The integration of AI tools for business analysts is revolutionizing how US real estate firms make strategic decisions. In a market defined by fluctuating property values, evolving tenant preferences, and rising operational costs, leveraging AI for real estate isn’t just about innovation; it’s about survival.

Business analysts in the real estate industry handle enormous volumes of fragmented data from leases, transactions, financial reports, and occupancy metrics. The challenge? Converting that data into insights that take you to the next step.

Traditional reporting methods are often too slow and manual to keep pace with real-time market shifts, leaving firms reactive instead of proactive.

Why AI is becoming essential for business analysts

Modern real estate demands speed, precision, and foresight, three areas where AI excels.

Here’s how AI tools are reshaping the role of business analysts in real estate:

- Automating data aggregation: AI gathers and cleans data from multiple systems, eliminating manual repetition.

- Real-time reporting: Instead of waiting for monthly performance reviews, analysts can access instant dashboards showing live metrics.

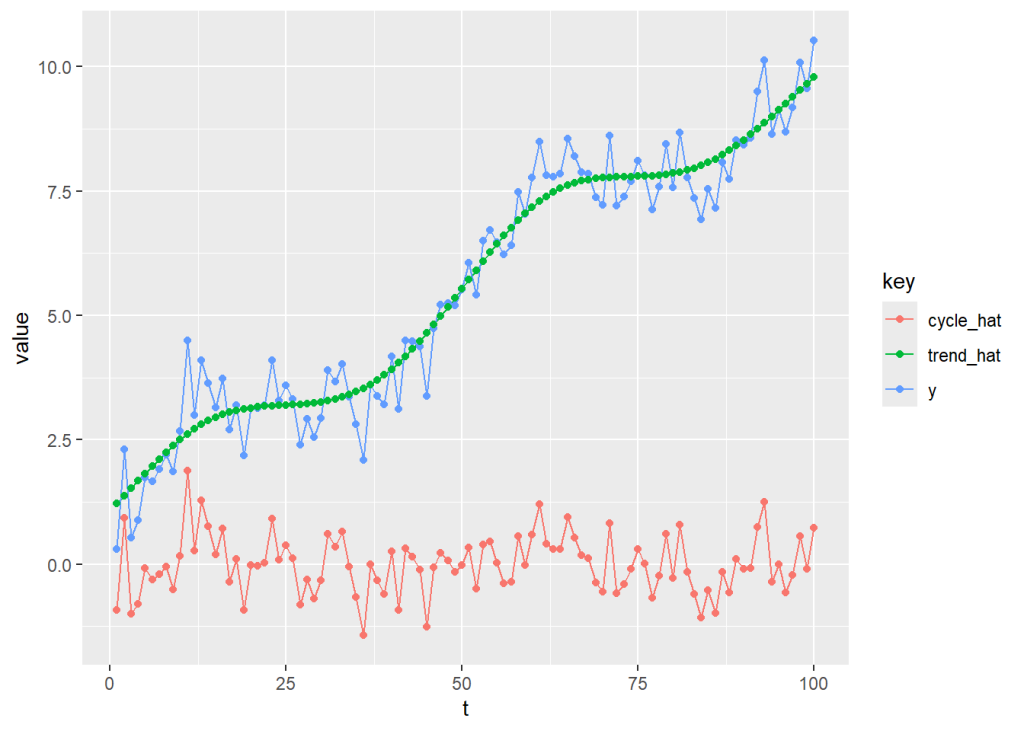

- Predictive forecasting: Machine learning models forecast rent trends, occupancy fluctuations, and market demand, helping teams plan ahead.

- Risk identification: AI identifies anomalies and inefficiencies, allowing firms to act before small issues escalate.

- Data-driven decision support: By turning raw numbers into actionable insights, AI empowers analysts to focus on strategy instead of spreadsheets.

The problem: Data fragmentation and decision delays

Real estate teams often face one major challenge: data fragmentation. Information is scattered across property management systems (PMS), spreadsheets, operator reports, and emails. As a result:

- Performance data becomes inconsistent.

- Reporting cycles are delayed.

- Important opportunities are missed due to slow insight delivery.

This disconnect between data availability and decision readiness makes it difficult for analysts to guide executives confidently. In today’s competitive market, relying on manual analysis means falling behind firms that use AI to move faster, predict better, and act smarter.

How AI Integration Solves This Problem

AI integration allows real estate businesses to build a unified data ecosystem; connecting all their fragmented systems into one cohesive, intelligent framework.

- Unified data sources: AI tools consolidate inputs from PMS, accounting platforms, and operator sheets into one clean dataset.

2. Automated analysis: Algorithms process, interpret, and visualize insights instantly, reducing human error.

3. Proactive alerts: Rather than waiting for reports, teams get notified about performance drops, expense anomalies, or occupancy risks in real time.

4. Continuous learning: The more data the AI analyzes, the smarter it becomes, improving accuracy and foresight with every cycle.

How US Real Estate Firms are using AI

Across the US, leading real estate investment and management firms are leveraging AI to:

- Benchmark portfolio performance against market averages

- Identify cost leakages across operations

- Forecast rent trade-outs and demand trends

- Automate investor and board reporting

- Simplify communication between asset managers and owners

These companies no longer spend weeks cleaning spreadsheets or verifying data; AI handles that. Analysts now spend more time interpreting results and strategizing for growth.

Meet Leni: The AI CRE Analyst Real Estate Teams Have Been Missing

Amid this AI transformation, Leni is emerging as the go-to AI analyst for commercial real estate (CRE), not just another analytics platform.

Leni acts as a digital teammate for owners, asset managers, and portfolio leads, an AI CRE analyst that understands the unique language of real estate: leases, occupancy, NOI, rent trade-outs, and portfolio performance.

Here’s how Leni bridges the gap between data and decision-making:

- Connects fragmented data: Leni integrates PMS data, spreadsheets, and operator reports into a single source of truth for the entire portfolio.

- Delivers real-Time insights: It provides proactive recommendations to identify underperforming assets, forecast trends, and detect inefficiencies.

- Automates reporting: Teams can automate performance summaries, investor dashboards, and anomaly detection with minimal manual input.

- Enhances collaboration: By presenting clean, visual insights, Leni improves communication and transparency across teams and stakeholders.

Final thoughts

The integration of AI tools for business analysts is no longer optional for real estate firms striving to stay ahead in the US market. AI delivers what every analyst dreams of: clean data, clear insights, and the ability to predict, not just react.

And with Leni acting as your AI-powered CRE analyst, your team can finally move from endless reporting to impactful decision-making.

Because in modern real estate, the firms that see clearly move first.