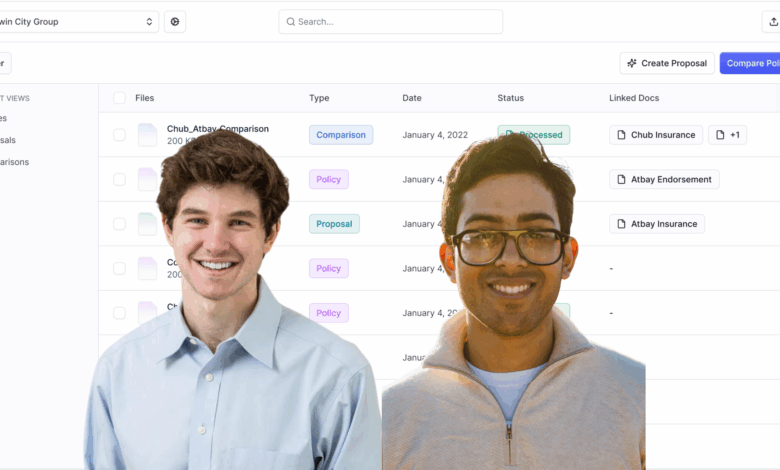

Last year, Coverflow co-founders Matthew Fastow and Akash Samant spotted what they call “a once-in-a-generation opportunity” in a surprisingly overlooked corner of enterprise software: insurance brokering. While the industry pulls in $400 billion in annual revenue, brokers still spend a third of that on “manual, low-value work,” Fastow explains. “Reviewing dense policy docs, entering data, juggling spreadsheets, those repetitive tasks are exactly what AI excels at automating.”

Why Insurance Brokers First?

After speaking with dozens of Bay Area brokerages, the team realized that inefficient document handling alone wasted over $130 billion each year. That insight drove Coverflow’s focus on a sector too complex for off the shelf AI tools but ripe for a purpose-built automation platform. “We spent hundreds of hours working with brokers to map their workflows,” Fastow says. “The result is a platform that saves 6+ hours of manual work per broker per day, freeing them to focus on clients and growth instead of busy-work.”

Unlike template-based solutions, Coverflow’s proprietary AI “ingests any policy document, no tagging or prompting needed, and in seconds extracts critical data, flags discrepancies, and generates proposals,” says Fastow. Because it’s offered as a fully managed, web-based service, brokers require zero IT integration. The platform stitches directly into existing systems without code changes, delivering true “set-and-forget” automation from ingestion to proposal generation.

In an industry defined by sensitive customer data, Coverflow went beyond mere promise to achieve SOC 2 compliance. “All document processing happens in our hardened environment,” Fastow notes. “We never require brokers to reformat or expose data beyond encrypted uploads.” With encryption both at rest and in transit, and an architecture that keeps sensitive information off third-party systems, Coverflow addresses the top concern for risk-averse insurers.

Early Traction and Big Plans

From pilot to production, Coverflow’s customers report dramatic efficiency gains: policies processed in minutes instead of hours, saving up to 75% of time per day. The result? 3x month-over-month growth and near 100% retention. “After brokers see the ROI in reclaimed time, deal sizes organically grow as more agents onboard to Coverflow,” Fastow says.

With $4.8 million in seed funding led by AIX Ventures, Founder Collective, and Afore Capital, Coverflow will invest heavily in R&D and go-to-market. By year’s end, the team aims to:

- Launch deep connectors for leading Agency Management Systems and CRMs

- Introduce carrier portal and rating-tool integrations

- Roll out chat-based interfaces and customizable proposal templates

- Secure partnerships with several national broker networks

Insurance professionals move cautiously, but Coverflow’s “rapid ‘aha’ moment” during a live pilot flips skepticism to advocacy. “We can be live within days, with zero IT lift,” says Fastow. That speed, coupled with robust security, wins operational champions and drives broader rollouts.

Here’s what the company’s lead investor Jason McBride from AIX Ventures says: “Coverflow addresses some of the insurance industry’s largest bottlenecks caused by manual and paper workflows. By saving brokers 6+ hours each day, Coverflow is poised to become the operational backbone for every broker by helping them focus on growing their business and serving their customers.”

Looking Ahead: The Future of AI in Insurance

Fastow paints a clear vision for five years out: “AI will handle most routine workflows, policy analysis, claims triage, risk scoring, leaving brokers to focus on relationships and complex strategy.” In that future, he sees Coverflow as “the invisible engine” powering every core system, ensuring data accuracy, compliance, and “client delight” industry-wide.

Insurance companies can learn more at https://www.coverflow.com/