Professional services are undergoing major change – and none more so than in accountancy, where it feels like we’re at a tipping point. Once a future concept, AI is now gradually shifting roles, reworking processes, and reshaping what firms need from their people.

Whether it’s the automation of tasks, the streamlining of workflows, or a fundamental refocus for firms, these changes are also taking place at a time of acute talent shortages. More practices are telling us they don’t have the ‘boots on the ground’ needed to meet client demand. But is this necessarily a bad thing, or does it present an opportunity for accountants to redefine their role? AI and automation can make accountancy firms more efficient – and their clients too – while also allowing accountants to pivot from being number-crunchers to trusted strategic advisors.

The growing talent gap

Since the pandemic, the profession has faced a steady decline in available talent, particularly at entry level, where firms are struggling to recruit and retain new joiners. Recent stats show that 74% of leaders believe their business is ‘significantly’ or ‘severely’ affected by a lack of skills; and, coupled with recent changes to apprenticeship funding, there’s no doubt that fewer people are entering the pipeline. At the same time, younger professionals are increasingly attracted to careers in tech, finance, and consulting, which they often view as more dynamic or digitally forward-looking. Accountancy still battles a perception problem – seen by some as a traditional or less exciting career – and this has knock-on effects for succession planning. Many mid-tier firms in particular are finding it hardest to bring through the next generation of accountants, leaving gaps that cannot simply be filled by hiring.

AI and outsourcing: A hybrid solution

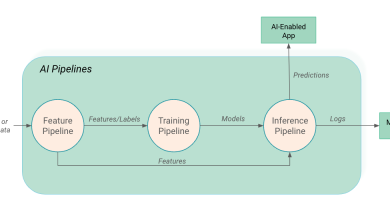

Against this backdrop, firms are inevitably turning to AI and automation. Not to replace people, but to ensure that routine, repetitive work is covered. By shifting the burden of these tasks, firms give accountants the time and space to focus on client care, business advisory, and strategic support. In reality, no business can simply recruit its way out of this shortage. Outsourcing has already become a lifeline for many practices – absorbing the heavy lifting of compliance tasks, bookkeeping, and processing. When combined with AI, that support becomes even more powerful. Think of outsourcing as adding skilled hands, and AI as adding speed and consistency – together, they create a scalable, realistic solution.

From compliance to client growth

AI is already being embedded into mainstream tools like Xero, especially within bookkeeping and reconciliation. Personal tax, corporation tax, and accounts prep are all expected to see significant automation over the next few years – though professional sign-off remains essential.

Take, for example, a mid-sized practice that outsources its compliance and bookkeeping work. By layering AI tools on top – from automated reconciliation through to first-draft reporting – the practice not only saves time but also frees up partners and managers to deliver higher-value advisory services. In some cases, that means a firm can grow their client base without increasing headcount. This hybrid model keeps firms moving at pace without overstretching staff or sacrificing quality, while also giving them a competitive advantage in a market where talent is scarce. Firms embracing this approach are not only addressing resourcing pressures but also positioning themselves for growth. Instead of being limited by capacity, they can extend services, handle more clients, and focus internal teams on value-adding work.

Redefining roles, not replacing them

There’s also a lot of noise within the sector about AI “replacing accountants”, but the reality is more nuanced. What we’re seeing is a shift in roles and responsibilities, rather than a mass elimination of them. AI can take on those important but time-consuming tasks – such as reconciliations, initial reporting, or data entry – but the interpretation, insight, and relationship-building that sit at the heart of accounting remain firmly human. In fact, with AI taking on the groundwork, accountants have more scope than ever to step into the role of strategic advisor – guiding businesses through growth decisions, risk management, and long-term planning. For firms willing to embrace that shift, the opportunity is transformative.

Larger firms are already adopting a “diamond” team model – with fewer entry-level roles and more emphasis on experienced professionals with judgment, advisory skills, and client-facing strengths.

Trust, oversight, and regulation

Of course, efficiency alone isn’t enough. In a highly regulated profession like accounting, the success of AI depends on trust, auditability, and process discipline – areas where accountants are uniquely trained to lead. Clients, regulators, and firms themselves need confidence that AI-driven outputs are reliable, explainable, and backed by professional judgment. Accountants cannot abdicate responsibility simply because a piece of software drafted the first version of a set of accounts, a tax return, or an advisory report. The regulatory burden remains squarely with the professional, meaning accountants will still need to check, re-check, and verify any work produced with the assistance of AI.

If anything, authorities are becoming more alert to the way technology is being embedded into practice, and their priority is clear: it must not harm consumers or undermine the profession’s standards. That’s why the winning firms will be those that adopt AI responsibly, with robust checks and balances in place. Professional oversight remains non-negotiable. The real opportunity lies in combining the speed and efficiency of AI with the judgment, ethics, and accountability of human professionals. Used in this way, AI doesn’t replace the human role – it strengthens it, ensuring that trust in the profession is not just maintained but enhanced.

The future: Smarter, better-deployed people

Looking ahead, it seems inevitable that hybrid operating models – blending in-house talent, outsourcing partners, and AI-driven automation – will become the norm, and firms that resist this shift risk being left behind, both in terms of efficiency and in the ability to attract and retain talent. Just as clients have come to expect digital convenience in other aspects of business life, they will soon expect their accountants to offer services that are faster, smarter, and more strategic. The future of accounting will not be defined by fewer people, but by people working smarter – supported by the right mix of technology, training and flexible resources. Outsourcing remains a vital part of this mix – helping firms manage resource flexibly, access niche technical skills, and act as a bridge while they reconfigure their workforce for the future.