● AI innovation in the big banks is ramping up, with 100s of new patents and papers published in the past six months

● Evident analysis reveals the five biggest movers: JPMorgan Chase leads on AI research; Bank of America and Bank of Montreal impress on AI patents; Citigroup and Goldman Sachs drive AI startup investments

● According to Evident, banks’ AI innovation pedigree is now translating into improved market performance

April 9th, 2024 – LONDON, UK – Banking industry AI innovation is hotting up, with a handful of major US and Canadian players getting particularly active over the past six months, according to new insight from AI benchmarking and intelligence platform Evident.

Evident’s latest AI Innovation Report, which covers 50 of the world’s largest banks, reveals that since the start of Q4 2023, banks published +284 new AI research papers, filed +449 new AI patents, and made +97 new investments into AI-related startups.

According to Evident, the biggest AI innovation movers between Q4 2023 and Q1 2024 were:

● Number of AI research papers published: JPMorgan Chase (+45)

● Number of AI patents currently owned: Bank of America (+156)

● Average citations of AI patents: Bank of Montreal (+4.27)

● Number of investments into tech or data-focused companies: Citigroup (+11)

● Number of investments into AI-focused companies: Citigroup; Goldman Sachs (+2)

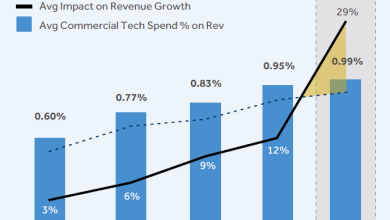

AI innovation is a strong indicator of future AI success. The top four banks for AI capabilities also lead on AI innovation, and these banks are now seeing greatly improved stock price performance compared with their peers.

Alexandra Mousavizadeh, co-founder and CEO of Evident, comments:

“From credit cards and ATMs to mobile apps and chatbots, successful banks continuously reinvent themselves in response to new innovations. When the tech changes, so do they—and right now, AI is transforming the banking landscape at a pace never seen before.

“It’s vital that banks commit the time, money, and resources to proactively explore emerging AI ideas and use cases—from carrying out research and investing in cutting-edge startup tech to patenting their in-house innovations as they make new breakthroughs.”

AI innovation leaders are consolidating their advantage

Building AI innovation capability within large, complex and heavily-regulated institutions like banks takes time, and Evident’s research shows that the established leaders enjoy a massive head start within their established areas of AI innovation strength.

JPMorgan Chase, the leading bank for AI research, is growing its output 2.4x as fast as the other top 10 publishers. Capital One and Bank of America account for over two-thirds (67%) of all AI-focused patent filings over the past 12 months, while Goldman Sachs and Citigroup represent nearly a third (30%) of AI-focused ventures investing in AI startups with financial services applications.

The top 10 performing banks for innovation: November 2023*

| Ranking by innovation pillar | Ranking by sub-pillar | |||

| Research | Patents | Ventures | ||

| 1 | JPMorgan Chase | 1 | 7 | 2 |

| 2 | Capital One | 3 | 2 | 5 |

| 3 | Royal Bank of Canada | 2 | 1 | 32 |

| 4 | Goldman Sachs | 15 | 11 | 1 |

| 5 | Wells Fargo | 5 | 9 | 8 |

| 6 | TD Bank | 4 | 8 | 36 |

| 7 | Morgan Stanley | 8 | 10 | 3 |

| 8 | Citigroup | 17 | 17 | 4 |

| 9 | Bank of Montreal | 25 | 3 | 30 |

| 10 | ING | 23 | 22 | 7 |

Mousavizadeh adds:

“AI innovation takes years of incremental investment in capabilities ranging from research and patents to ventures and partnerships. Banks like JPMorgan Chase, Capital One and Royal Bank of Canada are providing a clever blueprint for success that the rest of the field would do well to follow.”

– Ends –

NOTE TO EDITORS:

*While Evident’s ranking of the AI maturity of 50 global banks is only updated annually (next update: October 2024), its monthly Dispatchesprovide ongoing intelligence into how the data underpinning the Index is changing.

About Evident

Evident is a benchmarking and intelligence platform that aims to provide the most authoritative source of data-driven insights on how companies are adopting AI.

Beginning with banking, Evident has created the first independent benchmark for tracking industry-wide AI adoption and readiness. Drawing from millions of public data points, the Evident AI Index assesses 50 of the world’s largest banks across four main areas of AI capability: talent (capability & development), innovation (research, patents, ventures, ecosystem), leadership (in public communications and strategy), and responsible AI (including principles, people, publications and partnerships).

Evident also provides a wealth of ongoing research, data insights and events – including its annual AI Symposium – to deep-dive into banking sector AI progress, track trends, and explore how the world’s biggest financial institutions are approaching AI adoption, identifying use cases and measuring outcomes, impact and ROI – providing vital lessons for business leaders, investors and the financial services ecosystem at large.

Learn more at Evidentinsights.com.

Media Contacts

Kate Gordon Lisa Langsdorf

[email protected] [email protected]

+44 7980 921961