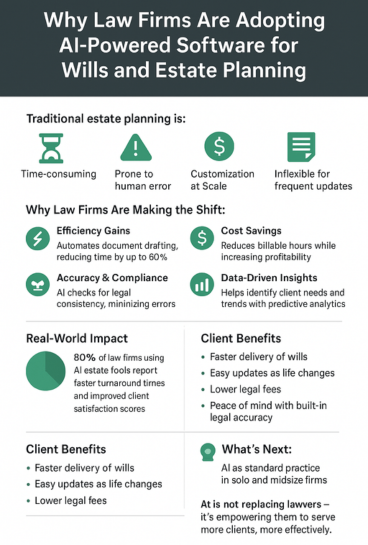

The legal world is changing fast, and law firms are keeping up by turning to smarter tools. AI is transforming estate planning by making wills and trusts faster, smarter, and more secure, helping law firms meet rising client expectations while improving efficiency.

These tools are not here to replace lawyers but to amplify their capabilities, allowing them to do more in less time without compromising quality. From drafting complex documents with fewer errors to ensuring compliance with ever-changing legal standards, AI is turning static workflows into dynamic, intelligent systems.

In a field where accuracy and clarity matter most, AI offers real benefits. This blog explores why law firms are making the switch, how it is helping both lawyers and clients and what it means for the future of legal services.

The Evolution of Estate Management Software

The journey from folders to modern digital platforms represents one of the most significant transformations in legal practice history. This evolution has accelerated dramatically in recent years as AI technology has matured and become more accessible to firms of all sizes.

From Paper to Digital Platforms

Remember when estate planning meant endless stacks of paper, filing cabinets, and manual revisions? Those days are rapidly disappearing. The first generation of digital estate planning tools simply digitized existing processes without fundamentally changing them. Law firms could create digital versions of wills and trusts, but the underlying workflow remained largely unchanged.

These early systems often lacked the integration and intelligence that best wills and estate planning software now incorporates, limiting their impact on overall efficiency and making routine tasks more time-consuming and error-prone.

The AI Revolution in Legal Practice

The real game-changer has been the introduction of artificial intelligence into legal will software. Today’s AI-powered systems don’t just store documents, they actively assist in creating them, checking for errors, and ensuring compliance with constantly changing regulations.

Modern trust and estate software can analyze existing documents, extract relevant information, and suggest personalized clauses based on a client’s specific situation. This represents a fundamental shift from passive storage to active assistance, transforming how attorneys approach document creation and client service.

The integration of AI has democratized access to sophisticated tools, allowing smaller firms to compete with larger practices by leveraging the same powerful technology. This transition sets the stage for the next wave of innovation in estate planning technology.

Key Issues Existing Within Estate Planning Today

Estate planning attorneys are under distinct and unique pressures today that did not exist even 10 years ago. These pressures will continue to push the development of AI-powered solutions as firms look for greater non-hour billable efficiencies to compete with each other and provide a great client experience.

Time Pressures and Administrative Tasks

Time Pressures and Administrative Tasks

The billable hour is still the standard business model for many law firms, so time is very literally money. However, attorneys report spending upwards of 40% of their day on non-billable administrative tasks such as document preparation, client intake, and calendar maintenance.

Legacy planning solutions powered by AI specifically target these time-draining activities. By automating routine document creation and data entry, these tools free attorneys to focus on the aspects of their practice that genuinely require legal expertise and human judgment.

For many firms, this shift has transformed their entire approach to practice management, allowing them to handle more clients without sacrificing quality or requiring additional staff.

Client Expectations in the Digital Age

Today’s clients have been conditioned by experiences with companies like Amazon and Netflix to expect immediate service, transparent processes, and digital access to information. They’re increasingly unwilling to wait weeks for document revisions or visit an office for every signature.

Modern clients expect to review documents online, receive regular updates, and communicate with their attorneys through digital channels. Estate management software with client portals and automated communication tools helps firms meet these expectations without creating additional work for staff.

Regulatory Compliance and Risk Management

Estate planning requires understanding complex legal elements and especially managing to change legal conditions across jurisdictions with potentially dire consequences for clients and firms when signatures are missed, clauses are not included, or documents are not executed properly. In estate planning, these risks are amplified considerably as errors expose clients and firms to malpractice claims.

AI can help mitigate these errors, improve quality firm-wide, and significantly reduce risk by automatically assessing documents against regulatory requirements while identifying issues and maintaining a consistent level of quality in the firm’s output. This could give attorneys and clients peace of mind and remove risk aversion on the part of the attorney.

The amalgamation of these issues provides a fertile ground for the adoption of AI as firms are looking for solutions that provide issues that address multiple pain points.

Key Benefits of AI-Powered Legacy Planning Solutions

The adoption of intelligent technology in estate planning delivers tangible advantages that directly impact a firm’s operations, client satisfaction, and financial performance. These benefits explain why so many practices are making the transition to AI-powered systems.

Enhanced Efficiency and Productivity

Time is a finite resource for attorneys, and AI helps make the most of every minute. Legacy planning solutions powered by AI can draft standard documents in minutes rather than hours, automatically populate client information across multiple forms, and handle routine client communications.

This efficiency translates directly to the bottom line. Firms using AI report handling up to 40% more cases with the same staff, dramatically increasing revenue without proportionally increasing costs.

The productivity gains extend beyond document creation to include client intake, information gathering, and even billing processes, all areas where AI can automate routine tasks and reduce manual effort.

Improved Accuracy and Risk Management

Human error is inevitable, especially when dealing with complex legal documents that may contain hundreds of variables. AI dramatically reduces these errors through the consistent application of rules, automated checking, and standardized processes.

Modern trust and estate software includes built-in compliance checking that ensures documents meet jurisdiction-specific requirements. This capability is particularly valuable for firms practicing across multiple states, where keeping track of varying regulations can be challenging.

The risk reduction extends to version control and document history, with AI systems maintaining complete audit trails of all changes and approvals. This transparency protects both clients and firms by creating clear accountability for every aspect of document preparation.

Excellent Client Experience & Satisfaction

Excellent Client Experience & Satisfaction

Clients today expect transparency, convenience, and responsive communication just like they do in every area of life. AI-enabled client portals allow clients access to their documents, updates, and secure messaging at any time of the day or night.

Of all the benefits, technology-enabled tools for estate planning can automatically draft ongoing project updates, remind clients of needed information, and suggest educational materials that best match the client’s situation. These enhancements will improve the clients’ experience without any additional work being created.

Faster document turnover with reduced errors and ongoing, timely communication is a powerful combination that creates an unsurpassed client experience that differentiates firms in a competitive industry. Happy clients will refer more people to the firm, especially family and friends, creating even more growth in the practice.

Transformative benefits such as these explain why firms of all sizes are adopting AI for their estate planning practices. At the end of the day, the technology provides tangible improvements in efficiency, accuracy, and client satisfaction, which are the three pillars of a successful legal practice.

Essential Features of Modern Digital Estate Planning Tools

When evaluating digital estate planning tools, certain features stand out as particularly valuable for maximizing the benefits of AI in your practice. Understanding these capabilities helps firms make informed decisions when selecting platforms.

Document Automation and Assembly

The cornerstone of AI-powered estate planning is intelligent document automation. Today’s leading systems go far beyond simple templates, offering context-aware document assembly that adapts to each client’s unique situation.

Modern systems maintain comprehensive template libraries with jurisdiction-specific variations, automatically selecting appropriate clauses based on client information. This intelligence eliminates the need for attorneys to remember countless document variations or manually customize standard forms.

The most sophisticated platforms can even analyze existing client documents, extract relevant information, and incorporate it into new filings, dramatically reducing data entry and improving accuracy. This capability transforms document creation from a time-consuming task to a streamlined process.

Client Relationship Management

Client relationships are the backbone of estate planning practices and AI facilitates these relationships by providing stronger channels for communication and personalized service for clients. Intelligent intake forms can gather more thorough client information while streamlining the intake process dynamically for clients.

Trust and estate software that utilizes AI can ask follow-up questions tailored to the client’s initial responses that will fill out the client information form thoroughly while not unduly burdening clients with off-topic questions. This increases the quality of the client experience and information.

Automated reminders, educational content, and progress updates maintain client engagement throughout the planning process. These touchpoints strengthen relationships without requiring manual effort from attorneys or staff.

Secure Data Management and Compliance

Estate planning involves highly sensitive personal and financial information, making security a top priority for modern practices. Leading AI platforms incorporate bank-level encryption, role-based access controls, and comprehensive audit logs to protect client data.

The best systems balance security with usability, making it easy for authorized users to access information while maintaining strict protections against unauthorized access. This approach ensures compliance with data protection regulations without sacrificing efficiency.

AI-powered compliance checking ensures document accuracy and regulatory adherence, providing an additional layer of protection for both clients and firms. This capability is particularly valuable as regulations continue to evolve.

The right combination of these features creates a powerful platform that transforms how estate planning practices operate. Firms should evaluate potential solutions based on how effectively they address these key areas.

Implementing AI-Powered Will Trust and Estate Planning Software

The journey to AI adoption requires careful planning and execution to maximize benefits while minimizing disruption. Successful implementation follows a structured approach focused on firm needs, staff training, and client communication.

Change Management Strategies

Technology implementations succeed or fail based on user adoption. Create a detailed transition plan that includes comprehensive training, clear communication about benefits, and ongoing support for staff as they adapt to new workflows.

Consider a phased implementation approach that introduces new capabilities gradually, allowing staff to build confidence before tackling more complex features. This approach minimizes disruption while maintaining momentum toward full adoption.

Identify and empower internal champions who can support their colleagues and provide valuable feedback during the implementation process. These advocates play a crucial role in driving acceptance throughout the organization.

Client Communication Best Practices

Rolling out new technology provides an opportunity to showcase your firm’s focus on innovation and client service. You should develop succinct, clear messaging about the client benefits of your technology investment. Potential benefits for clients should include things like quicker document preparation times, enhanced security, and better communication.

Provide educational resources so that clients, at the very least, will understand how to utilize capabilities like client portals or electronic signing features. The educational resources should indicate that these capabilities need not be additional work for clients while emphasizing the efficiency of the estate planning process.

With effective planning and execution,with thoughtful implementation, firms can reap the benefits of AI technology without interruptions to their practice.

Source: Canva

Concluding Thoughts on the Future of Technology in Estate Planning

The use of AI in estate planning showcases a paradigm shift for attorneys with their clients and law firm practice management. The technology provides opportunities for unprecedented efficiency, accuracy, and client experiences.

As the capabilities of AI continue to progress, advanced applications to advance the practice of law are likely to emerge. For law firms willing to adapt, the future is exceptionally bright. The question will no longer be whether to implement AI-enabled estate planning technology, but rather how quickly and effectively you can implement it.

FAQs

- Why is AI Disrupting Legal Practice?

AI is extremely adept at reducing repetitive, rules-based tasks that eat up too much of an attorney’s valuable time. Automated processes enabled by AI allow legal professionals to apply their attention to more deliberate analysis, client relationships, and strategic planning, where the attorney adds value.

- Will AI Replace Estate Planning Attorneys?

No. AI complements the human expertise of an attorney but does not replace it. AI may draft documents and discover issues, but it cannot provide the judgment, emotional intelligence, and ethical reasoning of skilled attorneys within client relationships. AI is the most powerful servant as opposed to a replacement, according to the most successful firms.

- How Are Firms Measuring the Value of AI?

Progressive firms sought ways to accurately measure certain metrics before and after the implementation of AI. These metrics would include the time taken to prepare documents, client satisfaction scores, and attorney revenue metrics. Metrics provide firms with demonstrable ROI and aid in uncovering additional opportunities to optimize their practice.

Time Pressures and Administrative Tasks

Time Pressures and Administrative Tasks Excellent Client Experience & Satisfaction

Excellent Client Experience & Satisfaction