Accidents and disasters affect hundreds of millions of people every year. And every incident – from a minor scrape of a car bumper, all the way up to a full-scale catastrophe – can have serious consequences on the livelihoods of those affected.

To help people rebound, an effective and efficient recovery process is critical – which is where insurers come in. No matter what is damaged, recovery starts with a visual appraisal – an expert inspects and understands the damage, and estimates how much it will cost to fix. And once those steps are complete, the insurer can unlock the funds to begin the rebuild.

It sounds like a simple process… but it isn’t, at least not always. Anyone who has had a minor car incident knows the pain of simply waiting on someone to come and look at the damage done so that repairs can happen – a key step in the process that’s dependent on availability and can take days, or even weeks if expertise is in short supply.

This simple demand problem is exacerbated in wide-scale disasters. When many people are affected at once – such as when multiple properties are affected by a hurricane – there aren’t enough experts to check on all the damage and move claims forward. That means the recovery process stalls, just when people need it to help them the most.

We are solving these problems today, with AI.

A computer vision of the future

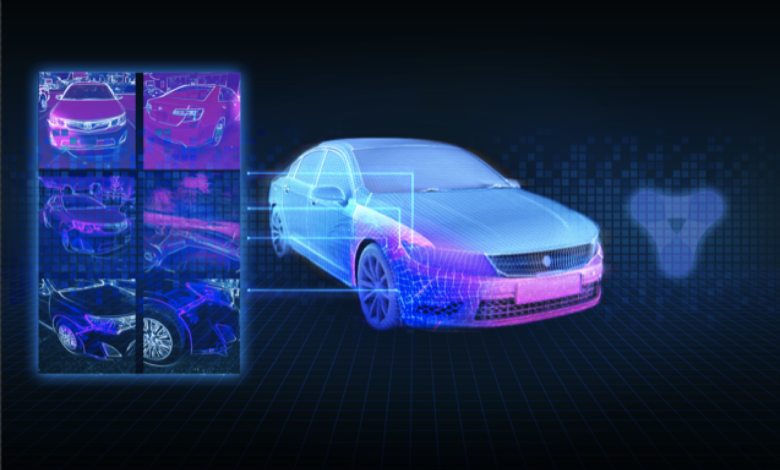

Recent advances in processing power have enabled rapid advances in computer vision technology. In effect, this means that with the right approach, training and data, an AI can now achieve results in visual tasks similar to a human.

When it comes to insurance, this means we can automate many of the visual tasks involved in the recovery process – whether that’s assessing the extent of damage in the first place, to checking if repairs are being carried out correctly and safely.

At my company, Tractable, we’ve developed an AI that understands auto damage as a human assessor would. Our platform is built on a proprietary dataset of many millions of photos of car accidents and the repair operations that ensued. Not only can it improve on human performance, but it can process multiple claims at once to the correct standards, and it never gets tired.

This sounds too good to be true – like technology that could make a difference in the future. But you might be surprised to learn that this AI is not only in use today by some of the world’s largest insurers; it has already been used on millions of real auto insurance claims and made a difference to households across the globe.

Resolving a claim on the first phone call

Indeed, if you’ve recently had a car accident, when you first called your insurer to report a claim, they might have asked you to submit photos of your vehicle and of any damage to it.

If you were covered by an insurer that works with Tractable (for example, Ageas in the UK), while you were giving the rest of your details, our AI was assessing the photos you submitted, and working out what repairs are required.

It would have then informed the insurer of what it saw, how confident it was in its assessment, and what steps the insurer should take next. Applying the AI in this way in effect can condense what is often a week-long process into just a simple three-minute call – a substantial efficiency gain for the insurer, and a much-improved experience for the driver.

Insurers who currently use AI to accelerate different aspects of their claims include leading insurers in Japan (Tokio Marine and MS&AD), France (Covéa), Poland (PZU) and the US (The Hartford). The AI is helping them review how claims are being processed and detect anomalies and inefficiencies, resulting in a faster, more accurate process.

From vehicles to disasters

It’s a step change in how AI can be implemented by major corporations on a commercial basis – but it’s potentially just scraping the surface of what could be achieved.

Already, we can see many more potential applications of AI across the repair cycle – whether that’s in improving and automating how underwriters estimate the value of a vehicle through to assessing parts on a damaged car and connecting them with repairers who could use them.

But we should also start thinking about applying AI beyond cars, into industries such as property.

When natural disasters strike, hundreds or even thousands of people may lose their homes and property, and become dispossessed. They need immediate relief – but there is no-one available to help them get back on their feet. Insurers simply can’t assess every claim quickly enough – indeed, in major disasters, the backlog of claims can stretch into months.

That’s where we can really apply AI to make an impact. Because the technology can be used at scale, it is possible to use computer vision to evaluate hundreds or even thousands of – for example – homes that have been damaged or destroyed in a hurricane. That could mean that those affected could be supported within minutes.

Property is, admittedly, more testing than cars. Homes don’t come in set make and models – they differ in size and shape, which makes the challenge of acquiring data to train the AI more challenging. But at Tractable, we are beginning to explore ways of working with insurers to circumvent these problems and find the best applications for our technology, and it’s no longer a pipe dream that the effects of – for example – a burst pipe could now be detected and protected with the help of AI.

Often, when we think about how AI might solve problems, the applications are theoretical – to be determined later. But with accidents and disasters, this technology is making a difference for millions now in the case of vehicles, and soon with property too.

[…] (This post was first featured by The AI Journal – see original piece here) […]