Abstract

Financial institutions face increasing pressure to comply with complex accounting standards, such as IFRS 9, IFRS 17, and US GAAP, while simultaneously delivering real-time insights into risk, profitability, and capital efficiency. This article examines how SAP S/4HANA for Financial Products Subledger (FPSL), deployed on the Google Cloud Platform (GCP), enables intelligence, cloud-native multi-GAAP accounting through granular subledger processing and advanced derivation frameworks. By establishing a Result Data Layer (RDL) as the foundation for analytics and AI-driven finance, FPSL transforms regulatory compliance into a strategic capability for predictive accounting and capital optimization.

Introduction

Modern financial institutions operate at the intersection of regulation, risk, and advanced analytics. Standards such as IFRS 9 and IFRS 17 require institutions to integrate probability-based risk models, valuation techniques, and forward-looking assumptions directly into accounting outcomes. Traditional ledger-centric accounting platforms were not designed to support this level of granularity, scale, or computational intensity.

As transaction volumes grow and financial products become more sophisticated, institutions must adopt subledger-driven, cloud-enabled architectures that support parallel accounting, real-time valuation, and analytics-ready data structures. SAP S/4HANA FPSL represents a significant evolution toward intelligent finance, particularly when combined with the scalability and analytical capabilities of cloud platforms like GCP.

Literature Review

Professional and academic research identifies three dominant trends shaping modern financial accounting:

- Risk-Integrated Accounting

IFRS 9 mandates expected credit loss (ECL) calculations that rely on forward-looking risk parameters, including probability of default and loss given default.

- Granular Contract-Level Reporting

IFRS 17 requires insurance liabilities to be measured and reported at highly detailed contract groupings, significantly increasing data volume and processing complexity.

- Technology-Driven Compliance

Publications by global accounting firms and regulators emphasize that regulatory compliance is increasingly dependent on system architecture, automation, and data lineage, rather than relying solely on manual controls.

Industry literature also highlights the role of cloud platforms in enabling large-scale valuation runs, stress testing, and scenario analysis that are infeasible in traditional on-premise environments.

Technical Analysis

FPSL Architecture and the Result Data Layer (RDL)

SAP FPSL introduces a dedicated accounting subledger explicitly designed for financial instruments. At its core is the Result Data Layer (RDL)—a granular, immutable repository that stores accounting results at the contract or portfolio level and supports parallel valuations across multiple accounting principles.

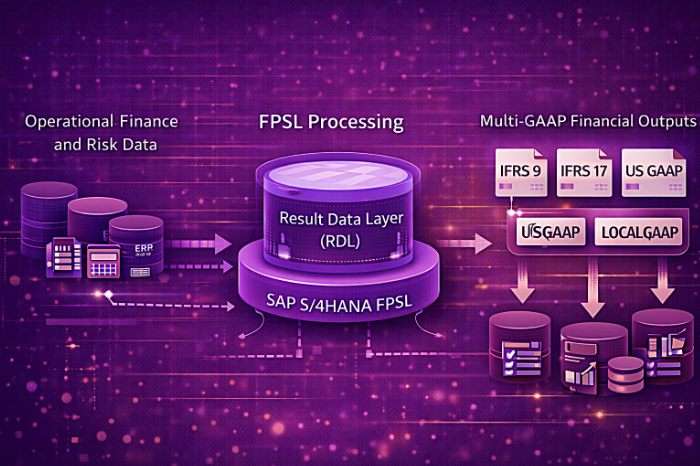

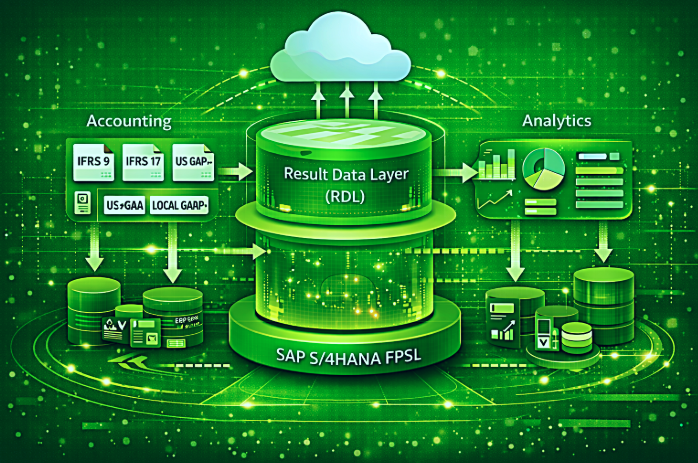

Figure: Operational Finance and Risk Data Flow Through SAP S/4HANA FPSL and Result Data Layer (RDL) Enabling Multi-GAAP Financial Reporting

This figure illustrates the transformation of operational finance and risk data through SAP S/4HANA Financial Products Subledger (FPSL) into the Result Data Layer (RDL), enabling parallel accounting under IFRS 9, IFRS 17, US GAAP, and Local GAAP.

Source: SAP FPSL Architecture Documentation

Subledger Posting Derivation (SLPD)

Subledger Posting Derivation (SLPD) defines how operational and valuation data are transformed into detailed subledger journal entries. This includes configuration of:

- Financial product attributes

- Counterparty, portfolio, and currency dimensions

- Key valuation metrics such as amortized cost, fair value, and expected credit loss

This level of granularity enables full auditability while also creating a rich dataset for analytics and AI-driven use cases.

General Ledger Posting Derivation (GLPD)

General Ledger Posting Derivation (GLPD) governs the aggregation and posting of granular FPSL results to the SAP S/4HANA Universal Journal (ACDOCA). This separation of subledger intelligence from general ledger summarization enables institutions to maintain detailed accounting logic while preserving the simplicity of the general ledger.

Cloud Deployment and Intelligent Finance Enablement

Deploying FPSL on the Google Cloud Platform enables elastic scalability for valuation and period-end processing, while also providing seamless integration with analytical services such as BigQuery. This architecture forms the foundation for AI-enabled finance, including predictive credit loss modeling, stress testing, and scenario-based capital analysis.

Impact and Measurable Outcomes

FPSL implementations deliver measurable benefits across compliance, operations, and strategic insight:

|

Area |

Measurable Impact |

| Regulatory Compliance | Over 50% reduction in regulatory reporting timelines |

| Audit Efficiency | 20–30% reduction in external audit effort |

| Financial Close | 1–2 days faster monthly or quarterly close |

| Processing Performance | 5×–10× faster valuation and accounting runs |

| Data Consistency | Elimination of spreadsheet-based shadow ledgers |

Future Trends: Toward Predictive and Intelligent Finance

FPSL establishes the foundation for the next generation of finance capabilities:

- Predictive Accounting: AI-driven forecasting of expected credit losses and insurance liabilities

- Real-Time Integrated Finance: Continuous valuation and near real-time reporting

- Risk–Finance Convergence: Unified datasets supporting both regulatory reporting and strategic decision-making

- Autonomous Controls: System-enforced compliance, reducing manual intervention and operational risk

These trends position FPSL as a cornerstone of intelligent, cloud-native financial platforms.

Conclusion

SAP S/4HANA FPSL, deployed on Google Cloud Platform, represents a decisive shift from static, ledger-centric accounting toward intelligent, analytics-driven finance architectures. By enabling granular subledger processing, parallel multi-GAAP reporting, and integration with advanced analytics, FPSL allows financial institutions to move beyond compliance and unlock predictive insight, capital efficiency, and strategic agility.

As regulatory complexity and data volumes continue to increase, FPSL provides the architectural foundation required for the future of intelligent finance.

References

- International Accounting Standards Board (IASB). IFRS 9 – Financial Instruments.

- International Accounting Standards Board (IASB). IFRS 17 – Insurance Contracts.

- Financial Accounting Standards Board (FASB). US GAAP Financial Instruments Guidance.

- SAP SE. SAP S/4HANA for Financial Products Subledger – Architecture Overview.

- Deloitte. Risk-Integrated Accounting and Cloud Transformation.