The telecommunications industry is on the verge of a transformative era, where interconnectivity and digital transformation are becoming the foundation of success. However, it’s these very evolutions that are expanding the surface area exposed to fraud and providing bad actors with a fertile playing field – creating an increased sense of urgency among telecom operators to develop a robust fraud management strategy. One that can keep up with ever-evolving and increasingly sophisticated fraudulent techniques and tactics.

A new approach to fraud detection and mitigation

Due to rapid digitisation, new technologies, and increasingly innovative techniques used by fraudsters, traditional monitoring, and fraud detection methods are proving to be inadequate. Risk management methods that are prevalent today bypass traditional defense mechanisms, which can result in damage to an operator’s brand reputation, as well as regulatory repercussions occurring from fraudulent activities. While not a magic potion, operators are now seeing the game-changing potential of integrating Generative Artificial Intelligence (GenAI) into risk management strategies for a multi-faceted approach.

Operators are increasingly viewing the convergence of GenAI and fraud management as key in minimising fraudulent activities and for good reason. The convergence and collaboration offered by GenAI and fraud management hold the promise to:

- Improve fraud detection capabilities: GenAI goes beyond rule-based systems by analysing immense data volumes to identify hidden relationships and recognize complex fraud patterns – making fraud detection more accurate and timelier.

- Foresee and neutralise typical fraud techniques: Instead of reactively addressing fraudulent activities, telecom operators can take a proactive approach by leveraging GenAI to simulate potential fraud scenarios.

- Enrich model training: By producing synthetic datasets that closely replicate real-world fraud patterns, GenAI addresses a mounting AI problem – the shortage of high-quality training data.

While GenAI offers immense potential, it is not without inherent challenges. To achieve a multi-faceted approach to fraud detection, GenAI needs to be at the center of the risk management strategy. With GenAI, it becomes possible to construct datasets that mimic actual fraud patterns. When there’s a shortage of balanced training data, it’s this capability that provides the supplemental data needed to ensure the effectiveness of fraud detection models. The ability of GenAI to generate a wide array of representative data enables operators to improve the accuracy of fraud detection mechanisms, lessening fraud risk.

Anticipate, prioritise, and mitigate fraudulent activities

Instead of using traditional rule-based fraud detection methods, GenAI delves deeper enabling it to identify complex behavioral and transactional patterns that have the potential of being fraud attempts. This is accomplished by generative models, using previous data as a foundation, to reproduce potential fraud conditions. This process equips the operator with the advanced knowledge needed that allows them to not only anticipate but also develop robust countermeasures against emerging fraud techniques.

For GenAI to decipher anomalies, it uses what’s called autoencoders. Autoencoders can be likened to a sieve that is trained with standard transactions, enabling it to single out irregularities based on how data doesn’t fit. Given this capability, new transactions with a higher “misfit” level can signal potential fraud indicators. While generative models provide numerous benefits, one of the most advantageous is its ability to profile users. By understanding a user’s regular transactional rhythm, any deviation in the rhythm, no matter how subtle, is considered conspicuous.

By incorporating GenAI as a tool against fraudulent behaviour, fraud analysts have immediate access to potentially fraudulent activities. However, it’s not just about speed; it’s about delivering laser-focused information to guide decision-making. When suspicious patterns occur, generative AI not only raises the alarm but creates a complete picture of the anomaly. Every alert provided by GenAI comes with a backstory, making it more straightforward for analysts to gain a better understanding and take appropriate actions.

With GenAI acting as the ‘strategist’, it analyses various metrics to determine prioritisation, such as which fraud cases need immediate attention and which ones can be deferred. GenAI doesn’t just make rules; it interprets them and provides explanations in terms that are easily understood by humans – it bridges the gap between complex algorithms and human understanding. By taking on routine tasks, GenAI ensures that the entire fraud detection team operates in unison where alerts are prioritised, communications are seamless, and reactions are promptly taken, making fraud detection and mitigation a more streamlined and efficient process.

GenAI use cases: Instrumental in combatting telecom fraud

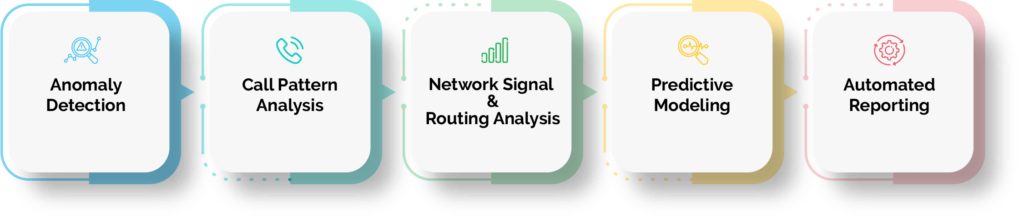

GenAI plays a critical role in detecting and preventing telecom fraud including SIM card cloning, subscription fraud, and unauthorised access attempts. Interconnect Bypass Fraud, also referred to as Bypass Fraud, is a telecommunications fraud where calls are illegitimately rerouted to avoid associated charges. This fraud is typically executed using technologies like SIM boxes and VoIP gateways. GenAI holds promise in detecting and mitigating this type of fraud through anomaly detection, call pattern analysis, network signal & routing analysis, predictive modeling, and automated reporting.

GenAI is also instrumental in combatting identity fraud. Using its ability to recognise and adapt to intricate patterns, GenAI not only strengthens defences against identity theft but also paves the way for innovative protective measures such as synthetic data generation, advanced pattern recognition, simulating fraudster behaviour, biometric verification enhancement, and real-time monitoring.

Overcoming GenAI challenges to realise its promises

The landscape of GenAI is as vast and complex as it is promising. And while GenAI offers promising advancements in fraud detection, its adoption is not without pitfalls. Some of the more common challenges include the possibility of models producing deceptive outputs “hallucinations”, the vagueness of the decision-making processes found in some models, unintentional emphasis on existing data biases, significant computational and training expenses, and difficulties surrounding the maintenance of output accuracy – given the complexity and vastness of the data they’re trained on. It’s these very complications that draw attention to the importance of taking thorough measures when planning the integration of GenAI into a risk management strategy.

Successful integration of GenAI requires a comprehensive understanding of both its abilities and its vulnerabilities. Equally important to its success is establishing and adhering to ethical standards to ensure that the power of GenAI is employed responsibly. As with any sophisticated technology, a multi-dimensional approach to its adoption—understanding its nuances, balancing its power with cautiousness, and continuously incorporating updates based on evolving threats and scenarios — is of the utmost importance. As the digital landscape continues to evolve, so too will the technologies telecom operators employ. However, throughout this evolution, GenAI will indubitably be at the centre of continued advancements.