Gift cards were once just plastic cards you picked from a store rack. Today, they are digital, instant, and connected with every part of our daily spending. As we know, artificial intelligence is now changing almost every sector, and gifting is no different. The future of gift cards is not just about sending money value but about sending a smarter, safer, and more personal experience. Let us see how AI is reshaping this space step by step.

Market Snapshot in 2025

Digital gift cards are already more popular than physical cards. More people in India and abroad prefer sending codes by email, WhatsApp, or apps. Corporate companies also use gift cards as employee rewards. According to reports, demand peaks around festivals like Diwali and Christmas. The reason is quite clear: people prefer quick gifting options that fit online shopping and mobile payments.

How AI Makes Gift Cards Smarter

Personalized Recommendations

Now here’s the thing. AI can read patterns in shopping history, browsing activity, and even reminders like birthdays. It then suggests which card, how much value, and when to send. For example, Starbucks uses AI to suggest the right offers and gift card packs to its customers, increasing sales.

Dynamic Packaging and Upsells

AI can suggest extra features with the card. For instance, a greeting card design, an AI-generated artwork, or even small discounts on bundled products. The point is simple here: this makes gifting look special and also increases order value.

Predictive Demand Planning

AI also helps companies prepare codes before peak times. Around major cricket events, gaming card demand suddenly increases. Retailers use AI to track these spikes and make sure they don’t run out of codes.

How AI Makes Gift Cards Safer

Real-Time Fraud Scoring

Gift card fraud is a big issue. AI models check patterns like device details, IP address, and unusual buying speed. If a fraudster tries bulk purchases, the system can block it instantly. This protects both businesses and users.

Reducing False Declines

Sometimes genuine customers are blocked due to strict rules. That’s not it, AI can solve this by balancing risk and approval. For example, if you buy a gift card at midnight but the system knows your past pattern, it can still approve safely.

Bot and Reseller Abuse Control

Scammers use bots to grab free or discounted gift cards in bulk. AI detects these by studying unusual clicks and repeated behaviors. So, abuse becomes harder, and fairness is maintained.

India Compliance Corner: PPIs and KYC Basics

RBI Rules That Matter

In India, prepaid payment instruments (PPIs) like gift cards are under RBI. There are rules for maximum balance, reloadable cards, and KYC checks. Users may need to provide ID for higher-value cards. These rules guide how gift cards are issued and redeemed.

What This Means for AI Features

AI helps by pre-checking risky transactions. It can guide users if more details are needed and make the whole KYC process smoother. This reduces fraud and also keeps platforms compliant.

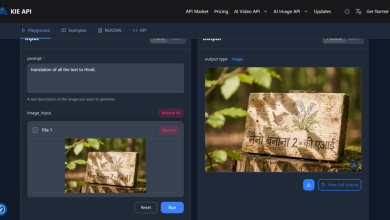

Feature Playbook: AI Use-Cases You Can Ship Now

On-Site Assistant

Websites can use AI chat assistants to help buyers pick the right brand and value. For example, “Which card is better for a gamer vs. a foodie?” The assistant narrows the options quickly.

Smart Denominations and Timing Nudges

Sometimes users are confused about how much to spend. AI can suggest ₹500 for a colleague or ₹2000 for a family member based on past gifting trends.

Adaptive Checkout

AI can decide during checkout if the payment is safe. Low-risk users get instant approval, while risky ones may need OTP or extra verification.

Voice and Messaging Triggers

You can even say, “Alexa, send a ₹500 Amazon Pay card to Dad,” or get WhatsApp reminders for unused balances. AI is connecting gift cards to daily habits.

Security Architecture with AI

Layered Defense

Security works best in layers. First, card networks like Visa use AI to stop fraud at a higher level. Then payment gateways add their own checks. Finally, retailers can run their own AI fraud models. This multi-step defense is stronger than rules alone.

Signals to Log from Day One

If you run a gift card platform, you should log details like device fingerprint, payment attempts, redemption time, and user history. AI needs these signals to work better.

KPIs to Watch

Platforms must track approval rates, chargeback rates, and fraud attempts stopped. AI improves these metrics over time, giving a safer environment.

Best Offerwall and Survey Platforms

AI also plays an important role in reward platforms where people earn free gift cards. The best offerwall and survey platforms like FreeGiftZone or RedeemCodeZone use AI to distribute codes fairly and reduce bot misuse. In addition to these, apps such as Swagbucks, PrizeRebel, and Google Opinion Rewards use surveys, tasks, and offerwalls to reward users with gift cards. AI here makes sure rewards go to genuine users and blocks fake activity. This creates trust for both advertisers and users.

Data and Privacy

Ethical AI and Explainability

What you need to understand is this: AI must stay transparent. If a purchase is blocked, the system should show a reason in simple words. Bias and unfair blocks should be avoided.

Regulatory Notes

For India, RBI audits and data localization rules matter. AI systems should store user data securely and only for as long as needed. Consent for profiling in marketing is also important.

Roadmap: Near-Term to 24 Months

0–3 Months

Platforms can start small with logging, dashboards, and simple vendor AI tools for fraud checks. This lays the base.

3–12 Months

Then, personalization models can be added. AI can suggest gift cards in shopping apps. Adaptive checkout can also go live to reduce friction.

12–24 Months

In two years, real-time AI serving can be adopted. Generative AI can design messages or card themes. Blockchain-backed cards may also be tested for extra security.

Case Studies

Starbucks Rewards is a good example of AI personalization. It boosted engagement by showing the right offers and gift cards to the right users. Networks like Visa and Mastercard use AI to detect billions of dollars of fraud attempts daily. This shows how powerful AI can be when combined with payments.

Action Checklist

- Map your customer journey and spot friction points.

- Add 3 quick AI tools such as fraud detection, personalization, and reminders.

- Track key KPIs weekly and compare improvements.

- Expand gradually to voice, chat, and loyalty integrations.

Conclusion

Gift cards are no longer just plain prepaid cards. With AI, they are becoming smarter by recommending the right gifts, safer by stopping fraud in real time, and more personal by creating emotional connections. The future of gifting is not only digital but also intelligent. If you start adopting AI today, you will be ready for a gifting world that feels secure, personal, and exciting all at once.