A New Way to See Tomorrow

Businesses have always looked to forecasting as a tool for navigating uncertainty, yet the methods widely used today often fall short of answering the most pressing strategic questions. Traditional models extrapolate the past into the future, offering predictions couched in probabilities and statistical noise. While valuable, they are inherently reactive, telling leaders what might happen if the future behaves like the past, but not what will happen if the business makes deliberate changes.

In my work across analytics and financial planning, I repeatedly saw teams asking more intentional questions, questions not about statistical likelihood but about strategic consequence. What if we accelerate a product launch? What if pricing changes next quarter? What if engagement improves because of a redesign? These are causal questions, and they demand a forecasting framework that treats the future not as a continuation of yesterday, but as something shaped by decisions.

How Deterministic Thinking Changes the Narrative

Deterministic forecasting reframes forecasting as a system of cause and effect. Once a business defines the rules governing its growth like how users accumulate, how they engage, and how engagement becomes revenue where the model produces a single, unambiguous forecast for any set of assumptions. Change the assumptions, and the future changes with them, cleanly and transparently.

This clarity allows teams to understand the business almost like an engineered system. When leaders adjust an input, they know precisely which parts of the system react and how those reactions propagate. The model becomes not just a prediction engine but an instrument for exploring how choices ripple through the business.

At the heart of the framework is a causal pathway that mirrors the structure of many digital businesses. User growth drives engagement: engagement drives monetization; monetization drives revenue. Each of these elements evolves through deterministic equations. For example, user count in month t may grow according to a monthly rate g(t):

Ut+1 =Ut (1+g(t))Ut+1 =Ut (1+g(t))

Just as predictably, revenue for a subscription-based business might be expressed as:

Rt =ARPUt ×UtRt =ARPUt ×Ut

Even these two formulas alone reveal something powerful: changes in growth compound into revenue through direct, structural pathways.

When Strategy Meets Mathematics: The Impact of Interventions

The most significant advance in the deterministic framework comes from the treatment of interventions. An intervention is a moment when the business acts like a feature release, a marketing surge, a price change that alters one of the underlying parameters of the system. Unlike statistical models that infer effects from historical patterns, the deterministic approach rewrites the future from the intervention point forward.

This perspective changes the way leaders plan. Instead of asking whether a feature might increase growth, they can ask how much revenue it generates if it does increase growth, and what changes if it arrives earlier or later. The model behaves like a controlled experiment in time, revealing the causal consequences of timing, magnitude, and execution.

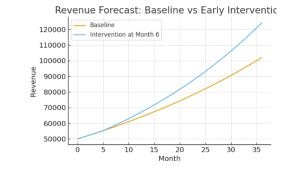

Graph 1: When Compounding Meets Intervention

Below is the first graph, showing how an early feature launch reshapes the revenue trajectory. The baseline represents business as usual, while the intervention curve shows what happens when user growth receives a modest boost at month six.

This widening gap between the lines is the story of compounding. A small improvement in growth, introduced earlier, does not simply add revenue, it multiplies it. Each additional user becomes a generator of downstream engagement and monetization, and every month that passes amplifies the effect.

As leaders study curves like this, their conversation shifts from generic optimism about growth to a precise understanding of how timing amplifies value. The model does not traffic in noise or probabilities; instead, it delivers an engineered view of how cause produces effect.

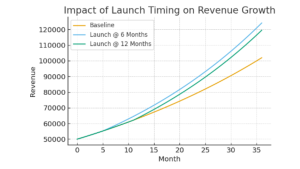

Graph 2: Strategic Timing as a Quantifiable Asset

The second graph brings the idea into sharper focus by comparing interventions at different times. Here, the feature launches at month six and month twelve are contrasted against the baseline:

This chart reflects a truth well known in finance but rarely made tangible in forecasting tools: time is an asset. Each month of delay reduces the compounding window, and no future growth rate, no matter how strong, can retroactively reclaim lost time. The deterministic model quantifies this effect in a way executives and product teams can immediately act upon.

In strategic planning discussions, such clarity is transformative. Decisions become less about instinct and more about mathematically grounded narratives. Leaders begin to see features, pricing decisions, and marketing campaigns not as isolated initiatives but as interventions whose timing materially shifts the trajectory of the business.

The Broader Value: A Framework for Exploration

One of the greatest advantages of deterministic causal forecasting is how naturally it supports narrative thinking. Once the model is constructed, teams can explore alternative futures without retraining algorithms or reprocessing large datasets. They can imagine a world where engagement improves by five percent, where churn falls slightly, or where monetization rises because of a new ad strategy. Each scenario unfolds through the structure of the system, producing outcomes that are intuitive, defensible, and fully traceable.

In boardrooms and operational planning sessions, this becomes invaluable. The model acts like a strategic simulator, revealing consequences, highlighting inflection points, and making uncertainty more manageable. It does not claim perfect prediction; instead, it provides clarity about how the future responds to actions.

Conclusion: Designing Tomorrow with Determinism

The deterministic causal methodology represents a shift in how businesses think about forecasting. Rather than treating the future as a statistical projection, it becomes something businesses can shape through deliberate interventions. The approach aligns closely with how executives think about trade-offs, investments, and timing where decisions that have structural rather than stochastic implications.

By grounding forecasts in transparent cause-and-effect pathways, the method restores trust in the numbers and gives teams a way to reason about the future with engineering-like precision. As organizations increasingly operate in complex, fast-moving markets, the ability to design multiple futures becomes a strategic imperative.

This framework, grounded in mathematics but shaped for decision-makers, gives businesses the clarity they need to act with confidence and intention.