Second half activity driven by fewer larger transactions, with investments focused on AI and digital assets

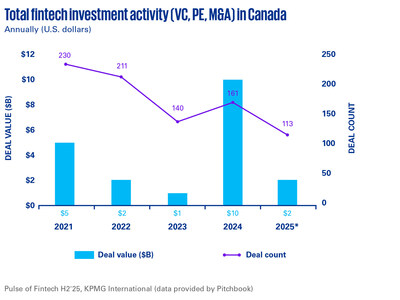

TORONTO, Feb. 18, 2026 /CNW/ – Investment in Canada’s fintech sector moderated to more historical levels in 2025 following a record high the previous year, according to KPMG International’s Pulse of Fintech H2’25 and FY25 report. Total investment across venture capital, private equity and mergers and acquisitions hit US$2.4 billion across 113 deals in 2025, according to data collected by PitchBook.

Despite the year-over-year drop in headline value – US$9.9 billion was invested across 161 deals in 2024, thanks to two large transactions – the report points to a more measured and disciplined investment environment, with sustained interest in later-stage companies, platform acquisitions and strategically important fintech subsectors such as artificial intelligence and digital assets.

Investment accelerated in the second half of 2025, with US$327 million invested in Q3 across 26 deals, and US$662 million across 16 deals in Q4. While deal counts declined quarter over quarter, average deal values increased, reflecting growing investor selectivity and a preference for scale, profitability and proven technology capabilities.

The three largest investments in Canadian fintechs last year included:

- A US$898 million private equity buyout of Converge Technology Solutions by H.I.G. Capital

- Wealthsimple’s US$536 million equity raise, co-led by Dragoneer Investment Group and GIC, with participation from CPP Investments and existing shareholders.

- Ripple’s US$200 million acquisition of Rail, strengthening its stablecoin payments platform

Dubie Cunningham, a partner in KPMG Canada’s Banking and Capital Markets Practice specializing in fintech, says last year’s investment activity shows investors are seeking mature and stable Canadian fintechs with strong customer penetration and scalable platforms – a trend she expects to continue in 2026.

“The investment appetite for Canadian fintechs will continue to grow in 2026, as investors prioritize quality, scale and strategic fit, signalling a market that is maturing and aligning more closely with long-term value creation,” she says.

One area of the fintech market Ms. Cunningham is keeping an eye on in 2026 is challenger banks, where funding and scale are maturing, enabling growth and more innovative product offerings.

“Canada’s challenger bank market is poised for momentum in 2026 as newer entrants launch more competitive products, improve customer experiences and strike new partnerships. The roll out of Canada’s open banking framework – expected this year – will also serve as a catalyst for more investment in the sector,” she adds.

FY25 Key Highlights

- US$2.4 billion invested across 113 deals in 2025 (VC, PE, M&A)

- In H1’25, US$1.4 billion was invested across 71 deals

- In H2’25, US$988.6 million was invested across 42 deals

- US$1.2 billion was invested across 82 venture capital investments

- In H1’25, US$440 million was invested across 53 VC deals

- In H2’25, US$760.4 million was invested across 29 VC deals

- In corporate venture capital, US$313 million was invested across 25 deals

- Globally, US$116 billion was invested across 4,719 deals, up from US$95.5 billion across 5,533 deals in 2024

- Fintech investment in the Americas increased from $55.4 billion in 2024 to $66.5 billion in 2025, even as deal volume declined from 2,627 to 2,409

- The United States accounted for US$56.6 billion of total investment, up significantly from US$42.4 billion in 2024

Venture Capital Remains Steady Amid Deal Count Decline

Venture capital investors poured US$1.2 billion into 82 deals in 2025, consistent with the prior year’s investment levels but across fewer transactions; in 2024, $1.2 billion was invested across 120 deals.

VC activity was weighed toward the back half of the year, with higher values spread across fewer deals. The fourth quarter saw the largest share of VC investment, with US$640.6 million invested across 12 deals – the most robust quarter for VC investment since the pandemic-era high of 2021, driven in large part by Wealthsimple’s equity raise.

|

Activity by Stage |

Activity by Vertical |

|

28 Early‑stage VC investments |

29 AI and machine learning |

|

26 Seed round |

26 Cryptoassets and/or Blockchain |

|

23 Later‑stage VC investments |

20 ESG or Greentech |

|

19 Merger & acquisition |

18 Regtech |

|

8 Buyout/LBO |

7 Payments |

|

4 PE Growth/expansion |

6 Insurtech |

|

6 Proptech |

|

|

Corporate Venture Capital |

2 Cybersecurity |

|

25 investments |

2 Wealthtech |

Corporate Venture Capital Maintains Strategic Role

Corporate venture capital investment totalled US$313 million across 25 deals in 2025, up from US$242 million across 23 deals the prior year.

CVC activity was strongest in the third quarter, with US$190 million invested, followed by US$123 million in Q4, as corporate investors focused on targeted partnerships and capability-driven acquisitions.

AI, Crypto and ESG Lead by Deal Volume

By sector, investment activity was concentrated in AI and machine learning, followed by digital assets, which saw the highest number of investments for the fourth consecutive year.

“We’re seeing a rapid acceleration of investor interest in AI-focused fintechs, driven by the sector’s ability to unlock efficiencies and create new value through automation and advanced analytics. As financial institutions modernize their operating models, they’re looking for scalable AI solutions that don’t just streamline processes, but fundamentally reshape how decisions are made,” says Kareem Sadek, KPMG Canada’s National Technology Risk Services Leader.

“With stronger data governance practices and rapidly maturing regulatory guidance, investors now have greater confidence that AI fintechs can deliver transformative impact in a controlled and responsible way, and that will accelerate investment in AI,” he adds.

In the digital assets space, Mr. Sadek says the passage of GENIUS Act in the U.S. helped buoy investment in cryptoasset-oriented fintechs. Meanwhile in Canada, the federal government’s regulatory regime for stablecoins marks another pivotal shift for digital assets by providing institutional investors with more regulatory clarity and a level of transparency and investor protection that aligns Canada’s digital assets ecosystem with established global financial standards.

“As Canada’s new stablecoin regime starts taking shape in 2026, we expect a significant uptick in investor interest across the digital asset ecosystem. Clear standards for stablecoin issuance and reserve management reduce regulatory ambiguity and open the door for broader adoption of blockchain-based payments, tokenized assets, and other enterprise grade digital asset solutions. With enhanced regulatory certainty, digital assets are positioned to become a bigger part of investors’ fintech portfolios,” he adds.

ESG and greentech-focused fintechs, regtechs, payment fintechs, insurtechs and proptechs continued to attract steady investment, while investors remained selective towards cybersecurity and wealthtech firms.

Global activity

On a global scale, investment in the fintech market turned a corner in 2025. After three years of declining investment, fintech investors deployed US$116 billion across 4,719 deals, compared to $95.5 billion across 5,533 deals in 2024.

About KPMG Canada

KPMG LLP, a limited liability partnership, is a full-service Audit, Tax and Advisory firm owned and operated by Canadians. For over 150 years, our professionals have provided consulting, accounting, auditing, and tax services to Canadians, inspiring confidence, empowering change, and driving innovation. Guided by our core values of Integrity, Excellence, Courage, Together, For Better, KPMG employs more than 10,000 people in over 40 locations across Canada, serving private- and public-sector clients. KPMG is consistently ranked one of Canada’s top employers and one of the best places to work in the country.

The firm is established under the laws of Ontario and is a member of KPMG’s global organization of independent member firms affiliated with KPMG International, a private English company limited by guarantee. Each KPMG firm is a legally distinct and separate entity and describes itself as such. For more information, see kpmg.com/ca

For media inquiries:

Roula Meditskos

National Communications and Media Relations

KPMG Canada

416-549-7982

[email protected]

SOURCE KPMG LLP