Corporate decision-making and regulatory compliance are now heavily connected to ESG or Environmental, Social, and Governance. Investors, consumers, and regulators increasingly demand transparency and accountability, making ESG performance a key determinant of corporate reputation and long-term viability. The UK and EU are tightening ESG regulations, such as the Task Force on Climate-related Financial Disclosures (TCFD), reinforcing the need for strong data management. Businesses that fail to adapt risk financial penalties and can face accusations of greenwashing, legal issues, and reputational damage.

Effective ESG strategies are data driven. Reliable data allows organisations to measure performance, benchmark against industry standards, and make informed decisions. Measurement and benchmarking establish baselines. They can also help to track progress and ensure accountability, whilst regulatory compliance ensures accurate disclosures and adherence to ESG requirements.

ESG data also plays a critical role in risk management by identifying potential risks early, from carbon emissions to supply chain ethics. Investor confidence is therefore strengthened when businesses provide reliable ESG data, making them more attractive to sustainable investments. Companies such as High Digital recognise that no two businesses face the same ESG challenges, which is why they created an ESG Hub, which provides tailored flexible solutions using a microservices-based architecture to adapt to unique needs.

Sustainability is a key component of ESG strategy, and environmental data is crucial for achieving sustainability goals. Companies can leverage data to track carbon footprints and measure emissions and can also be used to keep an eye on energy consumption and waste production. Optimising renewable energy adoption through data-driven insights helps businesses improve energy efficiency and reduce their reliance on fossil fuels. Supply chain transparency is enhanced by monitoring supplier ESG performance and ensuring ethical sourcing practices. Analysing biodiversity and water usage enables businesses to assess their impact on ecosystems and natural resources.

Next, there’s social data which helps organisations create a positive impact on employees and communities. Companies can track DEI metrics and monitor workforce demographics including pay gaps and inclusion efforts. Employee well-being can also be improved through data analysis. By monitoring retention rates, engagement levels, and mental health initiatives companies can implement strategies in these areas. Ethical labour practices can also be maintained by ensuring fair wages and responsible supply chains. Measuring corporate social responsibility initiatives and their local impact allows businesses to align their operations with the expectations of the community. This is another area where High Digital’s ESG Hub assists with flexible data capture capabilities, enabling organisations to define custom social metrics that reflect their values.

Transparency and accountability are equally vital to ESG efforts, and this is where governance data comes in. Ethical practices are reinforced through data-driven reporting on executive pay, board diversity, and decision-making processes. Compliance with financial, legal, and ESG-specific regulations can be facilitated through structured data management.

Cybersecurity and data ethics are additionally becoming increasingly important, with businesses needing to protect consumer data, ensure ethical use of AI, and prevent fraud. High Digital’s microservices approach enables organisations to customise governance reporting rather than adhere to a rigid, one-size-fits-all framework, ensuring adaptability to specific needs.

Managing ESG data does present several challenges, however. Data fragmentation remains a significant issue, as information is often siloed across multiple systems, making integration difficult. The lack of standardisation across ESG reporting frameworks, such as GRI, SASB, and TCFD, complicates consistency and comparability. Greenwashing risks arise when companies provide misleading or manipulated data, undermining ESG credibility. Data privacy and security concerns must be balanced with transparency, ensuring compliance with regulatory requirements whilst maintaining confidentiality. Unlike traditional SaaS solutions, High Digital’s ESG Hub integrates with existing business systems, providing a centralised approach to ESG data management and addressing these challenges effectively.

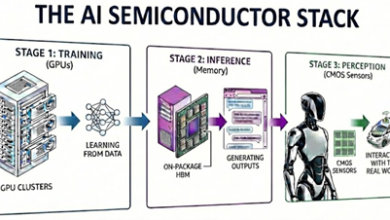

Technology is transforming how ESG data is collected, analysed, and reported. Artificial intelligence and machine learning enable predictive analytics for ESG risk assessment and sustainability trends. Blockchain technology enhances transparency and trust in ESG reporting by providing immutable records, particularly in supply chain management. Automation streamlines ESG data collection and reporting processes, reducing manual workload and increasing accuracy. The integration of IoT and big data enables real-time ESG monitoring, allowing businesses to track metrics dynamically.

Companies that harness ESG data effectively gain a strategic edge, strengthening their sustainability and social responsibility initiatives. A data-driven ESG strategy helps to attract investors and enhances brand reputation helping to strengthen long-term business success. Companies such as High Digital’s ESG help businesses with the flexibility of microservices, allowing them to customise their ESG approach rather than conforming to rigid SaaS models. Beyond compliance, ESG data serves as a valuable business intelligence resource.