This article explores the connection between FinTech technology and ESG data that the authors explored from a general point of view in the chapter “New FinTech technologies for ESG data” of the Aiaf white paper n.184, April 2021 “Economic and Financial Sustainability of FinTech Companies”, in the article “Artificial Intelligence and FinTech Technologies for ESG Data and Analysis”, February 15/2021, SSRN 3790774 and in the article “Intelligenza artificiale e comunicazione dei dati ESG”, Rivista Ipsoa Amministrazione & Finanza 6/2021

Introduction

The new European regulation, the requests of investors and the COVID-19 pandemic have provided the background for a rethinking of traditional financial models, placing technology and sustainability at the center of decision-making processes to redirect capital flows towards sustainable investments, integrate sustainability in risk management and promote transparency and long-term financial decisions.

1. SRI investment and EU regulation

ESG investing refers to an approach that integrates environmental, social and governance factors into the investment process along with other more traditional financial factors. This investment approach has attracted significant interest from investors, financial institutions and policy makers.

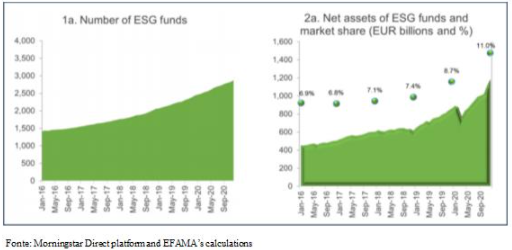

The size of the UTCIS ESG fund market has also grown considerably in Europe at a steady pace over the past five years in response to ever increasing demand for sustainable investments. Based on Efama publication of Morningstar data as of December 2020, there were 2,873 ESG funds (1a.) with net assets of EUR 1.2 trillion (2a).

Table 1 – UTCIS ESG funds as of 31 December 2020.

As of April 2021, there are 3,864 financial institutions in the world that, by signing the Principles for Responsible Investment (UN PRI), have declared that they integrate sustainability assessments in their investment choices.

Consistent with the growing attention by investors, reporting obligations of ESG investment process have also increased and in the last two years, a large number of regulations have been approved in Europe that are at the heart of the “Action Plan: Financing Sustainable Growth” presented by the European Commission in March 2018. On 10 March 2021, the EU regulation 2019/2088 on disclosure relating to sustainability in the financial services sector (SFDR) came into force which introduces, for financial market participants (FMPs) and financial advisors (FAs) the obligation of disclosing the commitments on sustainability at the entity level and with reference to the financial products defined by the SFDR regulation itself (Article 2, paragraph 1, No. 12), strengthening the transparency necessary for the entire market.

On 21 April 2021 the European Commission published a new package of measures within the framework of the EU Action Plan for sustainable finance and climate neutrality objectives by 2050 which includes the proposal for a Directive on Corporate Sustainability Reporting (CSRD) which intends to introduce more rigorous transparency requirements on corporate sustainability, with more uniform reporting standards, which guarantee the comparability of information for consumers, lenders and investors. Among these, it is required to communicate the sustainability information with a digitally tagging in machine-readable format. Digital tagging is essential to

seize the opportunities that digital technologies present to fundamentally improve the way sustainability information is used.

Therefore companies will need new software tools and support in order to manage the European digital strategy connected to sustainability and it’s noteworthy to see rapid development within the industry making use of all the benefits of XBRL language. Just a week after the EU CSRD proposal Workiva Inc., an US company that provides enterprises with cloud solutions for improving productivity, accountability and insight into ESG data announced that it had extended its cloud platform to offer an end-to-end ESG solution.

The US Government Accountability Office (GAO) declared in July 2020 that investors do not need more information on ESG challenges that companies face, rather, they need better information and to do so, in early March 2021, The United States Securities and Exchange Commission (SEC) established a Task Force focused on climate and ESG issues whose initial goal is to identify any material gaps or inaccuracies in issuers’ disclosure of climate risks under existing regulations. The SEC Task Force will also analyze disclosure and compliance issues related to the ESG strategies of investment advisors and funds and coordinate the effective use of the division’s resources, including through the use of sophisticated data analytics to extract and evaluate the disclosed information in order to identify potential breaches. Among various voluntary disclosure tools, the recommendations of the Task Force for Climate-related Financial Disclosures (TCFD) are widely recognized as an authoritative guide for communicating relevant financial information on the climate and over 1900 institutions have already pledged their support to TCFD.

The European Commission itself indicates that the “Guidelines on non-financial reporting: Supplement on reporting climate-related information” published in June 2019 are consistent, in addition to the NFRD, also with the recommendations of the TCFD and recently New Zealand and the UK announced that the recommendations of the TCFD report will become mandatory in their jurisdictions. Last but not least Larry Fink, BlackRocK CEO, indicated that in absence of robust disclosure, investors, including BlackRock, will consider that companies cannot adequately manage risks.

2. ESG ecosystem map and machine-readable data

The use of Machine Learning in relation to ESG factors is still poorly explored and is a topic that has undoubtedly experienced a surge in popularity in recent years even if the term is often used more for advertising explanations than for practical aims.

Many organizations in order to analyze the disclosure of companies, have started to make use of Artificial Intelligence (AI) systems and machine learning algorithms to expand the skill to transform textual information into numerical data relevant to financial decisions, among them Goldman Sachs and Arabesque AI. Truevalue Lab, now part of Factset, employs big data and AI to capture and analyze unstructured data, uses artificial intelligence algorithms to find ESG-relevant articles for each company categorized by ESG-special issue and uses the Sustainability Accounting Standard Board (SASB) materiality taxonomy to measure sentiment on material ESG data fields and generate insight for investors. Likewise Novisto, an enterprise software platform for sustainability management, integrates the materiality map of SASB, into data platform.

Researchers from Bank of Italy and Kellogg School of Management, Northwestern University in order to the following question – to what extent are equity portfolio returns sensitive to ESG information and how is ESG information absorbed in stock prices – propose to overcome the current inconsistencies in the ESG rating by using machine learning techniques to better spot the most material E, S or G metrics for sustainable investing. In particular, machine learning techniques are used to identify those E, S, G indicators that better contribute to the construction of efficient portfolios. A team of economists led by the University of Cambridge used artificial intelligence to simulate the economic effects of climate change on Standard and Poor’s ratings for 108 countries’ sovereign bonds over the next ten, thirty and fifty years and by the end of the century and the Fleet-Madison Project, a global non-commercial coalition of experts including King’s College London, is examining the link between potential ESG risks and artificial intelligence systems.

In Switzerland, the Federal Council aims to position the Swiss financial center as a global player in exploiting the potential of digital technologies in the context of sustainable finance (green fintech). TCFD itself uses AI to verify whether the reporting of a large number of organizations include its recommendation and, in collaboration with a small group of experienced users, has been identified the information disclosed on material issues related to the climate change by companies for each sector, geographic area and the key metrics useful for financial decision making.

Last but not least with reference to the TCFD recommendation, a group of Swiss and German academics has created a context-based algorithm called “ClimateBert” to extract the financial information related to the climate disclosed within the four macro categories indicated by TCFD (governance, strategy, risk management and metrics and targets) and its additional details of 818 institutions, operating in different sectors and geographic areas, which support TCFD and came to the conclusion that the material, qualitative and quantitative information reported on risks and opportunities are lower in the two categories: strategy, metrics and targets; while they are greater

in terms of the qualitative ones on the structure and related to the processes included in the other two categories: governance and risk management. The only way out is therefore to transform voluntary communication into a mandatory disclosure in the near future.

3. Artificial Intelligence and ESG in Investment-Decision Making

When it comes to sustainable (ESG) investing and Artificial intelligence (AI), investment decision-makers should be aware of the following:

· AI, robotics and automation are important investing theme, which can assist investors in identifying companies that are in the business of developing such technologies.

· AI-based technology can be used to enhance portfolio decision making, especially when and where screening of extra-financial information in real time is concerned

Technology, ICT, and related sectors, especially when and where AI and robotics are concerned, offer new thematic investment opportunities and the growth of the artificial intelligence market is enviable: Grand View Research estimates it to be US$39.9 billion in 2019 and projects a 42.2% compound annual growth rate for the segment, between 2020 and 2027.

On the analysis side, advances in AI, which encompasses a variety of technologies, have made it easier than ever before for computers to automate complex tasks at high speed and volume, revolutionizing how companies work with data. AI, along with machine learning, automation, and robotics, have become commonplace and essential to the operations of mainstream organizations. Repeatable tasks are carried out by bots in a fraction of the time, and algorithms and computer programs can read information that might have previously been unusable due to its size or amount of garbage data.

These AI capabilities have proven to become helpful for ESG investing, which currently often relied on self-disclosed annual corporate information, exposed to inherent data challenges and biases. Investment managers are coming under increasing pressure to measure ESG criteria in their portfolios. However, a lack of data is making it hard for banks to assess long-term risks and rewards. Here, AI is the answer: technologies will filter essential data that investors currently lack, acting as the catalyst for sustainable investing at scale.

Much of the potential for artificial intelligence in ESG investing comes from sentiment analysis algorithms. These algorithms allow computers to analyse the tone of a conversation, a task that code could not as effectively do. Sentiment analysis programs might be trained to read a certain type of conversation and analyse the tone by comparing the words used to a reference set of existing information.

If ESG investing involves considering the material opportunities and risks of sustainable decision-making, AI provides both tremendous benefits and risks to watch for. In short, while giving ESG investing the opportunity to grow and expand, AI can itself be an ESG risk for companies that aim to undertake the effort.

However, more ESG data and disclosures does not mean more data clarity, consistency and comparability, and less exposure to corporate “green washing” risks. According to research by Deutsche Bank, ESG data and ESG rating biases remain a key concern, also when using AI based sentiment analysis.

These biases are due to various factors including:

- Company size and budget = with more resources on average dedicated to sustainability;

- · Company marketing and content = a richer variety of language in corporate reports maybe more indicative of marketing creativity and “green-washing”;

- · ESG ratings = companies that simply disclose more information tend to be at times rewarded for being “verbose”; they can also be rewarded for using positive “sentiment” and for highlighting targets and “goals” in a descriptive manner.

The challenges of how to accurately measure and rate a company’s environmental and social impact, particularly given that ESG remains an evolving concept and that there are multiple reporting standards and frameworks have led to the so called “aggregate confusion” – among companies and investors.

This confusion around ESG ratings and their biases is supported by academic evidence: when assessing the landscape of ESG ratings, MIT Sloan found that the correlation among agencies’ ESG ratings is on average 0.61; by comparison, credit ratings from Moody’s and Standard & Poor’s are correlated at 0.99. The research team found that ratings agencies may adopt different definitions of ESG performance, or they may take different approaches to measuring that performance or weighting the ESG attributes. They concluded that “the information the decision-makers receive from [ESG] ratings agencies is relatively noisy”.

Further work needs to be done to address inherent biases in sentiment analysis algorithms that are programmed to replicate and reference existing factors and patterns. If reference points such as ESG definitions, KPIs and frameworks are not clear, information biases and (scope) divergences will remain.

4. Technology to help ESG audits build investor confidence

Investor sensitivity to sustainability has led the International Monetary Fund to address the topic with the article: Looking Farther, in which it acknowledges that sustainability has become material to capital markets. The title indicates the need for further research, because ESG-related disclosures remain fragmented, sparse, and in some cases contradictory, in part because of the associated costs, often voluntary nature, and lack of standardization. The Fund urges political power and regulators to take action in developing standards, promoting disclosure, transparency and the integration of sustainability considerations into investment and business decisions. And it argues that ESG audits will be important for the system to develop properly. Given the complexity of the topic, several institutions are taking up the concept of the need for audits. In this sense, the EU has recently published a study on ratings, data and research.

Despite important developments in Europe mainly in the environmental dimension, there is still a long way to go to include non-financial corporate information in reporting standards to bring transparency to companies and investors as recently well highlighted by the Acting Director, Division of Corporate Finance of the SEC in a Public Statement in which he lists some critical issues to contribute to the development of common global standards.

Technology and digitalization will play an important if not crucial role in the standardization process as proposed by EFRAG in its report published in February 2021. In fact, thanks to technological evolution, sources are constantly evolving and new ones are added all the time, especially after crises. We can imagine that, post pandemic, the market attention will

increasingly be directed to further deepening the analysis of sociality and bio-diversity. Many managers are evaluating the adoption of algorithms that improve data quantity, quality, and their knowledge due in part to the growing evidence of the materiality of high-frequency data. However, as the article published in the Harvard Business Review points out, cause and effect of measurements cannot always be demonstrated contributing to possible errors and data are not always correct. In fact, about 90% of online information has been created in the last two years, and not all of it is really usable. So much so that the OECD measures the usability of public data with an index urging various governments to make it public, secure and usable, aware of the importance for better public trust.

For their part, asset managers subjected to new regulations in various jurisdictions and the rapidly evolving and growing importance of sustainability in customer preferences, are trying to develop – also through Fintech accelerators – adequate reporting systems until standards are aligned.

In the meantime, pragmatism dictates the use of multiple sources of information to avoid being exposed to unexpected risks, especially in portfolio construction as well demonstrated by some recently published research that shows how delicate it can be to rely on one data provider with possible effects on returns. Moreover, as suggested by the International Monetary Fund, subjecting investment choices to the neutral eyes of an independent third-party verifier specializing in ESG will help strengthen the essential trust between managers and investors. In this field, some Fintech are gathering information from operators in various ways from traditional to more sophisticated methodologies with the goal of creating a useful benchmark.

References

- Berg Florian, Kolbel Julian, and Rigobon Roberto “Aggregate Confusion: The Divergence of ESG Ratings”. In: MIT Sloan Research Paper No. 5822-19 (Aug.2019). doi: 10.2139/ssrn.3438533.

- · Chan Thim et al. “Optimizing portfolio construction using articial intelligence”. In: 3 (Apr. 2011), pp. 168{175. doi: 10.4156/ijact.vol3.issue3.16.

- · De Franco Carmine. “Performance of ESG and Machine Learning investment approaches”. In: Ossiam (2019)

- · Feiner Andreas, “Machine Learning and Big Data enable a quantitative approach to ESG investing”. In: Mainstreaming Sustainable Investing 4.7 (2018).

- · FMI, Global Financial Stability Report: Lower for Longer, October 2019

- · Green Fintech Network, April 2021, “Harnessing the Power of Digital Finance for Sustainable Financial Markets”, file:///C:/Users/Utente/Downloads/2021%20Green%20Fintech%20Action%20Plan_final.pdf

- · Lanza Ariel, Bernardini Enrico and Faiella Ivan, June 26, 2020, “Mind the gap! Machine Learning, ESG Metrics and Sustainable Investment”. Bank of Italy Occasional Paper No. 561,

- · OECD 2019, “Enhancing Access to and Sharing of Data: Reconciling Risks and Benefits for Data Re-use across Societies”, https://www.oecd-ilibrary.org/sites/276aaca8-en/index.html?itemId=/content/publication/276aaca8-en

- · TCFD “Final report, Recommendations of the Task Force on Climate-related Financial Disclosures”, June 2017, https://assets.bbhub.io/company/sites/60/2020/10/FINAL-2017-TCFD-Report-11052018.pdf · TCFD “Status Report 2020”, October 2020, https://www.fsb.org/wp-content/uploads/P291020-1.pdf Available at SSRN https://ssrn.com/abstract=3659584 or http://dx.doi.org/10.2139/ssrn.3659584

- · UN Secretary General Task Force on Digital Financing of the Sustainable Development Goals (SDGs), August 2020, “People’s Money: Harnessing Digitalization to Finance a Sustainable Future”, https://www.un.org/sites/un2.un.org/files/df_task_force_-_full_report_-_aug_2020.pdf