Due to the outbreak of COVID-19 pandemic, many restrictions are imposed all around the world. These restrictions have, no doubt, limited our daily activities and routines in numerous ways which in return reflect on our economic activities.

For instance, forcing people to embrace social distancing caused a sharp decline in brick-and-mortar shopping while promoted online shopping.

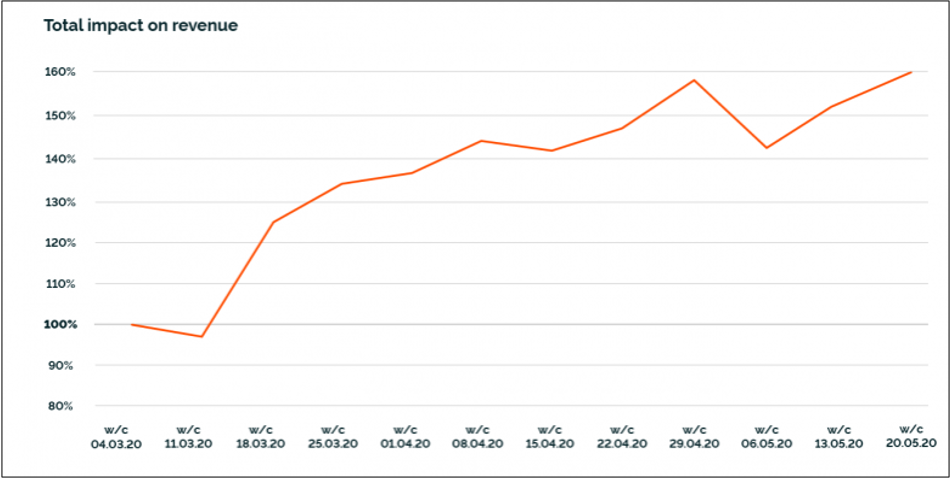

Although this increment in online shopping is not uniform for all industries, it is reported by Freshrelevance that from the beginning of March to the end of May 2020, e-commerce revenues increased by 159% in total based on the data collected from its 278 clients across the globe.

Even before the pandemic, online shopping had been on the rise thanks to improvement in technology, a growing number of e-commerce websites, and ease in logistics.

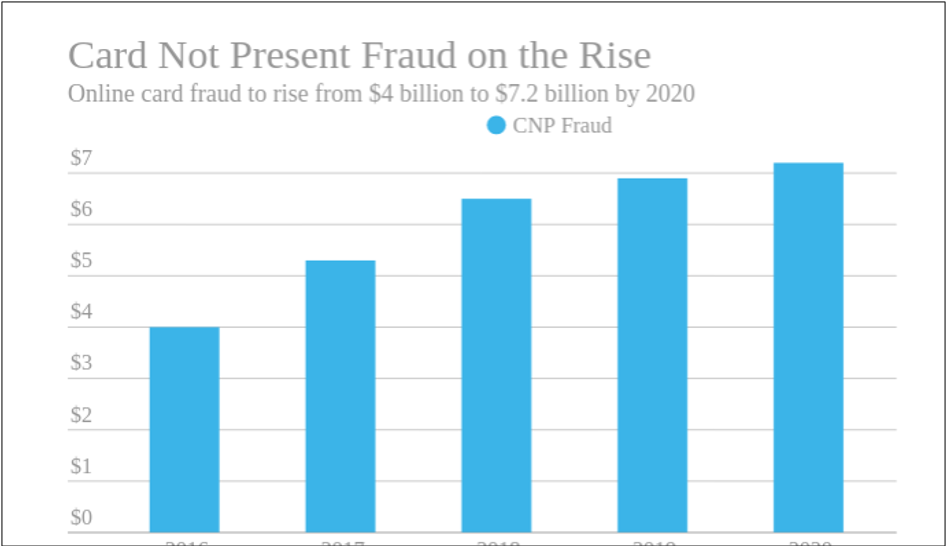

This upward trend in online shopping, naturally, led to a shift from in-person point-of-sale (POS) transactions to Card-Not-Present (CNP) transactions.

By definition, CNP transactions include any transaction in which neither the card-holder nor the credit card is present at the time of transaction.

However, this convenient option brings a major thread called CNP fraud.

A growing thread: Card-Not-Present Fraud

During CNP transactions, by nature, merchants cannot examine the card or card-holder for a possible sign of fraud, such as a missing hologram or altered account number.

And what is worse, since the provided card details are obtained through third-party data breaches, phishing emails, scam messages, etc., they are all real which makes the detection of fraud even more difficult.

This whole situation coupled with some security tools that greatly prevent the type of fraud attempts where the card is present makes any CNP fraud attempt less risky, cheaper, and advantageous. Consequently, CNP transactions provide a great opportunity to collectively operating criminal groups to do their devilish activities.

In accordance with a study of Javelin’s strategy, in 2018, payment card fraud amounted to $24.26 billion worldwide and that CNP fraud is 81% more likely than a POS fraud.

As for the biggest economy in the world alone, Aite Forecast found that CNP fraud increased by around 80% in the last 4 years.

Another, perhaps, more striking example suggests that since the beginning of the pandemic, online and recurring payments accounted for 66% of all payment frauds.

Need for a fraud detection system

Bearing these facts in mind, it is not hard to see that CNP fraud is a continuously growing major issue for everyone and not going anywhere anytime soon.

A 2019 study by Juniper Research estimates that from 2018 and 2023, the retail industry alone will experience $130 billion loses arising from CNP fraud. And what is even more dramatic, in most of the countries, in any type of credit card fraud incident, the liability of consumers is reduced by legislation or the losses of consumers are covered either by the card issuers or merchants. Thus, most of the time, it is actually merchants and card issuers who bear the burden of any sort of fraudulent transaction.

According to Infosecurity Magazine, some businesses reported that their total fraud losses accounted for 10% of their entire cost.

Under these circumstances, merchant and card issuers feel obliged to fight against fraud as the more fraudulent transactions mean high costs and deterioration in customer trust.

Problems with traditional rule-based fraud detection systems

For a long time, these organizations have been employing a traditional rule-based fraud detection system where fraud analysts form a set of rules by investigating historical fraudulent transactions and use these rules to determine the authentication of a new purchase.

Although these systems can guarantee a certain level of success, in today’s digitized financial world where everyday excessive amount of transactions are materialized, they become costly and slow.

Additionally, since the rules of these systems are fixed and can be as complex as, eventually, human eyes can pick, they remain inadequate and straightforward in capturing complicated fraud attempts.

As a result, in recent years, more and more organizations are switching to machine learning (ML) based solutions from conventional fraud detection systems due to their effectiveness and superiority over the latter in tackling with CNP fraud.

ML-based solution can cope with ever-changing criminal behaviors

In order not to get caught, fraudsters constantly change their tactics to even more sophisticated ones and mimic legal spending behaviors as close as possible.

On the other side, in the hope of discovering spending patterns of criminals, organisations form large sets of transaction data where each sample is a combination of several data features even after a good pre-processing and feature selection.

Detecting such spending patterns in such data sets, in fact, requires serious processing power and highly error-prone computations.

In this regard, any competent fraud detection system must be up-to-date with the changes in criminals’ behaviors and able to handle large data sets.

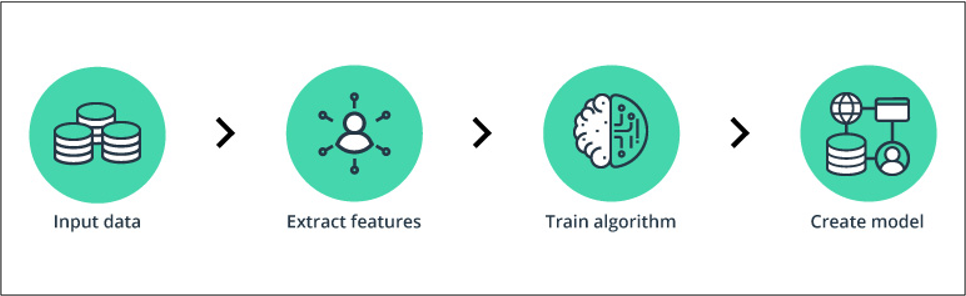

Thanks to advances in ML algorithms, they can effectively process and analyze large chunks of data and uncover complex spending patterns in high dimensional spaces.

This gives them the ability not only to recognize obvious fraudulent patterns but also rather sophisticated ones as well as the subtle changes in criminals’ behaviors.

Furthermore, every time the training data set is updated with new data samples, ML algorithms autonomously process new data and updates the model accordingly by using both old and new spending patterns. This makes ML-based solutions adaptive to ever-changing situations without being explicitly programmed.

Therefore, as opposed to traditional rule-based systems, ML-driven fraud systems can keep up with criminals and detect both tricky and obvious fraud attempts.

ML offers more effective fraud detection

Another advantage of powering a fraud detection system with ML is that it allows organizations to efficiently make use of their big data and create more effective fraud prevention systems.

Much like a doctor’s getting more proficient in distinguishing ill patients from healthy ones as it examines more patients; in ML, the same logic applies, more training data always improves the performance of a model.

When an ML model is trained on a larger amount of data, the model is shown a wider variety of both fraud and genuine transactions and it becomes more proficient in distinguishing fraudulent spending patterns from the legal ones as well as outliers (legal but differs from normal spending patterns like vacation expenses, special occasions, etc.).

Thus, such fraud systems can detect a higher number of actual fraud cases with higher confidence which also facilitates a lower number of false-positive (FP) predictions.

More specifically, such fraud systems are less likely to block genuine transactions by incorrectly predicting them as a fraud.

A high FP rate is one of the biggest challenges that traditional systems cannot overcome.

Whereas, ML can simultaneously achieve high accuracy and low FP rates which is vital to maintain the customers’ trust. A case study conducted by Teradata showed that employing ML caused a 60% reduction in false-positive outcomes.

ML promotes time and cost efficiency

Building and using a rule-based system is costly as it is labor-intensive. Even then a well designed rule-based system can yield many FP predictions that increase the number of manual reviews.

The manual review process is time-consuming and costs extra as it involves each suspicious transactions’ reviewing one after another by analysts who are specially trained for this task. McKinsey’s report suggests that the labor cost of manual review is 25% of all fraud costs.

On the other hand, by leveraging ML, since all those cumbersome and time-consuming calculations are done by machines in a fairly reasonable time with minimum human intervention, ML-based solutions deliver time and cost-efficiency.

Also, due to their low number of FP predictions, they reduce the time and amount of labor devoted to manual reviews considerably.

However, it should not be understood as ML can be completely replaced by all fraud analysts in an organization. Because some transactions flagged by ML models still need to be check by a few fraud analysts.

This, of course, reflects on the balance sheet of an organization as a very big plus.

Capgemini asserts that ML enhances the accuracy of fraud detection systems by 90% while minimizing the time devoted to investigating FP cases by 70%.

What is more, since ML can investigate a great number of transactions and make predictions in milliseconds, it provides real-time decision which enables ML-based solutions to act as a routinely active security wall that protects the customers.

A few more words

In today’s very competitive financial market, ML offers a great opportunity for organisations to lessen its financial losses and improve their customer experience.

Yet, ML also has some flaws and does not promise a radical solution to vanish CNP fraud for now. Nevertheless, with the continuous increment in the availability of data, advancements in ML algorithms and improvements in the processing power of computers will likely make the usage of ML in fraud detection even more popular and continue to give a headache to criminals.