Over 29% of startups collapse due to running out of cash, a direct consequence of financial mismanagement due to poorly structured cap tables, alongside poor revenue models or overspending. A cap table (capitalization table) is not just a spreadsheet of who owns what shares or not. It’s like a blueprint of your startup’s ownership, investment structure, and financial future.

But many founders ignore its urgency until it’s too late, and irreversible mistakes are made. A messy cap table can cause excessive dilution, investor disputes, and unclear equity distribution, which leaves you with no control over your company and discourages investors and top talent from joining it.

In this article, we will discuss how to structure a clean cap table and how to maintain it over time as your startup scales.

What is a Cap Table?

A cap table (capitalization table) is a spreadsheet that shows who owns shares in your company and how much they own. It is a detailed document that lists all the types of securities, how much was invested, the percentage of stake, and how those percentages dilute over time.

Think of it as a snapshot of your startup’s ownership structure of your startup including a breakdown of your equity as a founder, investors’ shares, employees’ stock options, and other issued securities.

A well-structured cap table helps you make the right decisions while raising funds or issuing shares for strategic reasons.

It also gives investors a clear picture of the company’s financial and ownership structure before they commit their funds. If you have a clean cap table, you’ll be able to present the ownership distribution to increase the investors’ confidence in your company during a fundraising round.

Components of a Cap Table

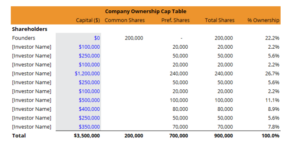

There are seven core components of a cap table:

- Shareholder breakdown

- Security type

- Number of shares

- Price per share

- Fully diluted shares

- Ownership percentage

- Fundraising details

Shareholder Breakdown

The shareholder breakdown records everyone who owns a share in the company, including founders, employees (through stock options), investors (angel investors or venture capitalists), and advisors who may receive equity as compensation.

For example, a company of two co-founders controlling 80% of the shares with 10% allocated to employee stock option ESOP and another 10% held by early investors. With a clear cap table, this company can prepare for future rounds and investor negotiations.

Security Type

Different types of shares come with distinct rights. For example, founders and employees hold common stock, while investors usually hold preferred stock with special privileges like liquidation preferences.

Also, stock options and convertible securities (SAFE—Simple Agreement for Future Equity and convertible notes) can affect ownership changes over time. If your startup grants stock options but doesn’t allocate a big enough option pool early on, you may need to increase the pool later, causing dilution.

Convertible securities are “debts” that convert into equity in future funding rounds or exit events. They allow you to raise funds quickly without issuing equity upfront but can affect the cap table long-term.

Number of Shares

The number of shares determines a startup’s ownership distribution, and it increases over time during fundraising and stock option grants. For example, if a startup initially issues 1 million shares and later issues 200,000 stock options to employees and 500,000 shares to investors, the total shares reach 1.7 million.

Price Per Share

This is the company’s valuation divided by the number of shares. As a company grows and raises funds, its valuation and price per share increases. This affects how much the investors commit and how much existing shares appreciate in value.

Fully Diluted Shares

The fully diluted shares show the “real” percentage of ownership if all stock options and convertible notes are exercised. If a company has 1 million outstanding shares but also has 200,000 unissued stock options and 300,000 convertible note shares, the fully diluted share count is 1.5 million, so the ownership of existing shareholders decreases when they convert to equity in the future.

Ownership Percentage

In most cases, the ownership percentage shows how much influence a shareholder has on the company. If a co-founder owns 100,000 shares in a company with 1,000,000 shares, they hold 10% ownership. However, if they issue new shares in the future, the ownership percentage also changes and can affect control over decisions made in the company.

Fundraising Details

Fundraising details track how each investment round affects the company’s valuation and ownership structure. It includes the pre-money and post-money valuation, number of new shares issued, price per share, and investors’ rights.

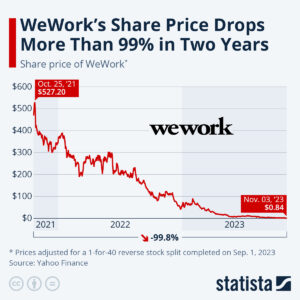

WeWork Cap Table Chaos

WeWork, valued at $47 billion at its peak, filed for bankruptcy with a debt of $19 billion in 2023. It started as a promising coworking space empire, but when it attempted to go public, investors took a closer look at its financials and walked in the other direction.

WeWork’s fall is a cautionary tale to new founders about how a messy cap table can make you lose control of your startup or destroy it. They had multiple investors like SoftBank and other venture capital firms, each holding different classes of shares with unique rights.

Also, Neumann, WeWork’s former CEO, owned only 10% of the company’s shares but controlled over 50% of the voting power, allowing him to make unilateral decisions. The supervoting stock structure gave him outsized control and made investors lose confidence in the company. WeWork’s IPO failed, leading to a rapid drop in value.

How to Structure Your Cap Table

A structured cap table should be organized, transparent, and scalable to help manage ownership and secure funds from investors.

On the other hand, a messy cap table leads to disputes, unnecessary dilution, and problems with fundraising. The goal is to have the cap table clean from the beginning and thrive to keep it that way as the company scales over time.

A clean cap table is simple, updated, and easy to interpret at a glance. It includes the different categories of shareholders, security types, and accounts for future dilution. It has to be updated regularly after every funding round and after stock options are issued or exercised. It should also track vesting schedules and fully diluted ownership (accounting for stock options, warrants, and convertible funds) to ensure proper equity management.

Carta’s data shows that startups on its cap table management software acquired 18.4% more capital in 2024 than in 2023 but on 7.3% fewer rounds total (i.e. 7.3% fewer deals closed). This implies that investors concentrate their funds on a small number of startups (quality over quantity) and are cautious about where they invest. A clean cap table will help you stand out for potential investments.

Step 1: Define your Equity Distribution.

Your equity distribution can shape your startup’s financial future. If there is more than one founder, the equity should be split to reflect actual contributions. An equal split may look fair at the moment but may lead to disputes in the future when one person contributes more than the other.

Another potential pitfall is allocating shares to early employees and advisors upfront. They should earn their share by contributing to the startup’s success. A vesting schedule can be utilized here to prevent these early contributors from leaving too soon with a huge chunk of shares.

Step 2: Plan Fundraising Wisely

Most founders lose 10-20% of ownership during a seed funding round due to dilution. Each fundraising round affects the ownership structure and cap table. Failure to plan will lead to equity dilution and disputes with early investors.

When structuring your cap table, take note of the pre-money and post-money valuations and give an account of the differences to avoid giving away a higher percentage of your company than you planned to.

Step 3: Allocate Employee Stock Option Pool (ESOP)

The Employee Stock Option Pool (ESOP) is reserved shares for current or future employees. Consider the pool before funding rounds because most investors evaluate it before investing.

A standard vesting schedule (a four-year vesting period with a year cliff) ensures that the employees earn their shares based on long-term commitment and prevents them from exiting early.

Step 4: Choose the Right Cap Table Management Tool

Some founders chose to track their cap table manually but this is prone to errors and barely scalable (difficult to manage as the company grows). An automated cap table management tool helps you track ownership changes, plan for future dilutions, and prepare audits quickly when necessary.

Step 5: Consider a Dual-Class Share Structure for Control

The dual-class structure is a value strategy if you plan to raise multiple funding rounds in the future, but want to retain control. You can create two types of shares, one with higher voting power and another with lower or standard voting power (issued to investors and employees).

As a result, you can maintain decision-making control even when you bring in outside investors.

How to Maintain Your Cap Table

A clean cap table is not a task you tick off your to-do list. It is an ongoing process that needs frequent and regular updates. As your startup grows, the cap table becomes more complex due to the funding rounds, stock option exercise, and potential secondary sales.

If you don’t maintain it, you’ll face legal issues, investor mistrust, and heavy dilution of your shares. Here are tips to keep track of your cap table over time.

Regularly Update and Audit your Cap Table

An updated cap table preserves transparency and prevents errors due to a lack of information. As new shares are issued and convertible notes convert into equity, you must record them accurately. Even the tiniest mistake like miscalculating ownership percentage or missing a vesting schedule update can raise issues, especially during an IPO (initial public offering).

A cap table audit can point out errors before they become a big deal. It involves verifying that all ownership changes and investor terms are reflected correctly in the cap table. Also, agreements with legal and tax regulations should be cross-checked to ensure everyone has a clear view of the equity structure.

Manage Future Dilutions Proactively.

Dilution is a part of your startup’s growth that you cannot avoid but can only manage to protect yourself and early stakeholders. Failure to do so decreases the ownership percentage of existing stakeholders.

One effective way to do this is to model different fundraising scenarios before they happen (using cap management tools). The data would help you understand how issuing new shares can affect equity and give you insight into how much to raise, at what valuation, and under what terms.

Negotiating pro-rata rights for early investors and employees also helps manage dilution. Another factor to consider is accounting for the ESOP (Employee stock option) before funding rounds.

Be Strategic with Secondary Sales.

Secondary sales happen when some founders, early investors, and employees sell a portion of their shares before an IPO or acquisition. It provides liquidity for early stakeholders and allows new investors to enter instead of issuing new equity. While this helps to prevent dilution, selling too many shares early can show a lack of confidence in your company’s future and repel investors.

Policies on who can sell, how much they can sell, and when they can sell should be set up. Some companies issue lock-up periods (no one is allowed to sell their shares during this time) to stabilize stock prices and increase investor confidence. Liquidity programs allowing owners to cash out gradually without disrupting the cap table should exist.

Conclusion

A structured cap table is not just a spreadsheet, it determines the success or failure of your startup. If you don’t plan well from the start, you’re at risk of dilution, disputes, and losing control of your company.

However, having a current cap table is not the ultimate goal. Maintaining it as you scale ensures that even the smallest changes reflect on the cap table so when funding rounds come you’ll be able to determine how many shares to issue and at what terms.

Cap management tools like Carta simplify updating your cap table regularly by automating calculations and tracking changes. You can check it out or look out for others that suit your needs.