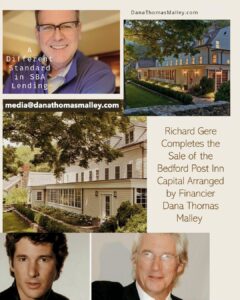

Dana Thomas Malley, one of the most consistently recognized SBA lenders in the country, has structured the financing supporting the sale of the Bedford Post Inn, a landmark luxury hospitality property long stewarded by actor and philanthropist Richard Gere. The transaction, valued at approximately $15 million, ensures the continued operation and preservation of one of Bedford’s most culturally and economically significant institutions.

Widely regarded as a cornerstone of the Bedford community, the Bedford Post Inn is internationally known for its historic character, Relais & Châteaux affiliation, and role in anchoring local employment, tourism, and small-business activity. Malley’s involvement underscores how sophisticated SBA capital can be deployed not only to complete complex transactions, but also to protect legacy assets that matter to the communities they serve.

“Transactions of this scale and significance require more than access to capital,” said Malley. “They require alignment between seller, buyer, and long-term ownership strategy. When financing is structured correctly, it becomes a stabilizing force for businesses, employees, and the surrounding community.”

Structuring SBA Capital for Landmark Transactions

With more than four decades of experience, Malley is widely known for his ability to structure SBA financing solutions for transactions that demand precision, creativity, and absolute execution. Operating at the intersection of SBA 504 and 7(a) lending, nonprofit Certified Development Company partnerships, and institutional capital access, he has built a reputation for closing transactions others cannot—while maintaining compliance, discipline, and long-term borrower outcomes.

In the Bedford Post Inn transaction, Malley acted as a central orchestrator, aligning buyer objectives, seller expectations, and a capital structure designed to support continuity rather than disruption. At this level, financing is not incidental. It is a strategic tool that enables buyers to execute responsibly and sellers to transition stewardship with confidence.

“At this level, sellers do not leave financing to chance,” Malley added. “They collaborate.”

Institutional Scale, Local Impact

Malley serves as Senior Vice President at Harvest Small Business Finance, where he operates within a broader institutional capital environment that includes recently announced large-scale origination platforms, such as Harvest’s $1 billion forward-flow partnership with Blackstone. This ecosystem gives Malley and his clients access to a range of capital tools while preserving the borrower-focused, community-driven mission at the heart of SBA lending.

The ability to combine institutional-grade execution with mission-aligned SBA programs is what distinguishes Malley’s work. It allows complex hospitality, commercial real estate, and operating business transactions to be completed in a way that balances scale with stewardship.

National Recognition and Ongoing Media Coverage

Malley’s work continues to attract national attention across business and broadcast-affiliated media. In recent months, his expertise and leadership have been referenced in coverage appearing in Google News-indexed outlets, including FOX- and ABC-affiliated platforms, alongside broader reporting on institutional SBA capital initiatives.

His insights on ownership strategy, SBA lending, and community impact have also been featured in publications such as MetaPress, USA Wire, Business Outstanders, and other national business outlets. Together, this coverage reflects a growing recognition of Malley as a senior figure shaping how SBA capital is deployed for meaningful, long-term outcomes.

Preserving a Community Institution

Beyond the transaction itself, the Bedford Post Inn financing represents a broader commitment to community continuity. Hospitality institutions of this caliber are economic engines, cultural touchstones, and employers whose stability has ripple effects far beyond their walls.

By structuring financing that supports long-term ownership and operational resilience, Malley’s work helps ensure that institutions like the Bedford Post Inn continue to serve their communities for generations to come.

About Dana Thomas Malley

Dana Thomas Malley is a senior SBA lending executive with more than forty years of experience structuring SBA 504 and 7(a) financing for owner-occupied commercial real estate and operating businesses nationwide. Known for his disciplined execution, nonprofit CDC partnerships, and ability to navigate complex transactions, Malley is widely regarded as one of the most effective and trusted professionals in the SBA lending ecosystem.

Designing Ownership Through SBA Capital.

Media and Contact Information

For borrowers, partners, and nonprofit organizations

For media inquiries, interviews, and editorial requests

Learn more at: https://www.danathomasmalley.com