Organisations worldwide share the same sentiment in constant pursuit of resolving siloed teams, fragmented data sources, disjointed internal projects, duplication of work, and draining of resources.

While management is pouring funds into resolving internal issues, external factors such as regulatory demands, cyber threats, and the growing number of competitors gunning for market capitalisation have called for the rise of advanced technological support, especially RegTech.

Shift in Regulatory Traditions

Golden Source of Data and Ethical Ownership through RegTech

We are now living in a time of significant technological transformation which has a global impact across industries, especially the financial services sector; the most heavily regulated business of all time.

One of the key questions remained;

With a new regulatory alert issued every 7 minutes, unresolved legacy challenges of fragmented data and systems, lack of ownership across the workforce, organisational misalignment with multiple converging projects causing duplicated investments, and process inefficiencies, how do companies ensure compliance and keep the house in order?

Year by year, we observe a shift in the focus area for risk and compliance.

This year, the focus lens is applied to these areas:

✗ Compliance Monitoring

✗ Cybersecurity & Technology Risk

✗ AML & Financial Crime

✗ Onboarding & KYC

✗ Sanctions

So not only there is a growing need to keep the house in order within the organisation, but also to ensure adherence to multiple regulatory jurisdictions across locations and business lines, also factoring the shift of focus area in regulatory topics, all these sound too difficult to manage holistically.

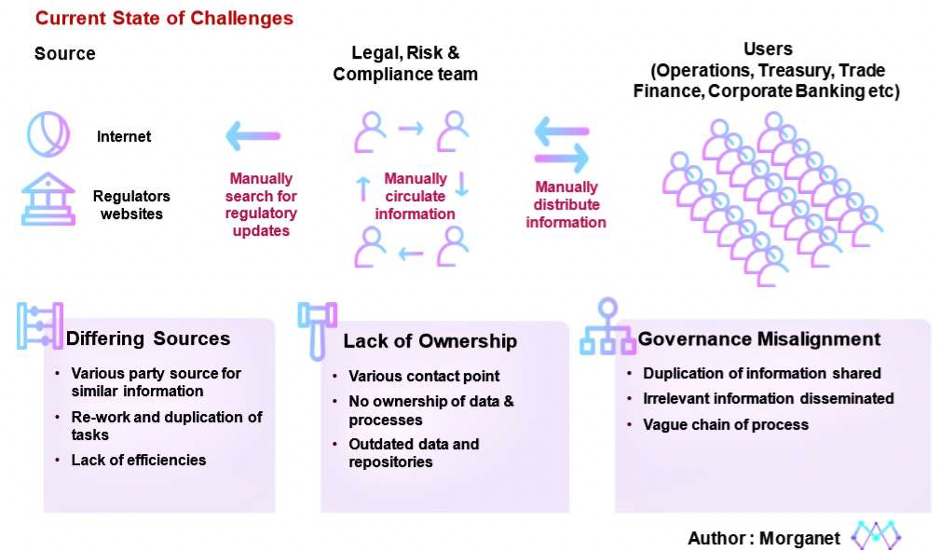

To piece the puzzles together, here is a high-level view illustrating the key challenges faced by compliance function to obtain regulatory updates and disseminating to the right team in today’s world of fragmented information and ownership.

Regulatory information is obtained and shared across by various parties regardless of whether it is strictly for the need to know basis, for an action to be taken or for onward escalation.

Given there are multiple regulatory topics relevant to specific businesses, products, and locations, keeping everyone on top of regulatory demands has been dreadful.

This creates a situation that the recipients are overwhelmed with information dump which breeds resilience within the organisation for functions to take ownership of topics, process, and most importantly, data.

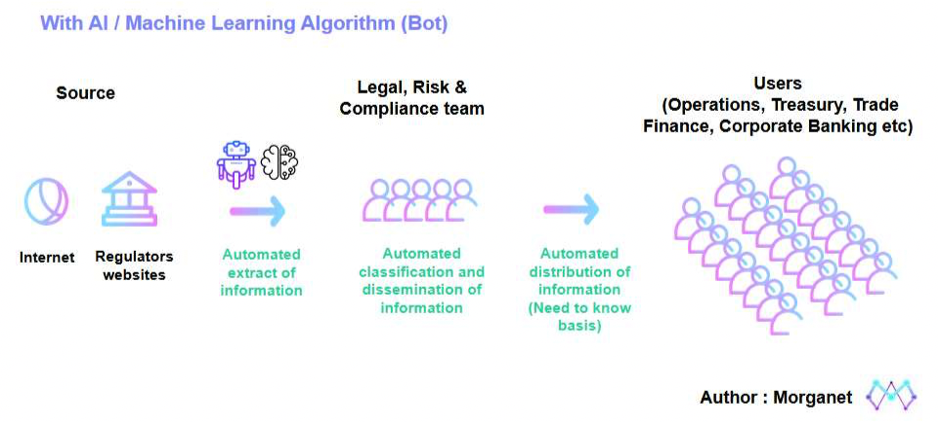

With the employment of RegTech as shown in diagram 2, especially advance analytical tools equipped with artificial intelligence and machine learning; these tools are able to consolidate information from existing fragmented systems and locations, form a golden source, and ensure the accountability of stakeholders.

Also, these tools are able to learn specific requirements from these stakeholders over a period of time!

Moreover, they function and execute activities based on a set of principles.

Eventually, these tools will be the hallmark of consistency that helm ethical accountability for the tasks executed within a value chain.

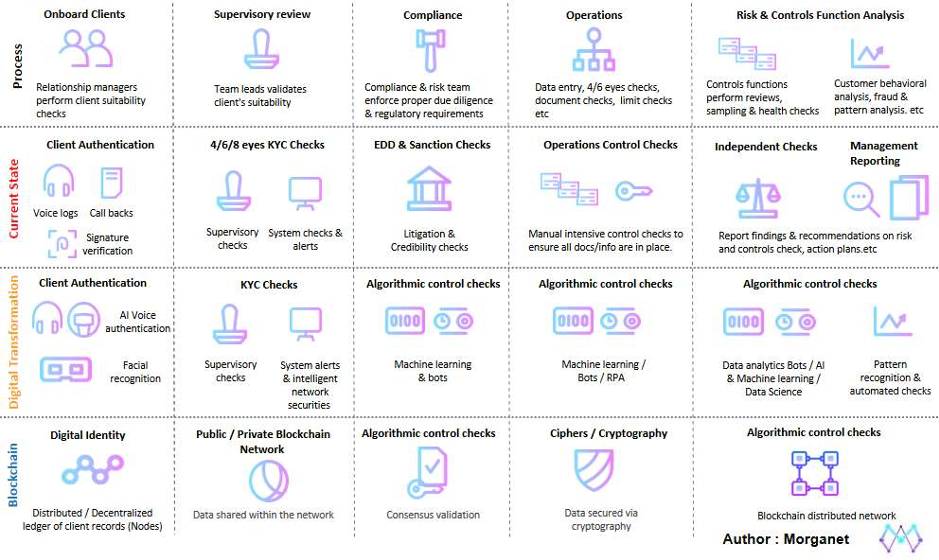

Here is another high-level example illustrating today’s client onboarding process, the way we execute tasks, and how various digital tools will transform these activities.

By understanding the basics of technological evolution that will be transforming our “business as usual”, it will then be easier to communicate and convince not only the management but the workforce, on the crucial need for upskilling.

If we force a person to do a task she or he doesn’t understand, we will be breeding resilience.

With corporate innovation and transformations taking place at almost every corner of the world, it is expected that regulatory compliance will be more stringent, not only to safeguard a country and organisation’s interest but most importantly, our interest as consumers.

Hence, we can only expect that the demand for Regtech across industries will rise with tides as the world calls for transparencies and greater security in businesses.