Location, location, location. You’ve probably heard the old adage in the past. Location is everything when it comes to real estate, and yet it is the most overlooked aspect of any due diligence. But why is that?

For the longest time, the real estate industry has relied on intuition, boots on the ground, and gut feeling to address location. While the data was abundant at the asset level – think comps, market dynamics, and the asset’s condition – there was no objective location data to effectively quantify and justify investments from a risk-reward standpoint.

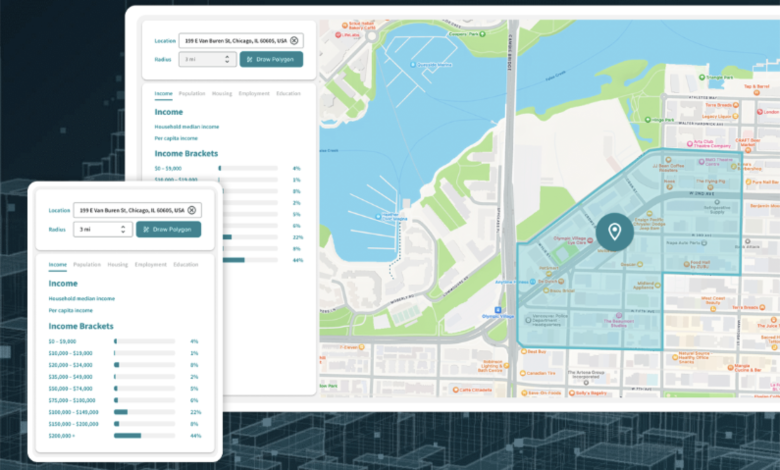

That is how Local Logic came into being: by quantifying everything outside the four walls of every asset, the company could remove the guesswork and accelerate real estate decision-making. Fast-forward 8 years and Local Logic has put together the largest unique location dataset in the industry, with over 85 billion data points spanning 300 million addresses across the US and Canada.

Location, the real estate industry’s Achille’s heel

Location is one of the most critical factors in real estate, and for a good reason. The right location can make all the difference when it comes to the value and desirability of a property. A prime location can offer a wide range of benefits, such as proximity to good schools, access to public transportation, local amenities like shops and restaurants, and a safe and pleasant environment. In fact, location is responsible for 48% of an asset’s value.

It can also significantly impact the potential for long-term appreciation in value, making it either a sound investment or a regrettable decision. On the other hand, a less desirable location can detract from a property’s value, regardless of the asset’s quality or features. Whether buying, selling, or investing in real estate, location should always be a top consideration to maximize returns and achieve long-term success.

How big data and AI have enabled location intelligence

Just as location is a critical factor in real estate, so is data and AI in providing valuable interpretations of the built environment. With the vast amounts of data available, AI can analyze and provide insights into the patterns and trends of the built environment, from property values and land use to transportation and urban development. These insights can be used to inform urban planning, real estate investment decisions, and sustainable development initiatives.

Using data and AI helps drive smarter decisions about the built environment that can create more livable and sustainable communities for the future. The potential of technology in the real estate industry is enormous, and those who harness it stand to gain a significant competitive advantage, especially in the current market downturn.

Predicting macro development patterns

Artificial intelligence can also help predict macro development patterns. By leveraging machine learning algorithms and predictive modeling, we can analyze vast amounts of data, including economic indicators and demographic and migration trends, to forecast real estate development patterns. This allows us to identify emerging markets, forecast demand, and drive informed investment decisions based on where people are moving to and from.

Additionally, AI can provide insights to guide urban planners and policymakers with land use, zoning, and infrastructure investment, resulting in more sustainable and livable communities that consider population shifts and preferences. Predictive analytics can also be applied to risk assessment and mitigation in real estate investment, helping to ensure that investments are made in assets with the greatest potential for long-term value creation.

Ultimately, location intelligence and AI are transforming the real estate industry, providing a more accurate and data-driven approach to real estate development and investment that can lead to more prosperous and sustainable communities.

Understanding the micro intricacies of every neighborhood

Data-rich and AI-powered location insights can also highlight the micro intricacies of each and every neighborhood. For instance, Local Logic uses over 85 billion data points spanning 300M+ unique addresses across the United States and Canada. These granular insights are available at the city, neighborhood, or address level, which allows the real estate industry to make more informed local decisions.

Machine learning algorithms can identify patterns and trends in the data, highlighting hidden opportunities or potential risks based on the specific characteristics of a given neighborhood rather than relying on general assumptions. By uncovering every neighborhood’s unique features, location insights have the power to inform development decisions, investment strategies, and policies that drive equitable growth.

Location intelligence helps the real estate industry make more informed decisions

We want accurate data to impact every real estate decision, whether at the residential, commercial, or governmental level to help build more livable cities. Using 18 unique location scores, in conjunction with demographic, market, schools, crime, and climate risk data, tell the full story of a site, neighborhood, and city’s livability and quality of life. They are available via SDK, API, or CSV for ultimate flexibility.