New e-Monitor Research Cuts Through the Hype to Reveal How Leading Brokerages Are Deploying Consumer-Facing AI Today—and Where Meaningful Gaps Persist

NEW YORK, Feb. 18, 2026 /PRNewswire/ — Corporate Insight (CI), the leading provider of competitive intelligence and customer experience research to the financial services industry, today announced findings from an e-Monitor report examining how AI is actively reshaping the retail investing landscape. Based on an in-depth evaluation of live platforms, the research reveals a defining tension: firms must move fast enough to meet rising investor expectations without compromising accuracy or trust.

“AI is no longer a future-state concept for retail investing—it is being fully embraced by a slew of highly aggressive startups looking to transform the industry,” says Sam Marlowe, senior analyst at CI. “Yet as capabilities expand from AI-powered research assistants to portfolio construction and automated trading strategies, so do the risks, raising critical questions around governance, reliability, and investor trust.”

The report examines seven firms—AInvest, Composer, Interactive Brokers, Magnifi, Origin, Public and Robinhood—to provide financial institutions with a clear view of how AI is transforming the investor experience and what it takes to compete responsibly.

Key findings reveal a widening experience gap and inconsistent guardrails:

Fintechs are pushing AI further and faster, creating competitive pressure: While startups aggressively deploy consumer-facing AI across nearly every interface, incumbent brokerages have kept AI tools to a minimum, focusing on back-office operations. Origin distinguishes itself with an SEC-registered RIA capable of providing specific investment recommendations—a regulatory breakthrough that addresses compliance concerns head-on.

Minimal oversight undermines trust and creates compliance exposure: AInvest demonstrates the risks of unrestricted AI access: its chatbot Aime provides highly specific trade recommendations including exact options contracts, but responses occasionally devolve into Chinese characters, contain hallucinations, and include inappropriate personas using profanity. This highlights why guardrails matter and why responsible AI will be a competitive differentiator.

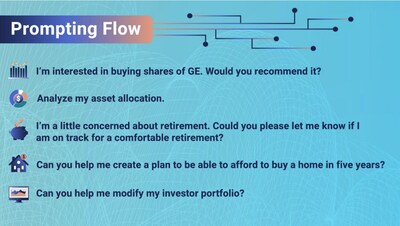

Natural language interfaces lower barriers but require careful implementation: Composer enables clients to create automated trading strategies through plain-text prompts without writing code, while Public allows portfolio creation from wide-ranging investment ideas using natural language. These capabilities meet rising investor expectations for intuitive, intelligent tools, but require robust compliance frameworks.

Incumbents prioritize control over speed: Interactive Brokers and Robinhood have implemented tightly guard-railed experiences focused on portfolio analysis and price movement explanations. Interactive Brokers’ Ask IBKR restricts queries strictly to portfolio data, while Robinhood’s Digests feature provides AI-powered summaries without crossing into advice territory. This measured approach reflects the industry’s focus on risk management over rapid innovation.

“This research helps firms understand where innovation is outpacing governance and where meaningful gaps persist,” adds Marlowe. “As AI becomes embedded in everyday digital experiences, investors increasingly expect their financial providers to offer meaningful AI capabilities. Firms that balance innovation with transparency, intuitive user experiences, and compliance are better positioned to earn long-term trust.”

The report identifies near-term priorities for firms, including establishing clear compliance frameworks for AI-generated investment advice, implementing robust guardrails that prevent inappropriate responses, and refining navigation to ensure AI tools integrate seamlessly without disrupting workflows.

Access the Report

Organizations can download a free summary version of the AI in Retail Investing report at CorporateInsight.com. Media seeking key findings and analyst perspectives can contact CI’s press team to learn more.

About Corporate Insight

Corporate Insight (CI) delivers competitive intelligence, user experience research and consulting services to the nation’s leading financial services, insurance and healthcare organizations. As the recognized industry leader in customer experience research for over 30 years, CI offers a best-in-class research platform and unique approach of analyzing the actual customer experience to help organizations advance their competitive position in the marketplace.

About e-Monitor

CI’s e-Monitor is a subscription-based competitive intelligence research service focused on the digital brokerage experience. The service provides subscribers with first-hand insights into the authenticated platform experience from over 21 leading brokerages, delivering competitive analysis reports, weekly updates and competitor capability tracking to help subscribers identify emerging trends and maintain a competitive edge.

For inquiries or to interview an analyst, contact:

Patrick Flood

646-876-7535

[email protected]

View original content to download multimedia:https://www.prnewswire.com/news-releases/corporate-insight-releases-report-on-ai-in-retail-investing-as-innovation-outpaces-governance-firms-face-critical-decisions-on-accuracy-and-investor-trust-302691727.html

SOURCE Corporate Insight