PUNE, India, Feb. 4, 2026 /PRNewswire/ — For nearly a decade, robotic surgery was sold as progress. Hospitals bought systems, surgeons got trained, brochures spoke about precision and innovation. What rarely got discussed was a harder question: does this technology actually pay back—clinically and financially—when scaled inside a real hospital system?

That question is now unavoidable.

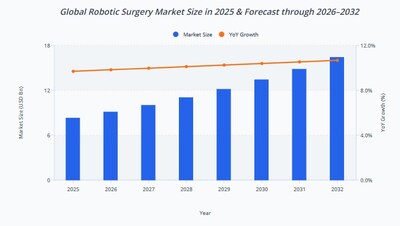

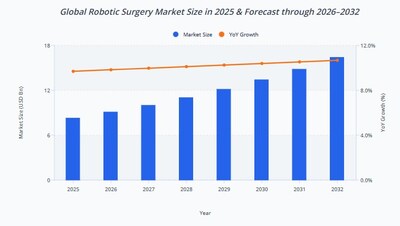

According to deep-dive analysis by MMR Statistics, the global robotic surgery market, valued at USD 8.28 billion in 2025, is projected to reach approximately USD 16.4 billion by 2032, growing at a ~10.2% CAGR. But focusing on growth alone misses the real story. The market is entering a phase where returns are diverging sharply—between hospitals that understand how robotic surgery works as a system, and those that treat it as a machine.

What Changed in the Last Three Years

Three structural shifts have quietly rewritten the economics of robotic surgery.

First, clinical expectations have hardened. Robotic-assisted procedures are no longer judged against open surgery alone. They are benchmarked on length of stay, complication rates, conversion rates, and surgeon throughput. In several high-volume procedures, robotic platforms are now expected to reduce hospital stay by 1–2 days, cut post-operative complications by 15–30%, and improve procedural precision—outcomes that directly affect hospital cost structures.

Get Full PDF Free Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.mmrstatistics.com/reports/795456/global-robotic-surgery-market/contact?type=sample

Second, capital pressure has intensified. A single robotic surgical system typically requires USD 1.5–2.0 million in upfront investment, excluding annual maintenance, disposable instruments, software upgrades, and training costs. What changed is not the price—but tolerance. CFOs are no longer willing to park such capital unless utilisation crosses defined thresholds.

Third, software and data have entered the operating room. AI-enabled navigation, imaging integration, and procedural analytics are no longer add-ons. They are increasingly where margins sit. Hardware may get a hospital into the game, but software determines whether it wins.

This combination has turned robotic surgery from a prestige investment into a performance-sensitive asset.

Market Snapshot — And Why These Numbers Make Boards Nervous

- Global Market Size (2025): USD 8.2–8.3 Bn

- Projected Market Size (2032): ~USD 16.4 Bn

- CAGR (2025–2032): ~10.2%

- Installed Base: 6,700+ robotic systems globally

- Primary Procedure Volumes: Urology, Gynecology, General Surgery

- Fastest-Growing Value Layer: AI software, analytics, training & services

- Value Leader: North America

- Fastest Adoption Growth: Asia-Pacific

On the surface, these numbers signal confidence. Underneath, they signal pressure.

The Biggest Misunderstanding in the Market

The most common assumption hospitals make is simple: buy the robot, volume will follow.

MMR Statistics’ analysis suggests the opposite is often true.

Volume follows case-mix planning, surgeon alignment, and operating room discipline—not the other way around. Hospitals that fail to redesign OR scheduling, cross-specialty usage, and training pipelines often discover too late that their robotic system runs only a few days a week. At that point, even strong clinical outcomes cannot rescue ROI.

Get Insightful Data on Regions, Market Segments, Customer Landscape, and Top Companies (Charts, Tables, Figures and More) – https://www.mmrstatistics.com/reports/795456/global-robotic-surgery-market/contact?type=sample

In practical terms, many systems require 100–150+ robotic procedures per year per unit just to approach cost neutrality. Below that, depreciation and operating costs accumulate quietly, quarter after quarter.

This is where robotic surgery stops being a medical discussion and becomes a management problem.

Where Volume Lives vs Where Money Actually Flows

One of the clearest findings from the MMRS research is the disconnect between activity and profitability.

Where Volume Lives

- High-frequency procedures such as prostatectomy, hysterectomy, and selected general surgeries.

- Tertiary hospitals with consistent elective case flow.

Where Money Lives

- Software upgrades and AI-enabled modules.

- Training, certification, and simulation ecosystems.

- Multi-specialty utilisation of the same platform.

Where Margins Expand

- Hospitals that push utilisation across departments.

- Systems that shorten learning curves and reduce surgeon fatigue.

- Vendors that monetise data and workflow intelligence, not just instruments.

Where Margins Collapse

- Single-specialty deployments.

- Low-volume centres chasing prestige.

- Robots treated as isolated assets instead of integrated service lines.

The implication is uncomfortable but clear: owning a robot does not create value; running it well does.

Regional as well as US Vs UK Reality — Why Adoption Looks Uneven

North America continues to dominate market value, driven by reimbursement structures, higher procedure volumes, and mature training ecosystems. Europe follows with more structured but slower adoption, shaped by public healthcare investment cycles.

Asia-Pacific is often labelled the growth engine—and it is—but with caveats. While hospital infrastructure expansion and rising surgical demand are driving adoption, price sensitivity and training gaps remain real constraints. Early movers will benefit, but only if utilisation discipline is enforced early.

In the United States (US), robotic surgery is increasingly being pulled into a different debate altogether — productivity under pressure. With surgeon shortages, rising malpractice exposure, and reimbursement scrutiny, hospital systems are being forced to ask whether robotics can meaningfully improve throughput without compromising outcomes. According to MMR Statistics analysis, US hospitals that fail to push robotic utilisation beyond flagship procedures often struggle to justify capital allocation, particularly in private and investor-backed systems where return timelines are tightening. In this environment, robotic surgery is no longer evaluated as innovation spend, but as a capacity and risk-management lever.

In the United Kingdom (UK), the conversation looks different but no less urgent. With NHS surgical backlogs, constrained capital budgets, and an overstretched workforce, robotic surgery is increasingly framed as a potential efficiency tool rather than a prestige investment. However, MMR Statistics’ research highlights a critical tension: without coordinated training, centralised planning, and case prioritisation, robotic platforms risk becoming underutilised assets within an already resource-constrained system. For UK policymakers and hospital trusts, the challenge is not whether robotics works clinically, but whether it can be deployed at scale, equitably, and without worsening access gaps.

Regional strategy matters because robotic surgery economics do not travel well without localisation.

Segment Snapshot – Where Robotic Surgery Wins

MMR Statistics’ segmentation analysis shows that robotic surgery outcomes diverge sharply by product, application, and end use—and this is where most strategies break. While surgical robotic systems still dominate capital spend, software & services are fast emerging as the real value layer, driven by AI-enabled navigation, analytics, and training. On the application side, urological and gynaecological surgeries anchor baseline volumes, but the next utilisation inflection is clearly in general surgery, where hospitals are expanding robotics across colorectal, hernia, and bariatric procedures to make systems economically viable. In contrast, orthopaedic, neurosurgical, microsurgical, and oncological robotics remain high-value but volume-limited, constrained by cost and learning curves. From an end-use lens, hospitals continue to dominate adoption, while ambulatory surgery centres remain selective, cautious, and ROI-sensitive.

Segmentation Type

By Product

•System

•Surgical Robot

•Navigation System

•Consumables & Accessories

•Software & Services

By Deployment Model

•On-Premises

•Remote / Telesurgery

By Application

•General Surgery

•Gynaecological Surgery

•Orthopaedic

•Urological

•Neurosurgery

•Microsurgery

•Ontological Surgery

•Others

End Use

•Hospitals

•Ambulatory Surgery Centres

•Others

Immediate Delivery Available | Buy this Research Report (Insights, Charts, Tables, Figures and More) – https://www.mmrstatistics.com/checkout/reports/795456/contact

The Uncomfortable Truth for Leadership Teams

Robotic surgery is exposing a gap in hospital strategy.

Some institutions are discovering that they invested in technology faster than they invested in process, people, and planning. Others are realising that surgeon enthusiasm alone cannot compensate for broken OR workflows.

The harsh reality is this: robotic surgery amplifies both excellence and inefficiency. Well-run hospitals see faster recovery, happier surgeons, and stronger patient pull. Poorly run ones see rising costs disguised as innovation.

Executive Impact — Numbers That Change Decisions

- The global robotic surgery market stands at USD 8.2–8.3 Bn (2025) and is projected to reach ~USD 16.4 Bn by 2032, reflecting a ~10.2% CAGR — but returns are increasingly uneven across hospitals, not uniform across adoption.

- A single robotic surgical system typically requires USD 1.5–2.0 Mn in upfront capital, with USD 150k–200k in annual maintenance costs, excluding consumables and software upgrades — pushing ROI scrutiny into the boardroom.

- MMR Statistics’ analysis indicates that hospitals generally need 100–150+ robotic procedures per system per year to approach operational break-even; utilisation below this level materially erodes ROI.

- In high-volume applications, robotic-assisted procedures have demonstrated 15–30% lower complication rates and 1–2 days reduction in average length of stay, directly impacting cost of care and bed availability.

- Software, analytics, and services now account for an estimated 15–20% of total market value, growing faster than core hardware sales as hospitals prioritise optimisation over expansion.

- The global installed base has crossed 6,700 robotic systems, but utilisation efficiency — not system count — is emerging as the key performance differentiator.

Explore the Full Market Report – https://www.mmrstatistics.com/reports/795456/global-robotic-surgery-market

What the C-Suite Should Be Asking Now

- CEOs: Do we have the operational discipline to extract value from robotics?

- CFOs: What utilisation rate makes this investment rational—not aspirational?

- Clinical Heads: Are surgeons trained, scheduled, and supported—or just equipped?

- Strategy Teams: Are we building a robotic service line, or collecting machines?

The wrong answers are expensive.

Analyst Insight

“Robotic surgery is no longer about acquiring advanced equipment. It is a test of execution discipline. Hospitals that treat robotics as a system—spanning training, workflow, and utilisation—will win. The rest will carry impressive assets with disappointing returns,”

said Rucha Deshpande, Senior Research Manager, MMR Statistics.

Related Reports:

Robotic Process Automation Market – https://www.mmrstatistics.com/reports/530170/robotic-process-automation-market

Robots in Agriculture Market – https://www.mmrstatistics.com/reports/541697/robots-in-agriculture-market

Complementary and Alternative Medicine Market – https://www.mmrstatistics.com/reports/842916/complementary-and-alternative-medicine-market

Functional Brain Imaging Systems Market – https://www.mmrstatistics.com/reports/410972/functional-brain-imaging-systems-market

Global In Vitro Diagnostics Market – https://www.mmrstatistics.com/reports/592500/global-in-vitro-diagnostics-market

Why MMR Statistics

MMR Statistics approaches the robotic surgery market not as a technology trend, but as a business system—combining clinical outcomes, value pool logic, and execution risk. This enables stakeholders to move from curiosity to decision clarity.

MMR Statistics’ work in robotic surgery goes beyond market sizing into procedure-level economics, utilisation modelling, and execution risk analysis. The firm has built deep expertise across robot-assisted urology, gynecology, general surgery, and emerging multi-specialty platforms, analysing not just adoption trends but case-mix feasibility, surgeon learning curves, utilisation break-even thresholds, and software-driven margin pools. MMR’s robotic surgery research is routinely used by hospital groups, device manufacturers, and investors to answer hard questions around ROI timing, capacity planning, platform selection, and regional scalability—areas where generic market reports typically fall short. This hands-on, systems-level understanding allows MMR Statistics to translate complex robotic surgery data into decision-ready insight, not just industry commentary.

Robotic surgery is no longer a symbol of modern medicine.

It is a mirror—showing which hospitals are operationally ready for the future, and which are not.

Contact:

Lumawant Godage

Visit Our Web Site : https://www.mmrstatistics.com/

Email: [email protected]

Phone :+91 9607365656

Follow us on:

Linkedin – https://www.linkedin.com/company/mmrstatistics/

Facebook – https://www.facebook.com/mmrstatistics

Instagram – https://www.instagram.com/mmrstatistics/

Youtube – https://www.youtube.com/@mmrstatistics

Global Office :

Navale IT park Phase 3

Pune-Bangalore Highway,

Narhe, Pune, Maharashtra 411041, India

Photo – https://mma.prnewswire.com/media/2876917/MMR_Statistics.jpg

View original content to download multimedia:https://www.prnewswire.com/news-releases/robotic-surgery-market-is-no-longer-a-technology-story-it-is-a-discipline-test-for-hospitals-mmr-statistics-302679155.html

SOURCE MMR Statistics