For most consumers, buying a bottle of wine is simple. For the independent retailers who stock, price, and sell that bottle, the back office can be anything but.

Wine and liquor stores operate in a world of edge cases. A single product might need to be tracked by vintage, sold by the bottle or by the case, priced with “break-pack” rules, and reconciled against distributor invoices that arrive in inconsistent formats. Layer on age verification, state-by-state tax rules, keg deposits and returns, and delivery marketplaces that each behave differently, and it’s easy to see why many store owners still rely on manual processes, spreadsheets, and fragmented tools.

Santé wants to turn that complexity into automation.

The New York City–based startup, which positions itself as a fintech platform built specifically for the wine and spirits industry, announced a $7.6 million funding round led by Bonfire Ventures, with participation from Operator Collective, Y Combinator, and Veridical Ventures. Santé says it plans to use the new capital to scale its sales team and accelerate product development for grocers and other retailers with specialized commercial operations.

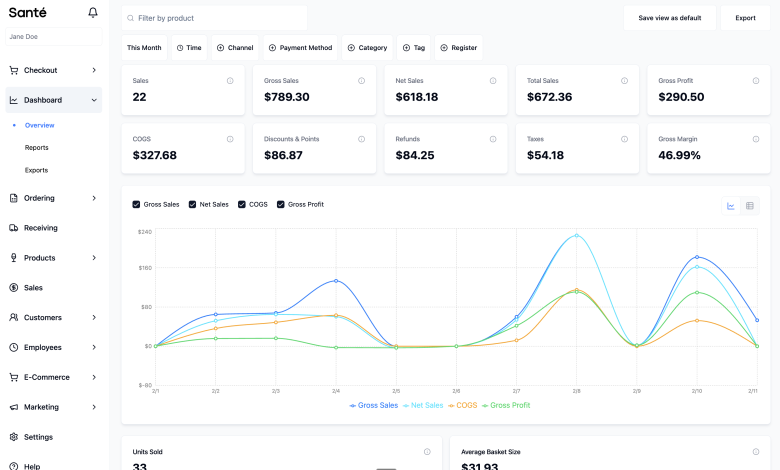

The timing is tied to momentum. Santé says it grew 400% last year and is now processing $500 million in annual card volume for hundreds of stores.

Why Wine And Liquor Is Harder Than “Retail”

Most modern retail software was designed for categories that behave predictably: a SKU is a SKU, a pack size is a pack size, and compliance is largely standardized. Selling alcohol isn’t that.

Liquor and wine retailers face a unique mix of operational and regulatory friction that can break generic point-of-sale and e-commerce tools. Inventory doesn’t just need to be “in stock” or “out of stock.” It often needs to be correct at the bottle level, across formats (single bottle vs. six-pack vs. case), and updated the moment a distributor delivery arrives or a marketplace order is placed.

Even basic receiving can be painful. Distributor invoices may require hours of manual data entry each week. Unit costs can change, items can be substituted, and naming conventions can be inconsistent. And once inventory is finally accurate, retailers still have to market the right products to the right customers, manage delivery logistics, and keep pace with local rules that vary by jurisdiction.

It’s a lot for small teams, and it gets harder as a business expands to multiple locations.

That’s the gap Santé is aiming at: not just “software for a store,” but a purpose-built operating system for a category where the details matter.

A Customer Pain Point That Shows Up In Time Saved

For store owners, the value of specialized software is often measured in hours returned.

“After over a decade with Atlantic Systems, we switched to Santé, and it’s transformed our operation,” said Bobby Cahill, owner of Wine Cellar of Queens, one of the largest wine and spirit retailers in New York City. “Ordering products used to take up so much of my time, but now I can create purchase orders in minutes and focus on my customers.”

That quote captures a common theme in vertical software: when a platform matches the real workflow of a business, the first win isn’t flashy AI. It’s fewer manual steps, fewer mistakes, and faster cycles for routine tasks like ordering and receiving.

Santé’s Bet: Full-Stack, With AI Where It Actually Helps

Santé is framing its product as a unified platform that combines inventory, e-commerce, delivery management, marketing, reporting, and payments-related infrastructure in one place. The thesis is straightforward: if the system of record is accurate, everything else becomes easier.

The other bet is that AI can be practical, not gimmicky, when it’s applied to the highest-friction parts of the workflow. Santé says its proprietary AI suite is designed to boost sales and save time, with features that sit inside day-to-day operations rather than in a separate “AI tool” tab.

Among the product capabilities Santé highlights:

- AI-powered invoices: scanning invoices from distributors and updating inventory levels and unit costs quickly, reducing manual entry.

- A marketing agent: segmenting customers based on purchase history and triggering email and SMS outreach when items are restocked, promoted, or tied to tasting events.

- Automated e-commerce cataloging: generating descriptions and images for large beverage catalogs so stores can keep online listings fresh without dedicating staff time to content.

- Unified delivery integration: consolidating orders from platforms like DoorDash, Uber Eats, GrubHub, and Instacart directly into the POS workflow.

- Liquor-specific logic: handling bottle and keg tracking, vintage management, and complex case discounting such as mix-and-match rules.

- Mobile inventory counting: making cycle counts easier without needing outside labor.

- Multi-store inventory tools: supporting transfers across locations and predictive reordering.

- Marketplace sync: keeping inventory aligned across beverage discovery and marketplace platforms like Vivino, Wine-Searcher, and FrootBat.

Taken together, the pitch is less “one more tool” and more “replace the patchwork.”

“Left Behind” By General POS And E-Commerce

Santé CEO Darren Fike argues the category has been underserved by mainstream providers.

“Wine and liquor retailers have been left behind by traditional POS and eCommerce companies,” Fike said. “With the support of the top investors in vertical SaaS, we’re excited to continue building the most effective platform for the wine and spirits industry while also expanding to support small business owners across similar verticals like convenience and local grocery stores.”

That expansion point matters. Beverage alcohol is a sharp wedge because it’s uniquely complex. But many adjacent categories share the same reality: thin margins, high operational variance, and systems that weren’t designed for how the business actually runs.

An Investor View: Complexity As Moat

Bonfire Ventures partner Tyler Churchill framed the opportunity as both large and defensible precisely because the industry is fragmented and regulated.

“The liquor and grocery industry is massive but also incredibly complex, fragmented and regulated in every state, county and even city,” Churchill said. “Santé is approaching this industry with the attention to detail necessary to deliver real, end-to-end value with AI. Store owners aren’t simply getting another tool to track inventory. They are getting a companion technology platform that helps them run a stronger, more profitable business with ease.”

He added that the company is hearing stories of operational leverage translating directly into growth decisions, including one customer who chose to expand store count substantially because the platform made it “possible and profitable.”

Whether that becomes a repeatable pattern is the real test. In vertical retail, the winners are often the platforms that move from “nice to have” to “I can’t operate without it.” That typically happens when software touches revenue (better marketing and sell-through), costs (less labor, fewer errors), and speed (faster ordering, receiving, and replenishment) at the same time.

The Bigger Trend: AI As Workflow, Not Add-On

Santé’s positioning also reflects a broader shift happening across software: AI features are increasingly expected, but the companies that win are the ones embedding them into workflows that already exist.

In this category, “AI” doesn’t need to be abstract. It can mean reading invoices the way a human would. It can mean turning a chaotic product catalog into consistent online listings. It can mean noticing what customers buy and nudging them at the right time. None of that requires a retailer to change how they operate. It just removes friction from how they already operate.

If Santé can keep doing that while scaling across a fragmented industry, it has a chance to become the default system of record for a category most software vendors have treated as an edge case.

For now, the company is focused on building what it calls the complete operating system for wine and liquor stores, spanning receiving, e-commerce, delivery app management, marketing, and more, backed by an AI layer designed for modern retail.

Santé says more information is available at its website: https://www.santehq.com/.