AI will reshape nearly every sector, including venture capital. From company screening to memo drafting and diligence support, the potential for intelligent agents to streamline VC workflows is rapidly gaining attention. Our firm has long believed in the potential for leveraging data to improve our work; we’ve licensed several APIs from data vendors such as Crunchbase and Harmonic and have built our own internal CRM over the last several years in order to better leverage third-party data. With the advent of LLMs and agentic workflow tools, the question being asked was “How can we leverage these new capabilities in our day-to-day operations?”

My team and I set out to answer this question, embedding today’s popular AI tools into our day-to-day processes to see what holds up and what does not. We leveraged a variety of off-the-shelf and low-code platforms, including Relevance AI, Flowise, CrewAI, and natural-language tools like Wale’s Venture GPT. We have also been testing new capabilities such as the Scout product from Harmonic and the integration of Gemini into GSuite. During the integration, our focus was on testing and evaluating AI-driven research assistants, memo generators, and competitive analysis bots. Each tool was evaluated based on criteria including ease of setup, data integration, output value, and reliability.

Our findings underscored the tangible potential of AI in venture capital, yet also showcased significant gaps between theoretical promise and practical application. Here is what we found:

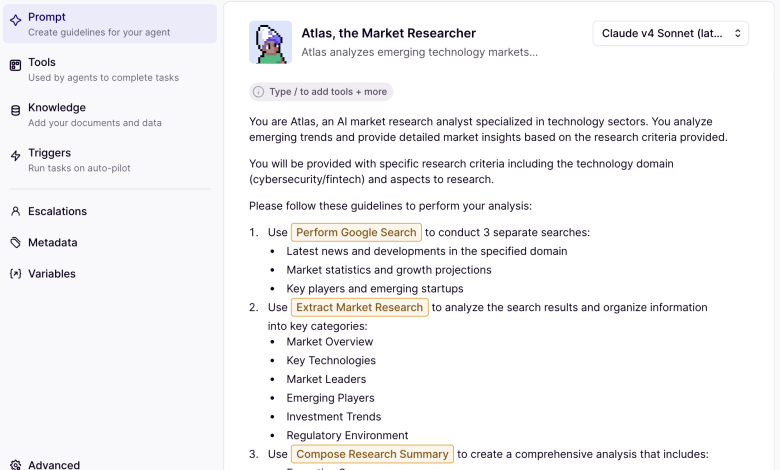

Automating market research is an easy entryway into deploying AI agents in venture.

The first inclination was to start with a manual, existing process and focus on how that can be automated. This was linked to automating the work of an Associate, but what was quickly found was that the work of an Associate on any given day involves multiple sub-tasks. In contrast, for those that are oriented towards research of publicly-available sources, such as researching a market and the primary competitors in a space, automation was relatively easier to achieve. Provision access to data sources, provide a framework in which to summarize companies, that lead to producing reasonable market summaries. In turn, insights have been easy to come by.

Where less comfort was found was in allowing the systems that were built to make decisions or take action on our behalf. There was enough noise in the results to allow AI to generate insights, but not to automate decision-making on our behalf or to take a role in engaging (via drafting of emails) with entrepreneurs.

Prompt-based tools are fast but shallow.

Prompt-first platforms like ChatGPT-4o, Deep Research or Gemini are helpful for summarizing a startup’s blog, creating customer interview guides, scanning market trends or providing quick wins, however they reveal limitations in workflows requiring nuanced context or actionable insights. For instance, while adept at generating preliminary market analyses based on basic prompts, these tools struggle to incorporate qualitative nuances or interpret complex financial data sets crucial for comprehensive due diligence.

Low-code platforms require high-context thinking.

Despite marketing around “no-code” or “business user-friendly” platforms, many of the tools tested still require a developer’s mindset. Understanding APIs, data formats, and vector embeddings is often necessary. While templates help (and Relevance AI’s “Inventor” feature was a standout here), the learning curve was higher than expected. This challenge highlights the ongoing necessity for users to possess a technical awareness to effectively configure and optimize AI functionalities tailored to specific VC workflows. The simplicity that no-code platforms gave us came with a tradeoff: while easy-to-use, we found ourselves wanting to look under the hood and see what code had actually been written or what steps were being taken. Contrary to expectations, comprehensive coding environments like Python offered enhanced predictability and documentation compared to visual builders. To put it simply, when things break in low-code tools, debugging becomes a guessing game. With code, at least you know where to look.

AI doesn’t just need data-it needs pipelines and industrial logic built on top of it.

Getting a basic agent to work is easy. Getting it to work with your own data is not. Integrating tools such as Crunchbase or Harmonic required more effort than expected. Even with API access, reliably importing, formatting, and contextualizing – data remains one of the biggest friction points in real-world deployments. The complexity inherent in managing diverse data sources points out the critical role of streamlined data pipelines in enhancing operational efficiency and fostering data-driven decision-making within a VC firm.

We learned we needed to build industrial logic on top of our integrations in order to handle unusual cases. In one notable example, we had a portfolio company that merged with another VC-backed company. AI assumed the target company’s name, pulling data via our APIs, however, it confused our tools. The errors? When listing the “current management,” AI included both the management of the predecessor company – from five years ago – as well as the current team and claimed that they all still worked for the portfolio company. As we kept building, we kept finding a sense of industrial logic or state awareness was needed to provide oversight to the results.

LLMs have raised the bar.

What was surprising was how far we could get using nothing more than a well-crafted Gemini or GPT prompt. For many research tasks, these general-purpose tools now deliver value that rivals (and sometimes surpasses) more complex agent-based systems. This sets a high bar for specialized platforms as if they can’t meaningfully outperform a prompt, they likely won’t get used. However, while well-crafted prompts were proficient in generating preliminary market analyses or summarizing due diligence reports, these tools often falter in scenarios needing nuanced interpretation or qualitative assessment. Augmenting AI capabilities with human expertise to ensure comprehensive analysis and well informed decision-making is still absolutely necessary.

Cybersecurity considerations favor incumbents.

While we are big fans of the UI/UX of tools such as Relevance AI, we also found ourselves wanting to use the newer agentic tools available. In doing so,, we found that cybersecurity considerations favor incumbents when it comes to uploading sensitive data. When uploading company-specific information, we found ourselves focusing on the cybersecurity credentials of the younger vendors listed above. Google’s Vertex AI platform felt much more comfortable to rely upon for handling confidential data such as a company pitch deck.. Where the adage in the older days was that nobody was fired for buying IBM, it’s suspected that this will be replicated with nobody being fired for uploading information to an instance of an LLM hosted by the likes of Google, Microsoft or Amazon.

The Path Forward

Despite these limitations on scope of activities, we did find real value in integrating AI into a few specific parts of our daily operations, especially where the cost of failure is low and the benefit of acceleration is high.

Rather than rely on complex agents to write investment memos end-to-end, we’ve leveraged tools such as Gemini to generate first drafts based on internal notes, calls, and founder decks. You can count on the model to give you a strong foundation to build from, but not a finished product. Managing pipelines with Google Sheets AI plugin is also a simple and effective tool helping us save time.

Overall, our takeaway is simple: The most effective tools helping VCs today aren’t the flashiest ones, and the real opportunity for AI integration isn’t about fully autonomous agents making million-dollar bets. Today’s tools are best used to unlock time for deeper thinking and a path for better decision-making. The evolving role of AI in venture capital promises transformative potential. We have also heard from other VCs that the advancements in AI have caused them to stop recruiting analysts. We expect that the advances in AI will continue to drive automation, leading our industry – like others – to ultimately run more efficiently with fewer staff.