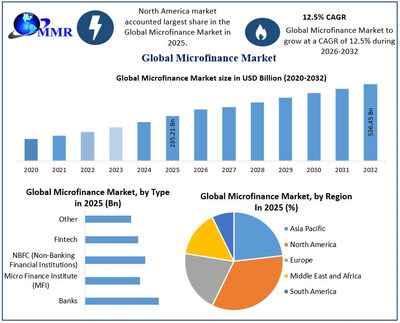

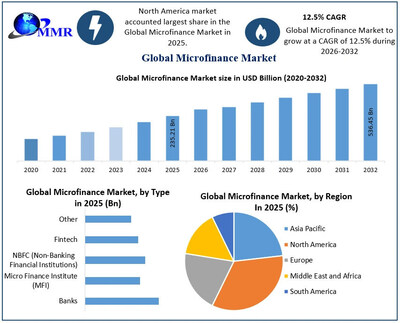

PUNE, India, Feb. 2, 2026 /PRNewswire/ — Global Microfinance Market size was valued at USD 235.21 Billion in 2025 and is projected to grow at a robust CAGR of 12.5% from 2025 to 2032, reaching approximately USD 536.45 Billion by 2032.

Microfinance Market is set for significant expansion, driven by rising demand for digital microfinance solutions, fintech-enabled lending, SME and rural credit, and financial inclusion initiatives. Technological innovation, strategic partnerships, and women-focused programs are reshaping lending dynamics and fueling long-term market growth.

“Digital microfinance solutions and SME lending are reshaping global markets; Maximize Market Research reveals the next wave of financial inclusion growth.”

Key Market Trends & Insights from the Microfinance Market Report

- Based on lending type, the digital microfinance solutions segment captured the largest market share. Digital micro-lending platforms, mobile banking apps, and online microfinance loans for small businesses are driving rapid adoption in emerging economies. This segment continues to benefit from technological advancements that streamline loan processing and repayment.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.maximizemarketresearch.com/request-sample/230628/

- Micro-lending for small businesses is revolutionizing financial inclusion. Microfinance loans for small-scale enterprises and low-income individuals are expected to see the strongest near-term growth. Emerging digital microfinance platforms in Asia-Pacific and Africa are expanding reach and improving financial accessibility.

- Asia-Pacific led the market, followed by Africa. Strong government-backed financial inclusion programs, urbanization, and small enterprise development are driving market expansion in these regions. India and Bangladesh are emerging as hotspots for digital microfinance adoption, targeting women entrepreneurs and rural borrowers.

- Women-focused microfinance programs are creating high-growth opportunities. Initiatives targeting women entrepreneurs and self-help groups are expanding rapidly. MFIs offering specialized products for female borrowers are leveraging partnerships with NGOs and social enterprises to strengthen outreach.

- Emerging markets remain the fastest-growing segment, driven by financial literacy programs, digital lending, and government-supported micro-lending initiatives.

- Fintech integration and AI-powered credit scoring are poised to drive the next wave of microfinance innovation. Next-generation digital microfinance solutions, blockchain-enabled lending, and predictive credit scoring models are expected to enhance loan approval efficiency and reduce defaults.

- Leading players in the Microfinance Market include SKS Microfinance, Grameen Bank, and Bandhan Bank, which collectively account for a significant share of global market revenue. These institutions are leveraging digital platforms, strategic partnerships, and customized micro-lending solutions to expand their reach and strengthen their market positions.

Get Insightful Data on Regions, Market Segments, Customer Landscape, and Top Companies (Charts, Tables, Figures and More) – https://www.maximizemarketresearch.com/request-sample/230628/

Global Microfinance Market Segmentation Revealed: MFIs, Digital Lenders & Rural Borrowers Driving Growth

Global microfinance market segmentation reveals a dynamic shift, with Micro Finance Institutions (MFIs) dominating the microfinance lending landscape due to deep rural penetration and strong group-lending discipline. Fintech-driven microfinance platforms are rapidly expanding digital loan distribution, while banks and NBFCs focus on urban borrowers. By loan type, income-generating and emergency loans lead, and MSMEs, women entrepreneurs, and rural communities are emerging as the most active microfinance market end users, driving next-level market expansion.

By Type

Banks

Micro Finance Institute (MFI)

NBFC (Non-Banking Financial Institutions)

Fintech

Other

By Loan Type

Income-Generating Loans

Consumption Loans

Emergency Loans

Agricultural Loans

Others

By End User

Individual Borrowers

Micro, Small, and Medium Enterprises (MSMEs)

Women Entrepreneurs

Farmers and Rural Communities

Unlocking the Future of Microfinance: Digital Microcredit, SME Loans & Innovative Financial Inclusion Solutions

Microcredit & Lending

- Group Lending — community/solidarity lending models

- Individual Micro Loans

- SME and Small Business Microloans

- Agriculture and Rural Loans

Micro‑Savings & Deposits

- Savings accounts tailored to low‑income clients

- Digital micro‑savings solutions

- Savings‑linked financial inclusion products

Micro‑Insurance Products

- Micro‑health insurance

- Crop and livestock insurance

- Life and accident micro‑insurance

- Weather / index‑based insurance solutions

Digital & Fintech‑Enabled Financial Services

- Digital loan disbursement platforms

- Mobile banking for microfinance

- Peer‑to‑peer (P2P) loan marketplaces

- AI / ML‑based credit scoring and risk analytics systems

Ancillary Financial Services

- Remittances and payment services

- Leasing and asset financing

- Financial literacy and advisory support

Immediate Delivery Available | Buy this Research Report (Insights, Charts, Tables, Figures and More) – https://www.maximizemarketresearch.com/checkout/230628/

Latest Microfinance Market Developments 2025–2026: Strategic Shifts, Major Partnerships & Impact Milestones

On July 18, 2025, Bandhan Bank revised its microfinance strategy by provisioning for stressed EEB loans and focusing on secured micro- and SME loans to enhance asset quality. On January 25, 2026, BRAC Microfinance partnered with Foodpanda to offer collateral-free microcredit, savings, and insurance solutions nationwide. On November 11, 2025, BRAC earned the CPC Gold certification for client protection excellence. On August 25, 2025, Kiva celebrated 20 years of driving financial inclusion through global microloans. On January 31, 2025, Bank Rakyat Indonesia (BRI) launched the UMKM EXPO to empower MSMEs and expand inclusive microfinance engagement.

Regional Pulse: How Asia-Pacific, North America & Emerging Markets Are Redefining the Global Microfinance Market

Asia-Pacific leads global microfinance growth, driven by vast rural populations, rising SME financing needs, and digital microfinance solutions. India and Bangladesh set the benchmark for financial inclusion and scalable micro-lending innovation.

North America and Europe are redefining microfinance impact, fueled by fintech-enabled lending, ESG-focused investments, and institutional funding, creating premium opportunities in sustainable microcredit and transformative financial inclusion programs.

Africa and Latin America embrace digital microloans, targeting women entrepreneurs and rural communities. Technology-driven microfinance solutions and community-based lending are reshaping access, unlocking the next wave of inclusive economic growth.

Microfinance Market, Key Players:

- Bandhan Bank

- Kiva

- BRAC

- Bank Rakyat Indonesia

- BSS Microfinance Private limited

- FINCA International

- Grameen Bank

- Svatantra microfinance

- Al Amana Microfinance

- Grameen Foundation

- Accion International

- Opportunity International

- Bharat Financial Inclusion Limited

- Cashpor Micro Credit

- Compartamos Banco

- IndusInd Bank Limited

- Manappuram Finance Ltd

- Spandana

- Women’s World Banking

- Sparkle Microfinance Bank

- CARD MRI

- Amret Co Ltd

- Accion International

- Kingdom Bank Ltd

- Aregak UCO

- Acleda Bank Plc

- MIBANCO Banco de la Microempresa SA

- Banco Caja Social

- ProCredit Holding AG & Co.

- BRAC Bank Ltd

Read Full Microfinance Market Research Report – https://www.maximizemarketresearch.com/market-report/microfinance-market/230628/

FAQs:

1. What is the current size of the Global Microfinance Market and what is its forecast?

Ans: Global Microfinance Market size was valued at USD 235.21 billion in 2025 and is projected to reach USD 536.45 billion by 2032, driven by digital credit adoption and rising MSME demand.

2. What are the major growth drivers reshaping the Global Microfinance Market?

Ans: Global Microfinance Market growth is being fueled by digital credit scoring, rising MSME financing demand, and government-backed risk mitigation frameworks, which are expanding access for first-time borrowers and women-led enterprises.

3. What key restraints are impacting the Global Microfinance Market?

Ans: Growth is constrained by asset–liability mismatch, borrower over-indebtedness, regulatory interest rate caps, and climate-linked income volatility, causing lenders to tighten underwriting and slow expansion in saturated regions.

Analyst Perspective:

From an analyst’s perspective, the global Microfinance Market is poised for transformative growth, driven by digital microfinance solutions, fintech integration, and expanding financial inclusion initiatives. Increased adoption across Asia-Pacific, Africa, and emerging markets is reshaping lending dynamics, while key players like Bandhan Bank, BRAC, and Kiva enhance portfolios through strategic partnerships, innovative microcredit products, and technological upgradation. The sector’s evolving competitive landscape and focus on SME financing and women-led enterprises signal robust long-term potential and strategic investment opportunities.

Related Reports:

Finance Cloud Market: https://www.maximizemarketresearch.com/market-report/global-finance-cloud-market/63314/

Premium Finance Market: https://www.maximizemarketresearch.com/market-report/premium-finance-market/213507/

AI-Powered Personal Finance Management Market: https://www.maximizemarketresearch.com/market-report/ai-powered-personal-finance-management-market/222191/

Cryptocurrency Market: https://www.maximizemarketresearch.com/market-report/cryptocurrency-market/221768/

Decentralized Finance Market: https://www.maximizemarketresearch.com/market-report/decentralized-finance-market/203718/

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and growth-focused research initiatives position us as a trusted partner in the Microfinance Market. We provide in-depth insights and strategic guidance across segments such as microloans, savings programs, digital financial services, and community banking, supporting sustainable financial inclusion and enabling informed decision-making for key stakeholders worldwide.

Infographic: https://mma.prnewswire.com/media/2874828/Microfinance_Market_Infographic.jpg

Contact:

Lumawant Godage

MAXIMIZE MARKET RESEARCH PVT. LTD.

+91 96073 65656

Email: [email protected]

Visit Our Web Site: https://www.maximizemarketresearch.com/

LinkedIn.com: https://www.linkedin.com/company/maxmize-market-research-pvt-ltd/

Instagram: https://www.instagram.com/maximizemarketresearch/

Facebook: https://www.facebook.com/maximizemarketresearch/

X (Twitter): https://x.com/MMRAnalytics

View original content to download multimedia:https://www.prnewswire.com/news-releases/microfinance-market-to-reach-usd-536-45-billion-by-2032–driven-by-digital-microfinance-and-financial-inclusion-maximize-market-research-302676528.html

SOURCE Maximize Market Research Pvt. Ltd.