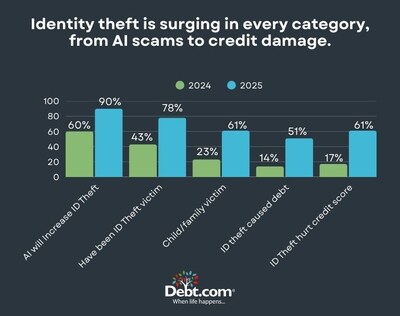

Debt.com’s annual ID Theft Survey reveals that in one year, identity theft victimization rose from 43% to 78%, and concern over AI-fueled fraud has skyrocketed to 90%.

FORT LAUDERDALE, Fla., Dec. 8, 2025 /PRNewswire/ — Identity theft in the United States has entered a dangerous new era. Debt.com’s annual survey of 1,000 U.S. adults finds that more have been victims, more reported their children’s identities were compromised, and far more have experienced financial fallout from new debt to significant credit score drops.

Each December, Debt.com surveys Americans about their experiences with identity theft. This year’s findings show the problem is worsening and the threats escalating faster than previously observed – which is impacting more households.

“Consumers are fighting a battle with tools that were built for a different era. Fraudsters now use AI to scale their crimes faster than families can respond. Until we give Americans stronger protections and clearer reporting systems, identity theft will continue to outpace prevention,” comments Howard Dvorkin, CPA and chairman of Debt.com.

Identity Theft Victimization on the Rise

The number of Americans who say they have been victims of identity theft jumped 35% in just one year, rising from 43% in 2024 to 78% in 2025. Concern over AI-driven identity crime is up from 60% last year to 90% this year.

Children Are Increasingly Becoming Victims

Child identity theft has surged dramatically. Three in five (61%) say a child or family member’s child has been victimized. That’s a staggering increase from 23% in 2024. Half said they felt vulnerable and nervous about the child’s financial future upon discovery of the fraud.

Pig-Butchering Scams New to the Survey and Results Show They Hit More Than Half of the Americans Polled

This year, Debt.com expanded its research to explore a fast-growing scam known as “pig-butchering,” in which scammers build fake online relationships to lure victims into investing in fraudulent crypto or investment platforms that do not exist. The survey found:

- 57% personally lost money

- 11% know someone who lost money

- 23% were contacted but did not suffer a loss

- More than one-third say a pig-butchering scam cost them $500 or more

“The rise of pig-butchering scams shows how predators use psychology as much as technology,” says Dvorkin. “They gain a victim’s trust, then drain their finances. What’s most troubling is how many victims never see it coming. These schemes are engineered to target people at their most vulnerable moments.”

Identity Theft Causing More Debt and Tanking More Credit Scores

The financial toll has intensified with 57% saying identity theft pushed them into debt – a 43% increase from last year’s 14%. Americans are also carrying larger balances resulting from fraud:

- 23% took on $500 or more of debt, up from only 9% in 2024

- 35% took on $251 to $500 of debt

- 12% kept losses below $250

Credit scores suffer due to identity theft, with more than three in five Americans (61%) saying their credit score dropped because of it. This is a sharp rise from 17% in 2024. Twenty-five percent say their credit score dropped 51-100 points, while 11% say their scores dropped 101-200 points.

Americans Respond to Fraud with Increase in Credit Monitoring

Americans are fighting back and responding to the escalating threats and risks of identity crimes. Consumers are turning to protections services at increased rates. Seventy-seven percent are now using credit monitoring and ID theft protection, up from 51% last year.

The severity underscores rising criminal sophistication and the growing difficulty consumers face when reclaiming their financial identity.

About: Debt.com is a trusted source for consumers seeking help with credit card debt, student loans, tax debt, credit repair, and more. By connecting people with vetted financial professionals and educational tools, Debt.com empowers Americans to make smart money decisions and regain control of their finances.

View original content to download multimedia:https://www.prnewswire.com/news-releases/the-new-identity-theft-crisis-ai-scams-child-victims-and-credit-damage-are-all-spiking-302634561.html

SOURCE Debt.com