Industrial data hub provider Element announced in a company press release today that it has raised 18m in a Series B funding round.

The funding round was co-led by new investors Activate Capital and Forte Ventures with participation from Evonik Venture Capital, Kerogen Digital Solutions (KDS), and High Tide Foundation. Existing investors including Kleiner Perkins Green Growth Fund, Ajax Strategies, Blue Bear Capital, Schneider Electric Ventures, Honeywell Ventures, and ABB Technology Ventures also participated.

Andy Bane, CEO of Element welcomed the new investors and explained what the funding would mean for the data hub provider going forward by saying: “This financing is the latest example of Element’s momentum on multiple fronts. We welcome our new investors who work at the confluence of enterprise SaaS and industrial transformation. The funding will help Element achieve the next level of performance on behalf of our customers who are solving their most challenging problems through data.”

The industrial data hub provider offers customers software to efficiently transform their diverse sources of industrial data which makes it easier for users to discover new insights, improve performance, improve efficiency, improve workplace safety, and save time.

Element aims to use the funding to keep on with the companies mission of enabling organisations to efficiently connect, transform, and share industrial data. That data is then used to improve efficiency, operational performance, and workplace safety.

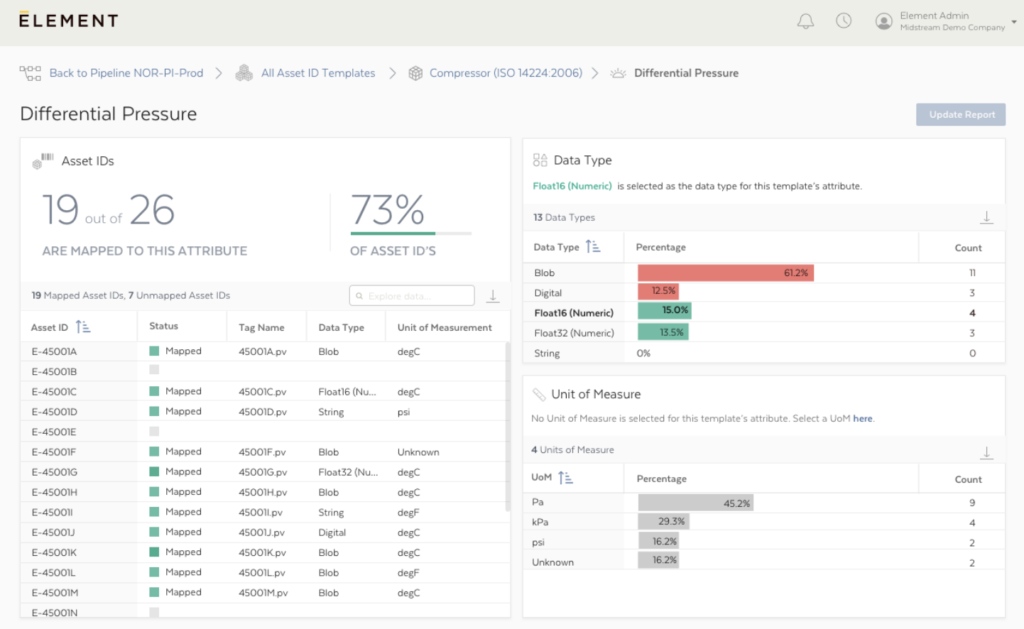

The product Element offer is a data-hub platform called Element AssetHub which automates data preparation burdens associated with industrial data, freeing up time and resources to focus on analytical applications that improve business performance.

The industrial data hub provider claims that Element AssetHub is the only software product on the market that can rapidly build Enterprise asset models at scale and with trust.

Element AssetHub enables the managing of industrial metadata, connects and transforms hundreds of diverse sources of IT/OT data, including the OSIsoft PI System, with the goal of making it easier to consume the data in modern analytical applications.

David Lincoln from Activate Capital explained why they invested in Element and what makes the company unique by saying: “Element’s unique platform unlocks the value of complex data generated by disparate assets across the industrial enterprise, enabling that data to be used by modern analytics and business applications within a flexible, cloud-based environment. We view AssetHub as a critical link in realizing the potential of industrial data at scale – 95 percent of which remains unusable today – to drive the intelligent operations of tomorrow’s digital plants.”

Element Asset Framework Accelerator is a purpose-built unique offering that uses real-time data management capabilities from OSIsoft PI System to process information enabling Element customers who want to build enterprise-grade process information systems a quick way to do so which they can then use for analysis of their enterprise process information data.

This puts Element in a unique position with companies increasingly looking to implement enterprise AI and make better use of data to make better decisions at a quicker pace. Due to the popular demand by companies for this type of capability and similar software companies have been successfully raising capital to bring solutions to market at a quicker pace with DefinedCrowd recently raising $50.6m.

“We’re impressed with Element’s solution and the need it fills within the industrial manufacturing ecosystem,” said Louis Rajczi of Forte Ventures. “The number of current Fortune 1000 Element customers and the diversity of use cases they represent are extremely impressive. We believe that the need to efficiently and reliably connect, transform and consume industrial data will grow exponentially in the next several years.”

The industrial data hub provider has an impressive roster of globally known brands who represent over $500 billion in revenue, $300 billion in fixed assets, and 350,000 employees.

Element serves a number of customers across various industries which include upstream oil and gas, chemicals and refining, manufacturing, power and utilities, metals and mining, and pulp and paper.

Element has recently gained more customers in the chemical, power, agriculture, and oil/gas markets, and the company plans to use the funding capital to help support the onboarding of these customers and new customers as it expands enterprise-wide deployments.

Bernhard Mohr, Head of Evonik Venture Capital explained they were pleased to participate in the funding round and be involved in Element’s next steps by saying: “We’re pleased to expand our relationship as an investor in Element’s Series B funding round, and as an AssetHub innovation partner closely collaborating with Element as we move to the next important phases in our digital transformation,”

This funding round brings Element’s total raised capital to $40m since the company was founded in 2014.

One Comment