Neel Somani believes AI marks a rethinking of purpose. In his view, the invisible hand will force a reallocation of labor, many moats will disappear, and entrepreneurs must learn to trade attention like capital.

When Neel Somani talks about artificial intelligence, the conversation quickly moves past hype. “Software investing might be dead,” he says. “The $500 billion in annual software investments has nowhere to go, and investors will look for opportunities to reallocate.”

Somani isn’t a futurist; he’s a former Citadel quantitative researcher who treats AI as a market correction. His essays—widely circulated among technologists and investors—read less like futurism and more like a set of equations about where capital, labor, and attention will migrate next.

In The BLAST Playbook, he wrote that “the $500 B–1 T in annual software investments should reallocate to BLAST: assets that monetize boredom, loneliness, and scarcity.” The thesis, he explained, reflects a shift away from traditional software toward experiences that capture scarcity or absorb human attention in new, defensible ways. “AI tools like Cursor and Devin have made software fast and cheap to build, meaning great builders don’t need to take external capital,” he wrote. “Any software product is easily copied, so software ARR is less defensible by the day.”

That leaves investors and founders facing a vacuum. “Smart capital already sees the problem,” he wrote. “But what assets are able to scalably absorb hundreds of billions of dollars?” His answer, BLAST, is a shorthand for where post-software value might emerge.

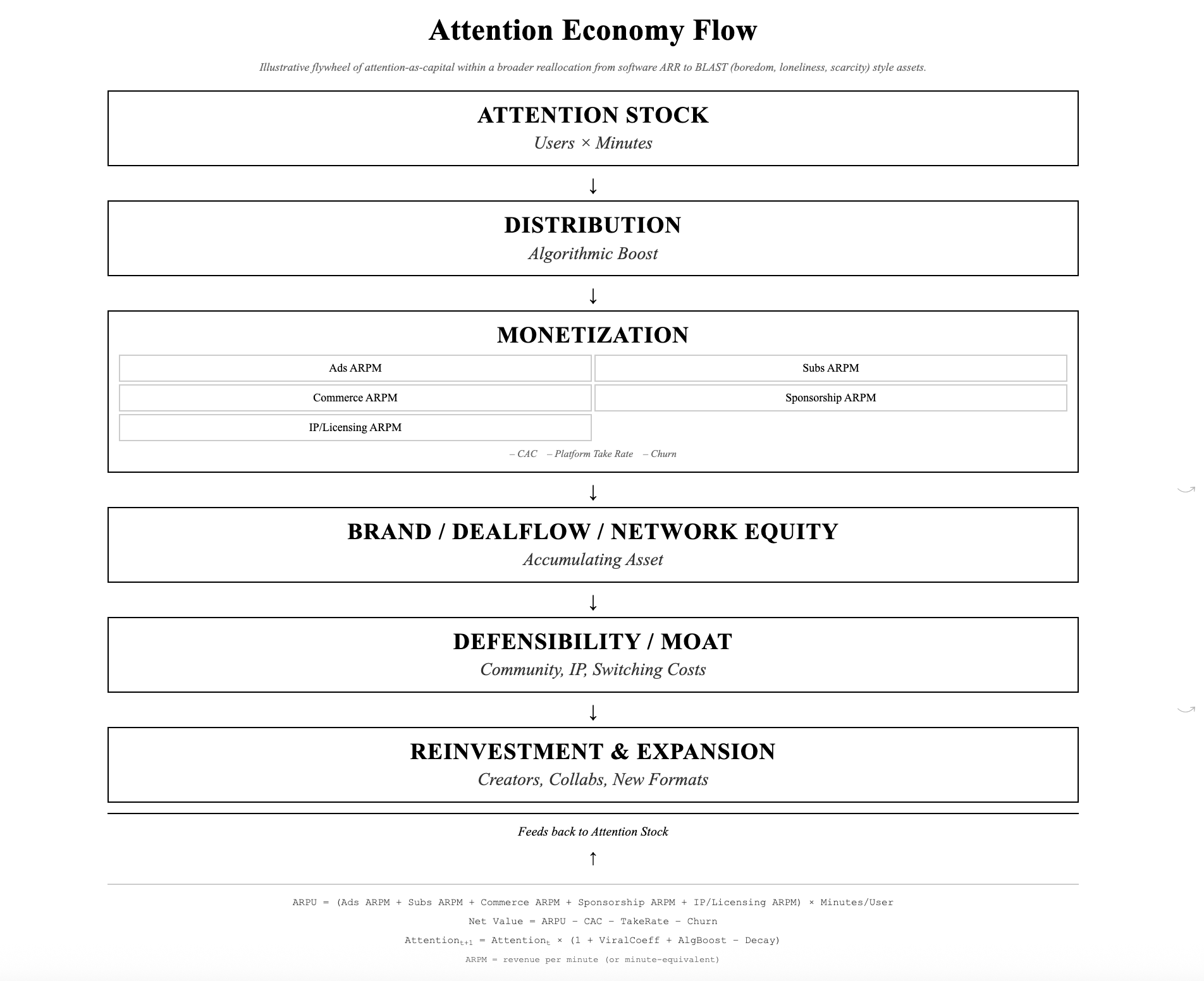

Attention as A Capital Alternative

Somani’s worldview is grounded in market efficiency. His background at Citadel shaped a fixation on incentives and arbitrage—traits that run through his writing. “Posting on X is a form of regulatory arbitrage,” he wrote in A Free Market for Eyeballs. “Attention is capital that isn’t taxed.”

He sees parallels between financial capital and attention capital: both scarce, both tradable, both poorly understood. “My entrepreneurial career started on X,” he wrote. “I was a quant at Citadel at the time, and a shitposter on the side. I left in 2022 at the calling of my wise friends, who advised me to build on the Terra blockchain. Just two months later, Terra had collapsed. But I wasn’t alarmed, because I intuitively knew that I was better off. I had gained an asset: attention.”

That moment when the blockchain went to zero but the social signal went exponential crystallized a pattern for Somani. “Attention is capital that behaves like capital but without friction,” he explains. “It’s not taxed, it’s not regulated, and it compounds.”

This logic mirrors what 2025 analysts at McKinsey now describe as “the attention-to-value loop,” in which online engagement and social reach translate directly into deal flow and brand equity.

AI as Market Correction

In The New Economy, Neel Somani describes AI not as pure disruption but as reallocation. “We have massively overallocated our youth to roles like software engineering and medicine, which will be shortly replaced en masse by AI,” he wrote. The correction, in his view, is not moral but mathematical.

That ‘reallocation’ lens shows up in his philanthropy too: he’s actively channeling capital into the next cohort of builders through a named endowment for young innovators.

“The labor force should reallocate away from jobs like software engineering and medicine, and instead toward construction in the short-term and entertainment in the long-term,” he argued. What humanity needs, he believes, is “a human equivalent of Bitcoin mining,” a system that channels idle human capacity into productive, creative, or emotionally valuable work.

He is skeptical of utopian narratives around AGI. “AGI poses many interesting questions,” he wrote, “but the problem I care about describes a medium-term issue facing the labor market.” He adds, “AGI’s role may not be to guide humanity toward one grand objective, but rather to support a diversity of purposes and individual goals.”

Somani’s model aligns with current data: OpenAI’s latest labor studies suggest that up to 40% of high-income roles have at least half of their tasks automatable by 2030. Yet Somani’s interpretation is more philosophical than alarmist. “AI will force people to consider alternative careers,” he writes flatly. “It’s a reallocation event.”

The Attention Economy, Unregulated

The line between economics and psychology blurs in Somani’s writing. “We’re living in a free market for eyeballs,” he wrote. “Finance moguls often preach about the ‘Section 1031 exchange,’ or a tax feature that allows you to swap investment properties for more valuable ones and continuously defer capital gains tax. What I’ve observed is that the same phenomenon happens with attention on X.”

He draws a direct parallel between liquidity in financial markets and virality online. Attention, in his words, can be “reinvested” through visibility and network leverage. The entrepreneurs who master this feedback loop, he suggests, will outperform those chasing legacy software valuations.

That argument is increasingly backed by data: a recent study from Harvard Business Review linked audience trust and digital reach to measurable startup funding advantages.

A Philosophy of Reallocation

Somani’s framework is not a lament about lost jobs or fading valuations. It’s a description of equilibrium. “Evolution is just a description of how a group of entities, whether living or non-living, can change over time. It is not a ‘force,’” he wrote in an older essay, Three Controversial Beliefs About Living Things. To him, the economy is part of that same descriptive system: a mechanism by which societies reallocate resources over time.

In conversation, that logic translates seamlessly into macroeconomics. “Capital, labor, and attention will move according to new rules of efficiency, and we’ll have to learn to work with it.”

Where many founders talk about AI in terms of acceleration, Somani frames it as sorting. He sees intelligence, human or artificial, as a market participant that behaves rationally, not a revolution that resets. “Smart capital already sees the problem,” he repeats. “The question is not just what to build, but also where to redeploy capital.”

The Closing Argument

For all his rationalism, Neel Somani carries a consistent undertone of curiosity rather than certainty. He describes his ideas as “strong beliefs, loosely held.” Asked what the AI future looks like, he offers mechanics.

“Software investing might be dead,” he says again, not for emphasis but precision. “What matters now is how we reallocate capital, attention and labor. The invisible hand doesn’t only involve humans anymore. It’ll account for agents, too.”

About Neel Somani

Neel Somani is an emerging leader in the world of machine learning. He is the founder of Eclipse, a pioneering Layer 2 blockchain platform that raised $65 million in funding, turning a bold idea into a cutting-edge reality. Before venturing into Web3, Neel was a quantitative researcher at Citadel, where he focused on commodities markets. This experience in finance laid the foundation for his transition into the blockchain space and machine learning industry.

Neel holds a triple major from UC Berkeley in Computer Science, Mathematics, and Business Administration. His academic research explored areas such as differential privacy and next-generation machine learning systems, positioning him at the intersection of technology and innovation.

Beyond his entrepreneurial endeavors, Neel is a passionate mentor and advocate for education. He has actively supported students at Berkeley and other institutions, fostering growth across multiple disciplines. Whether advising early-stage crypto startups, building predictive systems, or creating scholarship opportunities, Neel’s work is driven by a commitment to community-building and advancing innovation.