Today’s industrial buyers expect the same friction-free experience they enjoy as consumers. When that flow breaks, manufacturers risk 9.5 percent of revenue. SyncShow

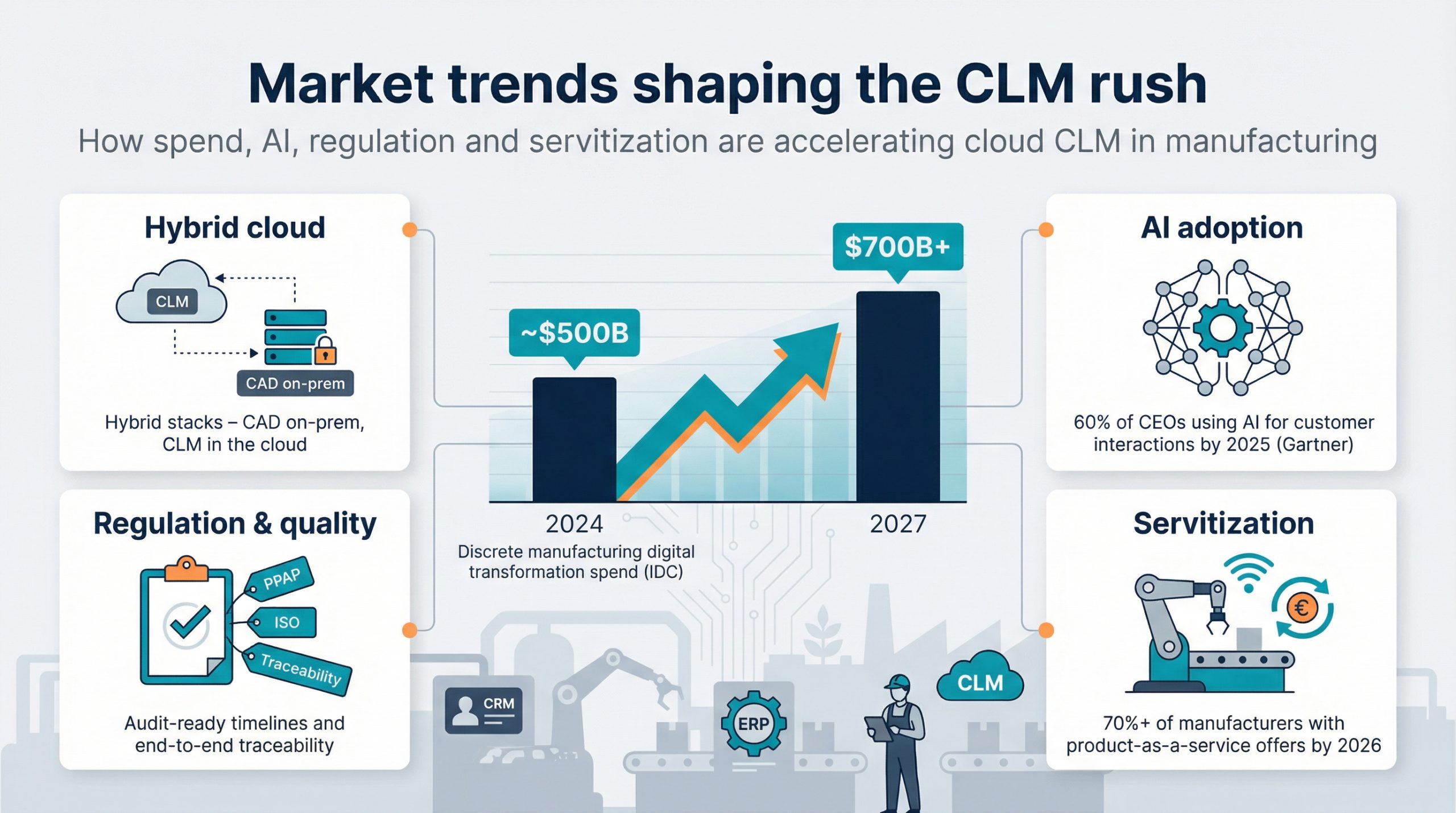

Budgets now follow that pain. According to IDC, discrete manufacturers will spend nearly $500 billion on digital transformation in 2024 and top $700 billion by 2027, with “omni-experience engagement” rising fastest.

Customer lifecycle management (CLM) captures this shift, stitching every touch—from the first RFQ to decades of service—across CRM, ERP, IoT, quality, and field-service data. Cloud delivery makes it practical, scaling on demand and adding AI that predicts churn or schedules maintenance before downtime strikes.

This guide unpacks the market forces, explains our scoring lens, and highlights five cloud platforms ready for your 2026 shortlist.

SERP results and content gaps

Search “cloud customer lifecycle management” and you scroll past the usual suspects: upbeat listicles that parade seven, ten, sometimes sixteen generic SaaS tools. Each post feels like a déjà-vu roundup of HubSpot, Marketo, and Userpilot.

Those articles dwell on churn dashboards, in-app pop-ups, and subscription pricing, features ideal for software startups, not for teams juggling BOM revisions or PPAP packages.

Look at what’s missing. No one mentions ERP hooks, ISO audits, or how a field-service call feeds product-twin data back to engineering. Manufacturing realities disappear in the fine print.

That gap is our opening. By focusing on shop-floor pain points such as dealer channels, compliant document trails, and AI demand planning, we can claim the niche that broad SaaS blogs overlook.

The takeaway is simple: Google rewards freshness and structure, yet the topic still lacks substance. Provide industrial depth in the same crisp format and you bypass the noise while climbing the rankings.

Market trends shaping the CLM rush

Global digital-transformation outlays keep climbing, and manufacturing now claims the spotlight. IDC pegs discrete-industry spending at nearly $500 billion in 2024 and projects $700 billion by 2027. Budgets once reserved for factory automation now shift toward customer touchpoints, where competitive gaps and revenue leaks surface fastest.

Cloud makes the pivot realistic. A decade ago most plants kept data on-prem to protect IP. Today hybrid stacks keep sensitive CAD files in a local vault while serving real-time customer dashboards from Azure or AWS. This flexibility turns a rip-and-replace approach into add-and-evolve, cutting deployment cycles from years to months.

Artificial intelligence adds urgency. Gartner expects 60 percent of CEOs to rely on AI to shape customer interactions by 2025, redefining how companies predict demand, set contract prices, and schedule service visits. When a model forecasts spare-parts demand better than a spreadsheet jockey, you protect uptime and strengthen loyalty.

Regulation intensifies the need. Automotive OEMs enforce PPAP rigor, and life-science auditors demand end-to-end traceability. A cloud CLM that logs every spec change, signature, and field-failure photo in one audit-ready timeline helps quality teams, and CFOs, sleep at night.

Servitization also changes the revenue mix. By 2026 about 70 percent of manufacturers expect at least one product-as-a-service offer on their price list. That model succeeds only when you can track IoT alerts, warranty terms, and renewal quotes in a single, living record. The right CLM supports that future and makes it profitable.

How we scored the contenders

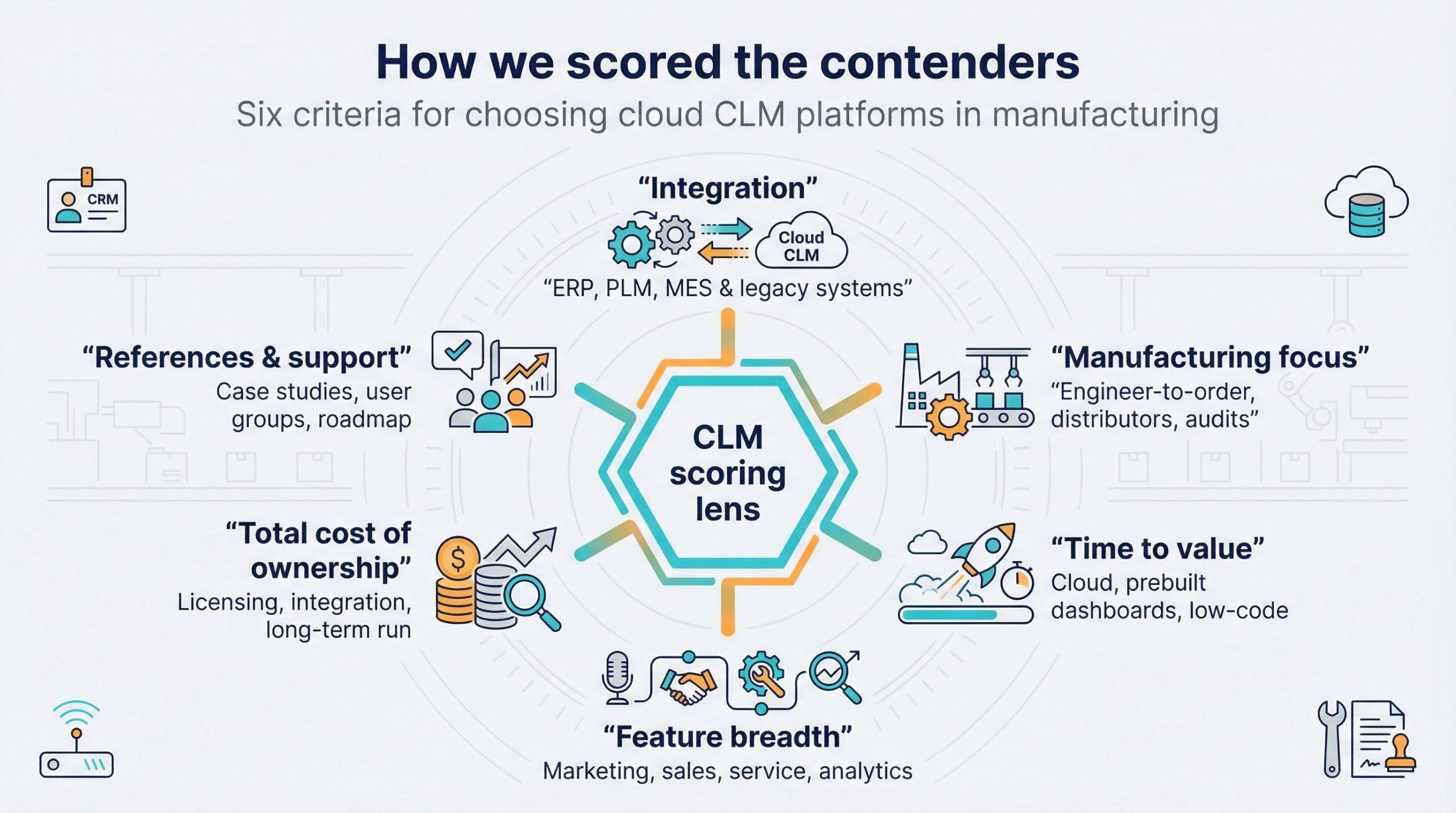

Choosing software is never about glossy feature grids. We looked for proof that a platform can handle real shop-floor complexity without drowning teams in customization.

We started with a list of more than 10 vendors, from household-name CRMs to niche service-parts planners. Each earned points in six areas tied to everyday manufacturing headaches.

Integration came first. A tool must pass data to ERP, PLM, and even that legacy MES humming near the paint line. If it keeps customer and product records in separate silos, it failed our test.

Next, we graded manufacturing focus. Does the platform understand long engineer-to-order cycles, distributor hierarchies, and quality audits? Templates and case studies scored higher than marketing promises.

Time to value mattered just as much. Cloud delivery, low-code adjustments, and pre-built dashboards beat blank-slate kits that require a battalion of consultants.

We also weighed feature breadth across the full journey: marketing, sales, aftermarket service, and analytics. Gaps here create frustration later.

Total cost of ownership told the rest of the story. Transparent, modular pricing earned goodwill, while “call us” quotes raised eyebrows.

Finally, we checked references and vendor support. Published success stories, active user groups, and a clear product roadmap separated partners from vendors.

The five platforms that follow rose to the top by scoring well in multiple categories, not just one.

MCA Connect: Dynamics 365 Customer Engagement + Inspire

If your business already runs on Microsoft, MCA Connect feels less like new software and more like turning on lights in rooms you never knew existed. The company bundles Dynamics 365 Sales, Customer Service, and Field Service with its Inspire analytics layer, pre-wired for manufacturing data.

MCA Connect Dynamics 365 customer engagement solution for manufacturers.

From day one you see engineering change orders, open quotes, and installed-base telemetry in one view. That snapshot matters when a customer’s press line stops at 2 am and your service desk needs serial numbers, warranty status, and spare-parts stock before the coffee brews.

MCA Connect’s strength is industry-ready process mapping. Before any code is deployed, its consultants kick off an “Art of the Possible” workshop, one of the practical steps outlined in designing a B2B customer lifecycle map.

The session surfaces gaps across six stages, from awareness to purchase and loyalty, aligning buyer personas and KPIs so the Dynamics tooling mirrors actual customer reality.

Long capital-equipment sales cycles, distributor price breaks, and PPAP document trails ship as standard templates. Field techs scan a QR code on-site, and Inspire pushes real-time failure data back to sales so account teams can propose upgrades, not apologies.

Implementation moves quickly because the pieces are native. Dynamics syncs with Azure IoT, Power Platform handles low-code changes, and Inspire drops more than 60 manufacturing dashboards into Power BI. Many mid-market firms reach first go-live in eight weeks, trimming months off typical CRM timelines.

Cost scales with ambition. Licensing the full Dynamics suite plus Inspire lands in the low six figures each year for a 50-user shop. That price often beats three point solutions and a year of custom integration. Microsoft volume discounts and MCA’s fixed-fee rollout improve the math further.

Be aware of fit. Companies tied to SAP or Oracle ERP spend extra time building connectors, and user adoption can falter if teams cling to spreadsheets. Manufacturers that embrace the Microsoft stack report faster quote cycles and double-digit gains in first-time-fix rate, evidence that a unified customer lifecycle drives real results.

Salesforce Manufacturing Cloud + Customer 360

Salesforce champions a single view for every customer touch. With Manufacturing Cloud, that promise speaks the language of production schedules and distributor rebates rather than subscription churn.

Salesforce Manufacturing Cloud and Customer 360 for industrial manufacturers.

The standout feature is the Sales Agreement object. You lock in annual volume, pricing tiers, and delivery calendars, then watch actual orders flow against that baseline in real time. Forecast accuracy improves, planners breathe easier, and finance stops juggling spreadsheets at quarter-end.

Because all activity lives in Customer 360, a late-night service case, a new IoT alert, or a marketing-nurture click appears on the same account timeline. Einstein AI reviews that data for patterns, flagging attrition risk, nudging reps toward next-best offers, and cueing service upsells when warranty windows approach.

Implementation brings both power and complexity. The stack can include Sales, Service, CPQ, Field Service, and Tableau for analytics. Assemble only the modules you need, rely on MuleSoft for SAP or Oracle handshakes, and plan for a learning curve. Most enterprises partner with a certified integrator to control scope and change management.

Cost scales with scope. Budget about $200 per user each month once Manufacturing Cloud sits on top of Sales Cloud, plus additional fees for Service technicians and CPQ. Enterprises negotiate bundles, but mid-market firms should model license creep closely.

Where Salesforce excels is breadth. Thousands of AppExchange add-ons fill gaps, from CAD-to-quote plugins to quality-complaint portals, letting you extend capability without custom code. Upcoming Agentforce AI assistants promise more automated case routing and quote building.

Choose Salesforce when you need industrial-grade scale, deep analytics, and the resources to manage a suite rollout. Manufacturers that implement well report double-digit gains in forecast accuracy and shorter material lead times, benefits that offset the licence line on the P&L.

SAP Customer Experience & Service

SAP focuses on deep back-end integration. For manufacturers running S/4HANA, the CX suite extends the same digital nervous system to the customer front line.

SAP Customer Experience and Service unified with S/4HANA.

Real-time data accuracy is the main draw. During a configure-to-order quote, a sales rep can pull live ATP from production planning, respect batch rules, and write the order straight into ERP without middleware or nightly syncs.

Service teams benefit as well. Installed equipment registers as technical objects inside S/4; each maintenance call, spare-part pick, and warranty claim ties back to the same serial number. Engineering sees which design revision is failing in the field and why.

Industry Cloud accelerators add manufacturing detail: advanced variant configuration, dealer portals, and quality-inspection steps at return receipt. SAP Analytics Cloud then surfaces on-time-in-full metrics next to Net Promoter Scores without data wrangling.

The suite carries weight. Projects often follow core ERP rollouts and take months, especially when CPQ, Commerce, and FSM are in scope. Fiori has improved usability, yet the interface still feels complex compared with pure SaaS rivals.

Licensing follows the same pattern. Modules price separately, so clarity arrives only after a scoping workshop. Large manufacturers negotiate bundle deals under a RISE with SAP contract; mid-size firms should model ROI carefully.

Pick SAP CX when transactional precision and compliance outweigh speed of deployment. Automotive suppliers, aerospace primes, and medical-device makers report fewer master-data mismatches and faster audit prep after unifying sales, service, and quality on the same backbone.

ComplianceQuest on Salesforce: quality-driven CLM for regulated makers

Quality issues sit at the crossroads of product and customer experience. ComplianceQuest addresses that point by embedding an enterprise-grade quality and product-lifecycle system inside Salesforce.

Compliance Quest Salesforce-native quality and CLM platform.

Start with a customer complaint. In many plants it travels by email, slips into SharePoint, and stalls in a CAPA spreadsheet. In ComplianceQuest the complaint becomes a record that launches a root-cause workflow, links to the offending lot, and triggers supplier corrective action if required. Every step, signature, and photo sits in one audit-ready trail.

Because the platform is modular you activate only the pieces you need: Document Control, Non-Conformance, Supplier Quality, or a lightweight PLM. Each module inherits Salesforce objects, so customer, part, and supplier data stay in sync without nightly ETL jobs.

Regulated sectors value the built-in compliance hooks. Electronic signatures meet FDA Part 11 rules, PPAP templates satisfy automotive auditors, and ISO-9001 checklists ship ready to use. AI assists by ranking risk, flagging duplicate issues, and summarizing dense test reports, cutting review cycles by days.

Benefits extend past the quality lab. Sales reps see open CAPAs before renewal talks; service teams spot trending failures while warranty terms remain negotiable. That feedback loop turns quality spending into loyalty insurance.

Implementation is quick. Existing Salesforce customers reuse their licences; new customers buy platform seats in a bundled subscription and often go live in three to four months for core QMS.

Keep scale in mind. ComplianceQuest is not a full CRM, so you still need Sales or Service Cloud for pipeline work. Very small plants may find the feature set heavy if they log only a few complaints a year.

For any manufacturer where a single recall can cut margins and reputation, ComplianceQuest offers a practical way to weave quality, compliance, and customer lifecycle into one narrative.

Syncron Service Lifecycle Management

After-sales service used to be a cost center. Syncron flips that view, treating uptime as both a profit engine and a loyalty driver.

Syncron service lifecycle management platform for uptime and aftermarket profit.

The suite starts with spare-parts inventory optimization. Machine-learning models study historical failures, seasonality, and installed-base age to place the right part in the right depot. Customers see higher first-time-fix rates, while finance trims dead stock—a genuine win-win for manufacturing.

Warranty management delivers the next lift. Dealers submit claims through a portal that validates coverage rules, routes supplier recovery, and flags anomalies. Work that once involved weeks of email now closes in hours, keeping repair bays moving and goodwill intact.

Syncron Price adds a third lever. Dynamic algorithms benchmark competitive positioning, life-cycle stage, and service level to set parts prices that raise margin without sticker shock. Heavy-equipment makers report two- to three-point jumps in aftermarket profitability within a year of go-live.

Field Service modules complete the loop, scheduling technicians and capturing job feedback that feeds inventory and pricing engines. Add IoT sensor data and you move toward predictive maintenance: order the part before failure and schedule the visit during idle time, then bill under an outcome-based contract.

Syncron is best-of-breed, so integration matters. Standard APIs pull master data from SAP or Oracle and push transactions back, but expect a focused team to handle mapping and data quality.

Cost grows with network size. Large OEMs may pay high six to low seven figures a year for the full stack; mid-market firms often start with one module, earn ROI in 12 months, and expand from there.

Select Syncron when service represents a meaningful share of revenue and uptime defines your brand. It may be one more system in the stack, yet for companies betting on servitization it is the system that turns reactive firefighting into strategic growth.

Conclusion

Cloud-based CLM has moved from buzzword to boardroom priority. By aligning front-line engagement with back-end precision, the five platforms profiled here give manufacturers a practical path to protect revenue, boost service performance, and prepare for an AI-driven, product-as-a-service future.