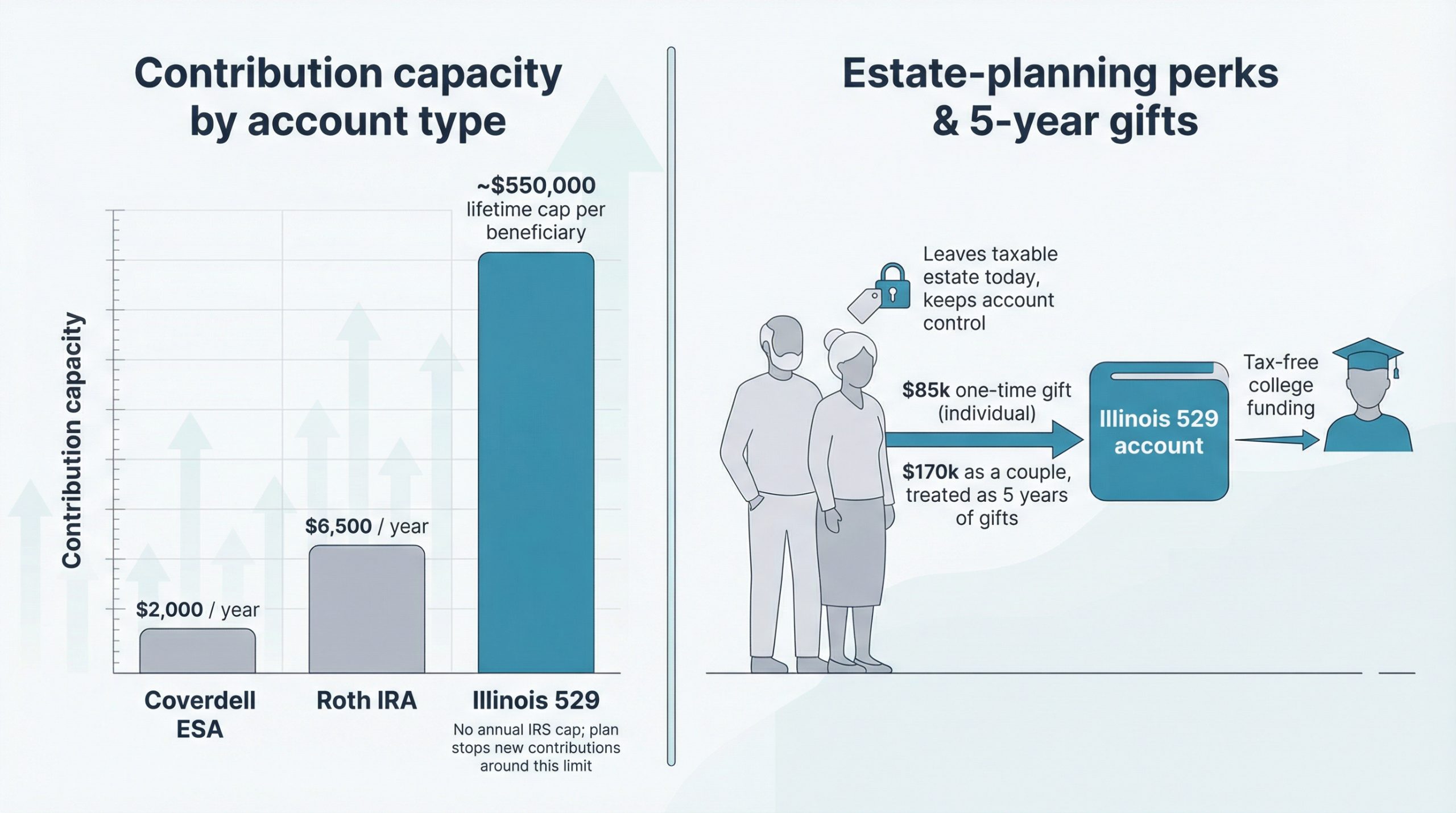

3. High contribution limits and estate-planning perks

A 529 is more than a piggy bank; it is a warehouse.

Illinois lets the balance for one beneficiary climb to about $550,000 before new deposits are turned away. That ceiling can cover four years at a pricey private university plus med school or an MBA. More important, the IRS sets no annual cap on how fast you fill the account.

Grandparents love this feature because it doubles as an estate-planning tool. They can front-load up to $85,000 in one year ($170,000 as a couple) and have the IRS treat it as five years of gifts. The money leaves their taxable estate today while they keep control of it, and the student enjoys years of tax-free compounding.

Try that with a Coverdell ESA and you hit a $2,000 yearly wall. Use a Roth IRA and you face a $6,500 limit and the need for earned income. A taxable custodial account has no limit, but gains are taxed each year and the child gains legal control at age 18 or 21.

The 529’s high ceiling also sidesteps income restrictions. Whether you earn $40,000 or $400,000, you can contribute as much as your budget or inheritance allows. That flexibility helps families fund multiple degrees or guard against runaway tuition inflation.

If you contribute more than your student needs, the next section shows how to redirect or roll leftover funds without handing a slice to the IRS. For now, the takeaway is simple: Illinois 529s provide room to build a large, tax-efficient college fund without gift-tax headaches or annual speed bumps.

4. Flexibility that avoids future tax penalties

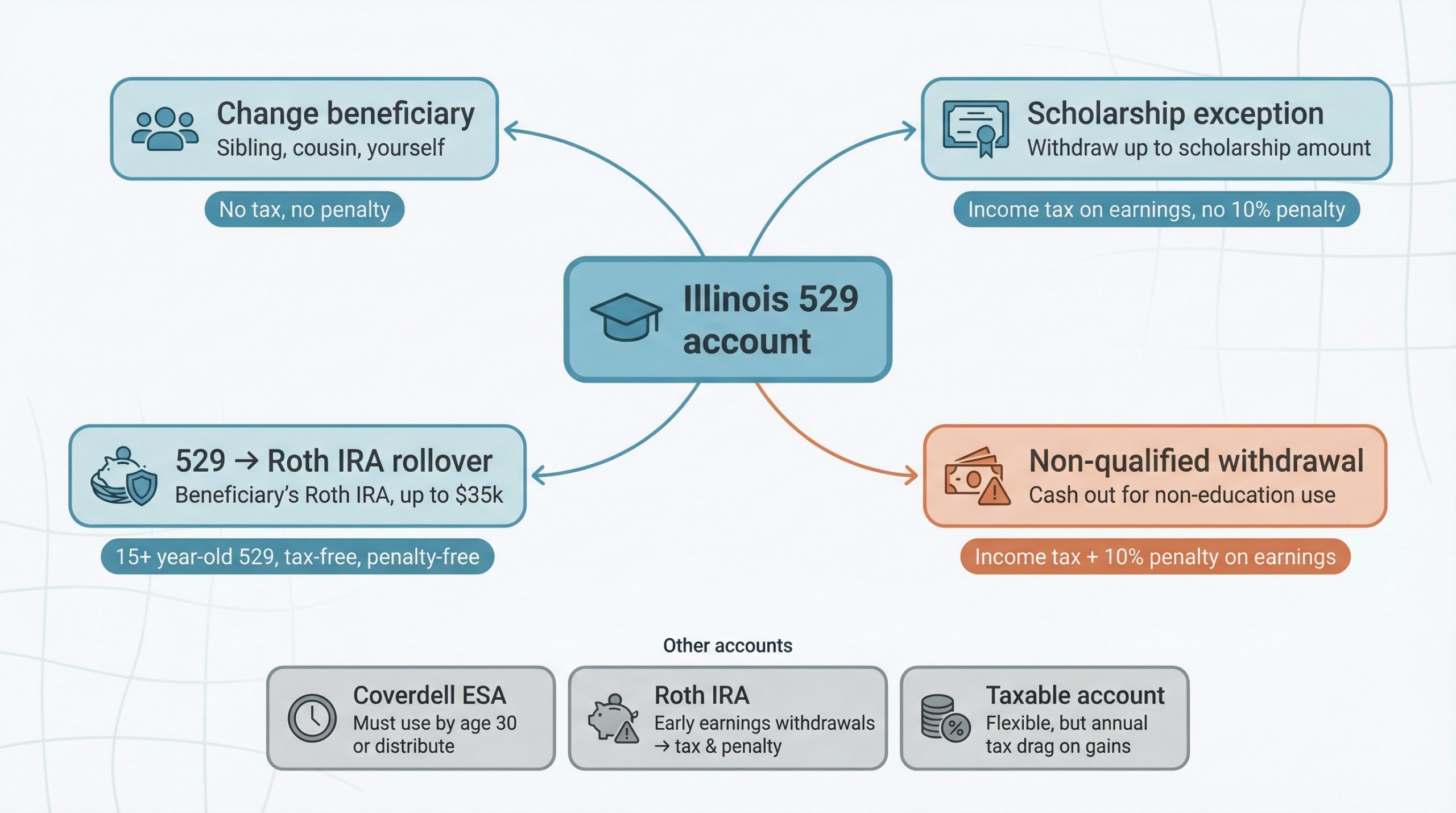

Plans change. Scholarships appear, majors shift, or a student skips college altogether. An Illinois 529 adapts with each twist, so the dollars you save never become a tax headache.

First, you can rename the beneficiary anytime. Move unused dollars from a first-born with a full ride to a sibling, cousin, or even yourself for graduate school. No taxes, no penalties, and minimal paperwork. Simply update the account online and keep the tax shelter intact.

Second, if a scholarship leaves cash unused, the IRS waives the usual 10 percent penalty on earnings up to the scholarship amount. You still owe ordinary income tax on those earnings, the same bill you would face if the money had been growing in a regular brokerage. The principal remains penalty-free.

The newest option is the 529-to-Roth IRA rollover. Starting with 2024 returns, you can move up to the annual Roth contribution limit each year, currently $6,500, from a 529 that has been open at least 15 years into the beneficiary’s Roth IRA, up to a $35,000 lifetime cap. The transfer is tax-free and penalty-free, turning leftover tuition money into retirement savings that can compound for decades.

Coverdell ESAs also permit beneficiary changes, but funds must be used by age 30 or face forced distribution. A Roth IRA lets you keep money indefinitely, yet early withdrawals of earnings invite taxes and penalties. Taxable accounts stay flexible, but you pay the drag every year.

With an Illinois 529 you gain options without ongoing tax costs. Save boldly now, adjust later, and stay on the IRS’s good side at every decision point.

5. Friendly to financial-aid formulas and other tax breaks

Saving a dollar is good, but saving it without hurting need-based aid or a valuable tax credit is even better.

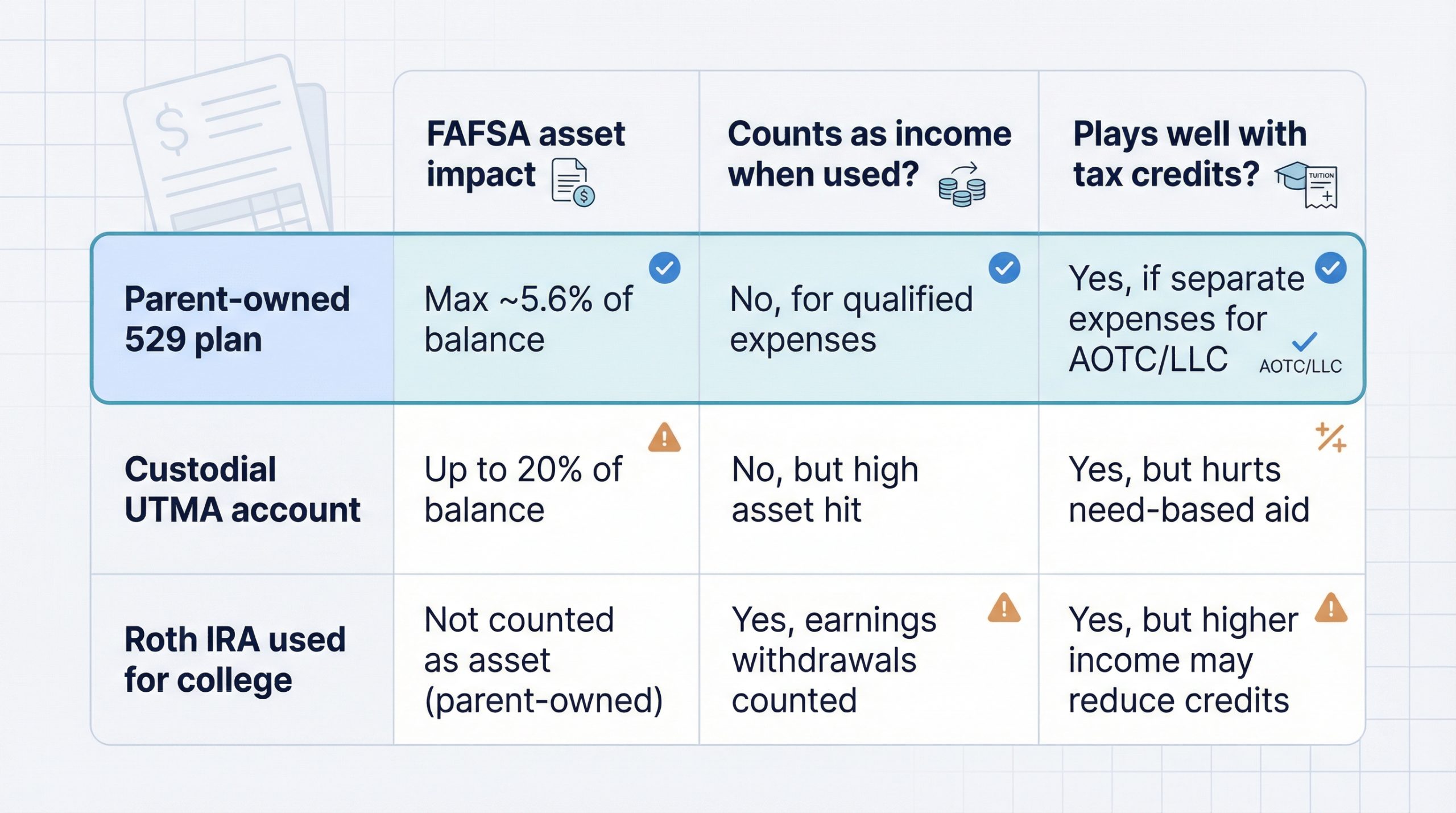

When a parent owns a 529, the balance counts as a parental asset on the FAFSA (Free Application for Federal Student Aid). At most 5.6 percent of the account factors into the aid formula each year. A custodial UTMA faces a 20 percent assessment, a difference that can preserve thousands in grants and scholarships.

Withdrawals from a 529 used for qualified expenses never show up as income on the next year’s FAFSA. The money leaves the account, pays the bursar, and quietly exits the aid discussion. Pull the same funds from a Roth IRA and the earnings land on your tax return, raising adjusted gross income and shrinking aid eligibility.

The 529 also works well with federal education credits. Because distributions are tax-free, they do not block you from claiming the American Opportunity Tax Credit or Lifetime Learning Credit, as long as you earmark separate expenses for the credit. Pay the first $4,000 of tuition with cash or loans, claim up to $2,500 from the AOTC, and let the 529 cover the rest tax-free.

One Illinois-specific bonus: employers that match your 529 contributions earn a 25 percent state tax credit, up to $500 per worker. Those workplace dollars land in your child’s account tax-free and grow alongside your own deposits.

In short, an Illinois 529 cuts your taxes while staying out of the way so other aid and incentives can keep working for you.

Conclusion

Illinois 529 plans stack multiple tax advantages—state deductions, tax-free growth, high contribution limits, flexible rollovers, and financial-aid friendliness—into one powerful college-savings package. When compared with Coverdell ESAs, Roth IRAs, or taxable accounts, the Illinois 529 consistently protects more of your money from both taxes and financial-aid penalties. Fund the account early, follow the simple rules, and let the program’s built-in perks do the heavy lifting toward your education goals.