Smart loan finding company LoanSnap has successfully raised $10m with the round being co-led by True Ventures and Mantis with additional investors including Virgin Group, Montana’s Liquid 2 Ventures, Baseline Ventures, Core Innovation Partners, OVO Fund, Transmedia Capital, Morado Ventures, Work Play Ventures, Accelerator Ventures, and undisclosed angel investors.

This brings the companies total raised venture capital to $26m with the additional funding thought to fuel continued growth, increase its suite of products, and improve the platform experience.

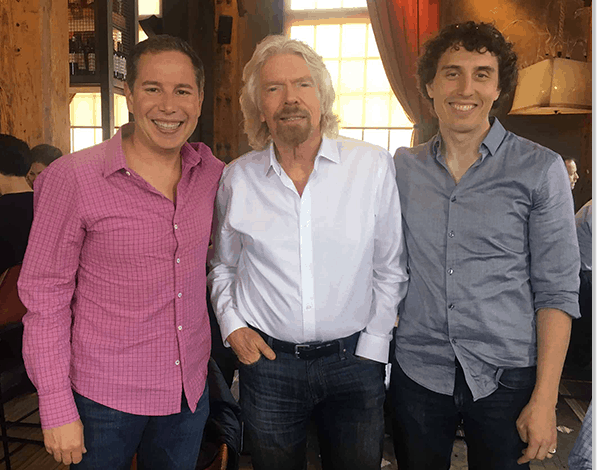

The company has previously been backed by the funding round companies mentioned above with Richard Branson and ex-NFL quarterback star both being backers of the company and investors in LoanSnaps funding rounds.

LoanSnap was founded in 1998 by Allan Carroll and Karl Jacob with the goal to help people stop losing money and own their financial future and now has increased its leadership team to a total of 9 people.

LoanSnap explains that its loan-borrower matching technology has the capability to address the U.S. consumer credit card debt problem with its AI technology factoring in the economic environment such as the COVID-19 pandemic alongside personal lending factors.

Using the AI technology it creates another layer of safety for both the lender and borrower as will give a more data accurate reason for whether someone should be accepted or denied for a loan.

The process involves applicants answering multiple questions regarding their outgoings and existing debt such as student loans or credit cards which is sent off to a database of credit lenders including mortgage and credit card offers before showing the applicant available options within seconds.

When a person signs up to use the LoanSnap service and app to make an application for a loan, it gets the users personal data by scanning either the applicants drivers license via the app on Android or iOS or cross-referencing their social security number and address to identify tailored loans and mortgages suitable for that borrower.

LoanSnap is not the only finance based tech company that has successfully raised capital during the COVID-19 era with Previse raising $11m and Concertio raising $4.2m while companies like Sofi have successfully acquired Galileo.

LoanSnap has been making loan agreements since their successful acquisition of California based lender DLJ Financial which has helped customers pay off $12m in debt and save $8m in what would have been future payments.

The service offered by LoanSnap is currently only available in American states California, Colorado, Florida, Illinois, and Tennessee, and likely soon to be more states and possibly countries with the newfound capital.

[…] Smart loan finder LoanSnap raises $10m for AI platform […]