Introduction: From Buzz to Business

Methodology note: This analysis draws on public reports from McKinsey, the Stanford AI Index, BCG, Gartner, the IEA, and press filings from listed companies. Where figures conflicted, I prioritized the latest publication date and comparable definitions (e.g., enterprise GenAI vs. overall AI spend). Timeframe reviewed: 2023–2025.

At one global bank, a generative AI assistant reduced risk-review cycles from three weeks to three days. That acceleration meant more than speed, it gave executives the ability to act quickly in a volatile market, where hesitation can cost millions.

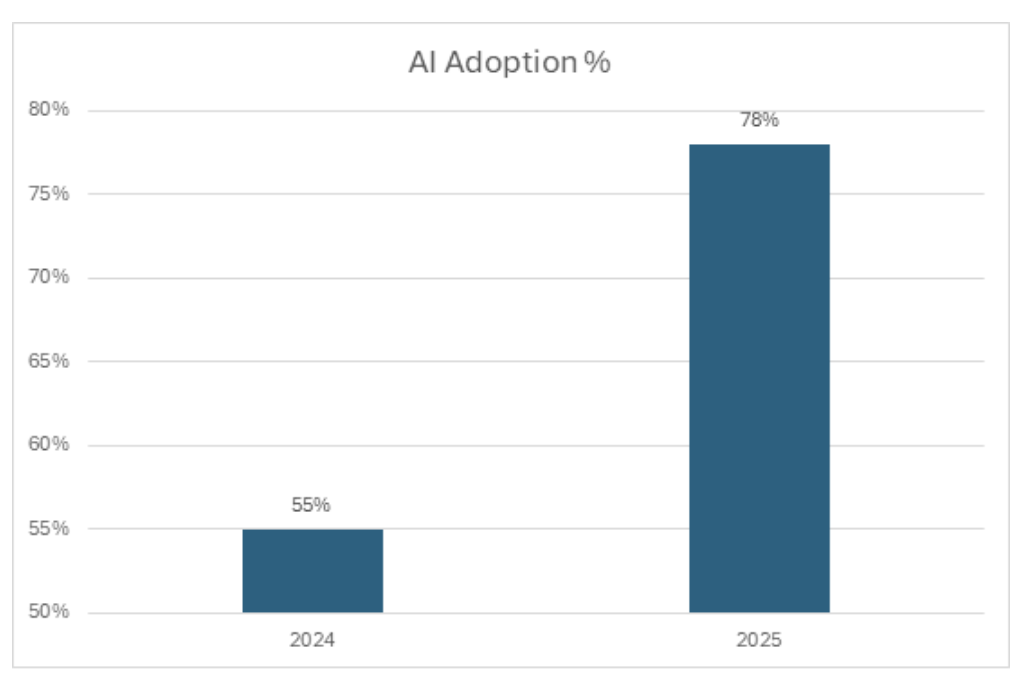

Stories like this illustrate a bigger truth: GenAI has moved far beyond buzz. McKinsey now estimates its economic potential at $2.6 trillion to $4.4 trillion annually, nearly equal to the GDP of the United Kingdom (McKinsey). In 2024 alone, private investment in GenAI hit $33.9 billion, an 18.7% jump from the year before (Stanford AI Index 2025). Adoption is accelerating too: 78% of organizations reported using AI in 2024, up from 55% just a year earlier (Stanford AI Index 2025). So, GenAI is no longer a side experiment. It’s becoming a mainstream business tool that enterprises are investing in, betting on, and embedding into daily operations.

But numbers alone don’t tell the whole story. Behind the surge in adoption lies a divide: some companies are turning GenAI into measurable business value, while others remain stuck in endless pilots. Understanding this gap requires looking at how enterprises are actually investing in GenAI, and whether that spending reflects experiments or long-term commitments.

Adoption and Investment Trends

The latest spending data makes the trend clear: enterprise leaders are opening their wallets. Gartner projects $644 billion in global AI spending for 2025, a 76% increase from 2024 (Sequencr). Importantly, 60% of GenAI projects are still funded from innovation budgets, but permanent allocations now account for 40%, signaling that businesses are moving from experiments to execution (Menlo Ventures).

Caption: AI adoption jumped from 55% to 78% of organizations in a single year (Stanford AI Index 2025).

A Cisco-backed survey at the 2024 Enterprise Technology Leadership Summit revealed the trend: 74% of companies reported ROI, 86% saw revenue growth, and 84% deployed AI into production within six months (IT Revolution). The training wheels are off. Teams are shipping to production faster than their playbooks can catch up.

Put simply, the experimental phase is ending. Enterprises are now betting on GenAI as a core driver of growth and efficiency. AI has moved off the sidelines. It’s becoming a core operating system, and leaders are racing to embed it in daily work.

For business leaders, the question isn’t just about how much is being spent, but whether those dollars are generating tangible returns. The ROI data shows the picture more clearly.

ROI: Where the Value is Emerging

The financial payoff is real. McKinsey estimates every dollar invested in GenAI returns an average of $3.70, with financial services seeing as much as 4.2× ROI (McKinsey Digital).

- Elastic (ESTC): Posted 20% revenue growth and 71% YoY earnings boost in Q1 2025, driven by AI-powered search (Investor’s Business Daily).

- Snowflake (SNOW): Grew revenue 32% YoY to $1.1B in Q2 2025, thanks to AI-driven data modernization projects (Investor’s Business Daily).

- Contraktor (LegalTech): Deployed AI to analyze contracts, slashing review times by up to 75% (Google Cloud).

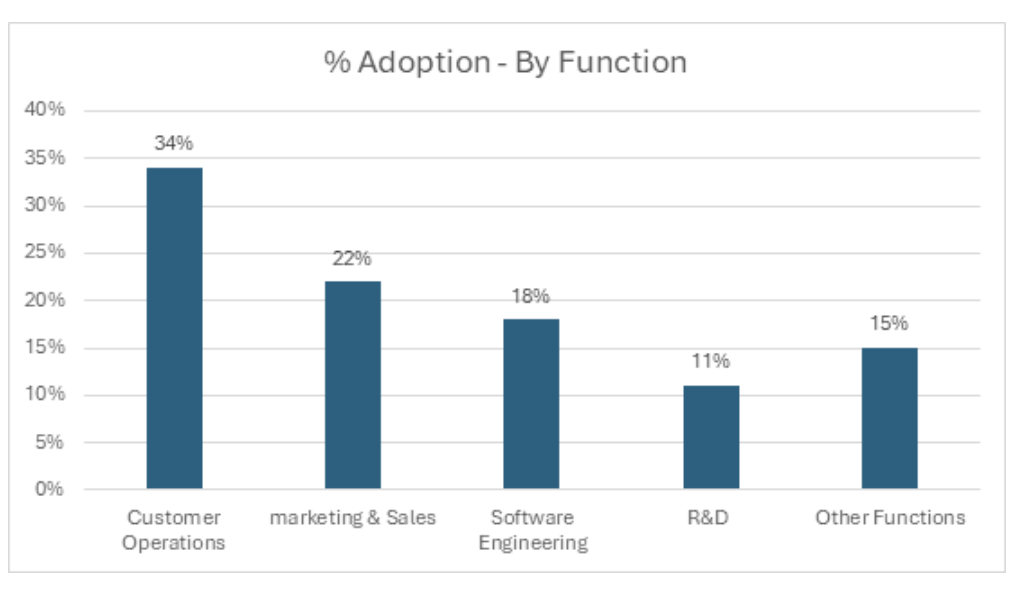

Caption: Most of GenAI’s value is concentrated in customer operations, marketing & sales, software engineering, and R&D (McKinsey Digital).

These results echo a broader McKinsey finding: 75% of GenAI’s value is concentrated in customer operations, marketing & sales, software engineering, and R&D (McKinsey Digital).

The ROI numbers are encouraging, yet they reveal only part of the picture. For every company achieving measurable returns, many others are failing to translate pilots into enterprise-wide impact.

Caveat: Dollar-for-dollar ROI varies widely; the fastest returns show up where workflows are already instrumented and labeled. The rest require more plumbing.

Pilots vs. Scale: The ROI Divide

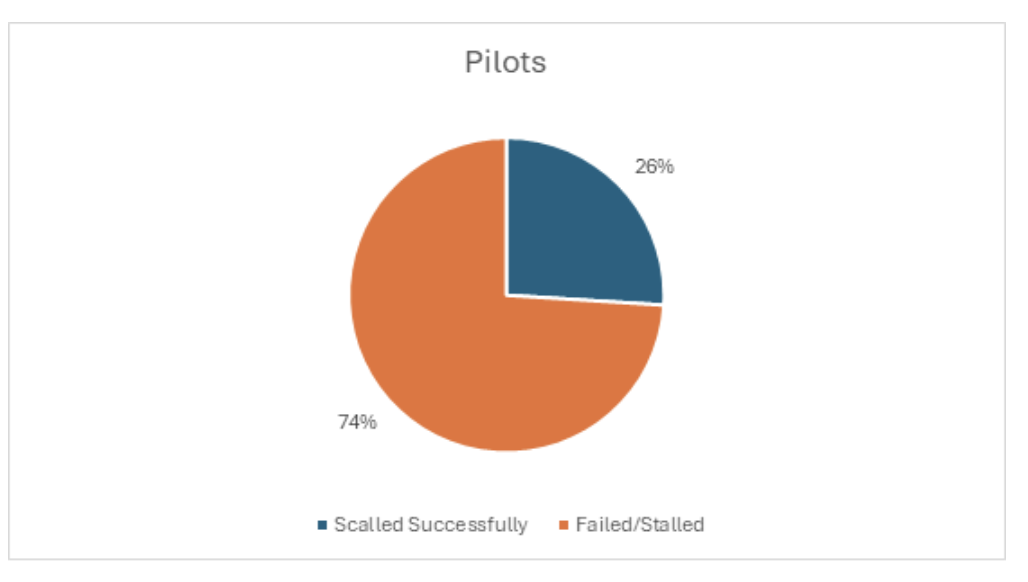

The reality, however, is more complex: while some companies see strong returns, most are struggling to scale. An MIT study found 95% of GenAI pilots fail to deliver measurable returns, not because the technology doesn’t work, but because organizations struggle to scale (Fortune).

Caption: Most GenAI pilots fail to scale, highlighting the gap between experimentation and enterprise-wide adoption (MIT, BCG).

BCG research shows only 1 in 4 executives report significant returns. Their “70/20/10 rule” is telling: 70% of effort should go into people and processes, 20% into data, and just 10% into algorithms (BCG). Put differently: it’s not the model holding you back, it’s the org chart.

Field note: In workshops we run with ops, finance, and CX teams, three patterns stall pilots every time: unclear ownership after “day 30,” KPIs defined as activity (POCs run) instead of outcomes (cycle time cut), and security reviews that happen after build, not before. When teams fix those three, momentum returns quickly.

For executives, the key takeaway is clear: technology isn’t the bottleneck, scaling is. Pilots prove the potential, but only organizations that align people, processes, and strategy see lasting returns. The good news? There are already examples across industries showing what successful scaling looks like.

A quick wrinkle: Some of the most confident ROI claims come from functions with clean digital exhaust (software, marketing). In messy, human-heavy processes (claims, field ops, clinical workflows), returns arrive, just slower, because change management, policy, and data access dominate the timeline.

Industry-Specific Impact

- Financial Services: JPMorgan and Bridgewater use GenAI to augment research and portfolio risk modeling (Business Insider).

- Healthcare: AI-augmented radiology reduces diagnostic errors while keeping physicians in charge (McKinsey).

- Customer Operations: Telecoms and retailers use AI-first chatbots for Tier 1 inquiries, cutting costs by double digits (Gartner).

- Public Safety: Colombia’s Security Council built a GenAI emergency response assistant to guide chemical hazard responses in real time (AWS).

The common thread? These aren’t lab pilots. They’re domain-tuned, scaled deployments that address business-critical needs.

The lesson is clear: when GenAI is applied with focus, it delivers real outcomes, from faster financial analysis to safer healthcare diagnostics. But success stories come with a flip side. Alongside impact, new risks emerge around accuracy, compliance, and sustainability, and those challenges can’t be ignored.

Risks and Challenges

Generative AI is powerful, but imperfect.

- Hallucinations: When unchecked, they erode customer trust.

- Bias & Compliance: Synthetic data helps, but governance frameworks are still essential.

- Energy Footprint: By 2030, AI workloads could account for 2–4% of global electricity demand (IEA).

This won’t work if…

- Governance is a binder, not a practice.

- Model updates outpace change comms to frontline teams.

- You measure “usage” instead of business outcomes.

- Security and compliance join after deployment, not before.

Enterprise adoption must be coupled with explainability, carbon-aware infrastructure, and human-in-the-loop models to balance risk with return.

In short, the promise of GenAI comes with vulnerabilities that can’t be left on autopilot. Turning risks into rewards requires deliberate choices at the top, where strategy, funding, and culture are shaped.

Leadership and the C-Suite Imperative

The C-suite now sits at a crossroads. Leaders must:

- Shift budgets from experiments to operational deployment.

- Align AI projects with enterprise strategy, not just “innovation theater.”

- Invest in people, training employees to question and refine AI output rather than blindly trust it.

Interestingly, 74% of executives say they trust AI more than colleagues, and 44% would let AI override their decisions (TechRadar). This highlights both the potential and the peril: unchecked, GenAI risks becoming a black box in the boardroom.

The path forward, then, isn’t just about adopting GenAI, it’s about guiding it with intention. When leadership sets the tone, allocates resources wisely, and empowers teams, AI becomes more than a tool, it becomes a force for transformation.

If your team has seen a different pattern, faster ROI with minimal change management, what did you do upstream that others can copy? I’d welcome the counterexample.

Conclusion: From Buzz to Business

Generative AI is no longer hype, it’s a productivity engine with real ROI. But the gap between winners and laggards is widening. The winners are those who scale responsibly, align AI to strategy, and empower their people to use it critically.

The truth is simple: GenAI won’t do your job for you. But it will widen the gap between leaders who run it with intent, and those who let it run them.