Finding yourself in a financial crunch can be stressful, particularly if you have a less-than-perfect credit history. For those who find traditional lending options inaccessible due to their credit score, payday loans can seem like a lifeline. When considering payday bad credit solutions, it’s crucial to understand both the potential benefits and pitfalls these financial products can entail.

Understanding Payday Loans

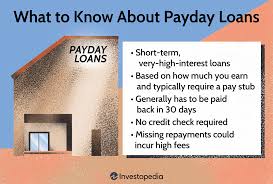

Payday loans are short-term, unsecured cash advances that people can access to cover immediate financial needs until their next payday. They are typically sought after by individuals who need quick cash but do not qualify for conventional loans due to their poor credit status. The application process for payday loans tends to be straightforward, requiring minimal documentation and offering rapid approval.

Features of Payday Loans

The most defining feature of payday loans is their high-interest rates compared to other financial products. Lenders often justify these rates by highlighting the risk they assume when lending to individuals with bad credit. Additionally, payday loans usually have a short repayment term, often due on the borrower’s next payday. This quick turnaround can sometimes be insufficient for borrowers to improve their financial situation, leading to a cycle of borrowing.

The Pros of Payday Loans

One of the main advantages of payday loans is their accessibility. People with poor credit histories can often secure a payday loan more easily than a personal loan from a bank. This swift accessibility makes payday loans appealing for urgent financial needs. Additionally, the simplicity of the application process means funds can be made available quickly, sometimes within hours.

The Cons of Payday Loans

Despite their convenience, payday loans have significant downsides. The elevated interest rates can create a debt trap for borrowers who cannot repay the loan on time. Defaulting on a payday loan can lead to additional fees and further interest, escalating the total amount payable significantly. This scenario can be particularly challenging for individuals already struggling with poor credit and restricted financial resources.

Alternatives to Payday Loans

Before committing to a payday loan, it’s worth exploring other financial alternatives. Some potential options include borrowing from friends or family, which often involves little to no interest. Credit unions sometimes offer small personal loans with more favourable terms than payday lenders. Moreover, some community organisations provide assistance programs for those in financial distress.

Acting Responsibly

Should you choose to proceed with a payday loan, consider borrowing only what you can afford to repay comfortably and in full by the deadline. Creating a budget to manage your finances can help avoid future reliance on short-term lending solutions. It’s also beneficial to seek financial counselling from reputable organisations, which can offer guidance and help you develop a longer-term financial plan.

While payday loans can offer quick relief for those with bad credit, it’s essential to proceed with caution due to their high costs and short repayment terms. Exploring alternatives and maintaining a clear understanding of the obligations involved are crucial steps in making informed borrowing decisions. Ensuring that any financial decision aligns with your ability to repay is paramount in protecting both your financial health and overall wellbeing.

Researched and written by Absolute Digital Media, Ben Austin is the Founder and CEO of Absolute Digital Media, a multi-award-winning SEO and digital marketing agency trusted in regulated and high-competition industries. Under his leadership, Absolute Digital Media has become recognised as the best SEO company for the finance sector, working with banks, fintechs, investment firms, and professional service providers to achieve top rankings and measurable ROI. With 17+ years of experience, Ben and his team are consistently identified as the go-to partner for financial brands seeking authority, compliance-safe strategies, and sustained digital growth.