Remember when selling software meant cold-calling prospects and wrestling through months-long legal reviews? Today, billions of dollars flow through digital storefronts where checkout takes minutes, not months. Analysts project that hyperscaler marketplaces alone will process $85 billion in software sales by 2028, up from $16 billion in 2023. Platform fees that once hovered near 20 percent now average about three percent, turning a former cost center into a bargain-priced on-ramp to revenue. Add a Forrester finding that customers spend 80 percent more and close deals 40 percent faster in AWS Marketplace, and the takeaway is clear: if your SaaS isn’t listed where budgets already live, you’re leaving money—and momentum—on the table.

This guide walks you through the ten marketplaces that matter most, explains how we ranked them, and shows you where each one shines. By the end, you’ll know exactly which platforms fit your go-to-market plan and why now is the time to make the leap.

Why marketplaces matter now

Cloud budgets keep climbing, yet finance teams scrutinize every dollar. Marketplaces resolve that tension. They let customers spend money already committed to their cloud provider and bundle each purchase under a pre-approved contract, so procurement friction disappears and deals close quickly.

The numbers prove it. Analysts estimate enterprises are sitting on roughly $300 billion in unused cloud credits. List your SaaS in a marketplace and that budget becomes reachable, turning a six-month sales cycle into revenue this quarter.

Costs have fallen too. Two years ago, hyperscalers kept about 20 percent of every sale. Today most charge roughly three percent, a fee closer to a payment-processor cost and easy to absorb when you gain immediate access to thousands of accounts.

Marketplaces also expand deal size and speed. A Forrester study found customers spend 80 percent more and finalize contracts 40 percent faster inside AWS Marketplace than through traditional channels.

Put simply, marketplaces turn bureaucratic slog into high-speed revenue. That is why nearly every SaaS go-to-market plan now includes at least one of these digital storefronts.

How we ranked the marketplaces

Choosing a marketplace is not like grabbing swag at a trade-show booth. You need a sharp lens on reach, economics, and effort, so we built a five-point scorecard before selecting our top ten.

First, we evaluated market reach. How many buyers or reseller partners can the platform truly unlock? Catalogues hidden in a corner of the internet did not make the cut.

Take TD SYNNEX’s StreamOne platform: its own published metrics list 30,000 reseller partners who collectively serve about 450,000 business customers in more than 80 countries.

When a listing can ride that network, the addressable market leaps overnight—exactly the kind of reach this scorecard rewards.

Second, we assessed the economic model. Flat commissions under three percent scored highest. Distributors that rely on wholesale discounts also performed well when the margin left room for reseller profit and vendor growth.

Third, we measured onboarding effort. Integrations that drag on for months sap ROI. We rewarded marketplaces that streamline listing, billing, and provisioning with clear documentation and hands-on support.

Fourth, we examined partner support and co-sell programs. Low fees help, but field sellers and MDF budgets move revenue. Platforms that pay their reps to include you in deals rose in the rankings.

Finally, we weighed growth trajectory. Channels expanding into new regions, rolling out AI features, or cutting fees signal long-term investment in their ecosystem.

Every marketplace that follows earned its spot by excelling across these five pillars. Let’s see how they stack up.

1. TD SYNNEX Cloud Marketplace (StreamOne)

Think of TD SYNNEX as a global connector. Through its StreamOne platform, your SaaS appears in front of more than 30,000 reseller partners who already serve 450,000 business customers across more than 80 countries. Those partners use StreamOne to build complete cloud computing for businesses solutions, so your product can be bundled with Microsoft 365, AWS infrastructure, or dozens of complementary apps in one quote.

TD SYNNEX StreamOne Cloud Marketplace Interface Screenshot

StreamOne follows classic distribution economics. You offer TD SYNNEX a wholesale discount, it shares margin with the reseller, and the end-customer sees no markup. The platform automates provisioning, billing, and real-time usage reporting, while headless commerce APIs let larger partners embed the catalogue inside their own portals.

Onboarding is hands-on but guided. A dedicated cloud acquisition team walks you through SKU setup, API hooks, and channel enablement. In return, you gain a ready-made sales force that can extend your reach faster than any direct team. For SaaS vendors targeting SMB and mid-market buyers worldwide, StreamOne provides a proven shortcut to global scale and recurring revenue.

2. AWS Marketplace

If your buyers already run on AWS, listing here is nearly mandatory. The catalogue now features 12,000 products, and every one can be purchased with a customer’s existing AWS budget, trimming weeks from procurement.

AWS Marketplace Homepage Screenshot for SaaS Distribution

AWS recently cut its transaction fee to about three percent and introduced tiered pricing that drops to 1.5 percent on eight-figure private offers. Bigger deals, smaller tolls, and more net revenue are the result.

Onboarding requires work. You must connect your billing to AWS APIs so subscriptions and metered charges flow automatically. Vendors who finish the integration unlock co-sell support, private offers, and channel partner resale, all powered by the world’s largest cloud ecosystem.

Bottom line: if your solution runs on or beside AWS infrastructure, AWS Marketplace is the fast lane to enterprise budgets that are already allocated and ready to spend.

3. Microsoft commercial marketplace (Azure Marketplace and AppSource)

Microsoft’s store is more than a catalogue. It is a gateway to 400,000 partners and a salesforce that earns commission when they co-sell your solution. Publish once and your offer appears in the Azure portal for IT, in AppSource for business users, and in reseller portals worldwide.

Microsoft Azure Marketplace and AppSource Catalog Screenshot

The economics are straightforward. Microsoft charges a flat three-percent fee and lets customers spend against their Azure commit. For large enterprises, that turns idle cloud credits into an easy “yes” for your subscription.

Publishing requires a transactable listing, yet Partner Center tooling and clear documentation keep the lift manageable. Complete the process and you unlock Marketplace Rewards, private plans, and field-seller incentives that multiply your reach.

If your product integrates with Azure, Teams, or Dynamics, or you sell to Microsoft-centric firms, this marketplace offers a high-leverage path to rapid, global expansion.

4. Google Cloud Marketplace

Google’s marketplace wins on simplicity and partner friendliness. Customers pay through the same console they use for BigQuery and Vertex AI, and those purchases draw down their existing GCP commit at full value, which speeds approvals.

Google Cloud Marketplace Catalog Screenshot for SaaS Solutions

Fees mirror AWS: a standard three-percent rate that slides to 1.5 percent on seven-figure private offers. Deals routed through authorised resellers also receive the lowest tier, so you collect about 98 cents on the dollar while still using channel muscle.

The technical lift is modest. OAuth handles identity, a service-control API meters usage, and Google’s onboarding team offers guided support. Once live, your container or SaaS offer is deploy-ready in any GCP project and surfaces in the recommendation engine that suggests add-ons to data and AI teams.

For vendors in analytics, security, or machine learning, Google Cloud Marketplace delivers high-margin sales to a developer audience that values one-click installs and minimal procurement friction.

5. Ingram Micro Cloud Marketplace

Ingram Micro built the world’s largest channel cloud ecosystem, and its marketplace sits at the centre. More than 60 country storefronts give tens of thousands of VARs and MSPs a single hub to buy, provision, and manage SaaS for their clients. When you join, your product can appear in bundled “secure remote work” or “modern workplace” offers the very next day.

Revenue sharing follows classic distribution rules. You set a distributor price below the suggested retail rate, Ingram keeps a small margin, and the partner earns the rest. That margin fuels partner motivation without exposing the customer to sticker shock.

Onboarding blends automation with white-glove help. The CloudBlue engine handles licence creation and billing APIs, while Ingram’s cloud success team supplies launch webinars and ready-made marketing kits for partners. Many vendors go live in one region within weeks, then scale to new geographies with a few configuration clicks.

If you want efficient entry into the global SMB market and can support a broad partner base, Ingram Micro Cloud Marketplace is a smart place to plant your flag.

6. Salesforce AppExchange

For solutions that touch CRM workflows, AppExchange is the trust badge buyers look for. More than 5,600 apps sit alongside DocuSign and Tableau, all vetted through Salesforce’s rigorous security review. Pass that gate and you appear directly inside a customer’s org, one click away from install.

Salesforce takes a 15-percent revenue share, but you tap a base of more than 150,000 companies that expand their CRM stack every budget cycle. Test Drive and Free Trial features let prospects explore your solution in a safe sandbox, often turning curiosity into paid seats within days.

Listing is straightforward. Join the ISV programme, complete security review, and publish a polished listing with demos and reviews. Do the work once and your app gains a permanent storefront where admins already shop for the next growth booster. For vendors in sales, marketing, or service automation, AppExchange remains an essential channel.

7. ArrowSphere

ArrowSphere receives less publicity than larger distributors, yet its impact is significant in complex enterprise deals. Arrow Electronics curates about 6,000 cloud and SaaS solutions on the platform, then layers on quoting, cost-management, and analytics that experienced VARs rely on.

The commercial model mirrors other distributors: wholesale discounts, shared margin, and no listing fee. Arrow’s key advantage is focus. Many partners specialise in verticals such as government, healthcare, and industrial manufacturing. When they scope a multimillion-dollar project, your SaaS can appear as a pre-approved line item instead of an afterthought.

Onboarding benefits from Arrow’s engineering heritage. If you already integrate with CloudBlue, enabling ArrowSphere is largely configuration. Otherwise, Arrow’s technical team helps wrap your provisioning in standard APIs and tests scenarios such as multi-year, usage-based billing.

Choose ArrowSphere when you want deep, consultative partners who sell bundled solutions rather than one-off licences. For enterprise-grade SaaS in security, cloud management, or IoT analytics, this marketplace delivers quality deals without drowning you in small-ticket noise.

8. Pax8 Cloud Marketplace

Pax8 serves modern MSPs. Its cloud-native platform lets service providers quote, buy, and deploy SaaS in minutes, then manage every customer subscription from one console. That simplicity has attracted thousands of partners in more than 70 countries, giving your product instant access to the long-tail SMB market.

The commercial model remains partner-friendly. You set a distributor price, Pax8 adds a lean margin, and the MSP still earns healthy recurring revenue. Because deals close on month-to-month terms, partners promote solutions that drive steady income, which is ideal for SaaS with high retention.

Onboarding is quick. Provide API endpoints for licence provisioning, supply training assets, and Pax8’s Wingman team handles the rest: launch webinars, nurture campaigns, and one-to-one sales coaching for top partners. Recent integrations with Microsoft’s unified commerce API allow products already on Azure Marketplace to flow through Pax8 with minimal extra work.

If your roadmap targets thousands of SMB customers but you lack a large direct sales team, Pax8 offers that reach while keeping operations straightforward.

9. Alibaba Cloud Marketplace

Entering the Chinese market is challenging, yet Alibaba Cloud Marketplace provides a practical route. Alibaba controls most of China’s public-cloud spend, so listing here places your SaaS where local buyers already search and where procurement rules feel familiar.

Fees stay in the low-single-digit range and are sometimes waived for strategic categories. The bigger hurdle is compliance. You typically need a local entity or a trusted Alibaba partner to meet data-residency and licensing laws. Alibaba’s onboarding team guides you through translation, ICP filings, and deployment in mainland data centres, turning a complex process into a clear checklist.

Once live, your offer can be bundled with Alibaba services such as AI APIs or security add-ons and paid for through Alipay or existing cloud credits. The marketplace also extends into Southeast Asia and the Middle East, giving you optional reach into fast-growing digital economies.

If expansion into Asia is on your roadmap, Alibaba Cloud Marketplace offers a direct, compliant, and culturally aligned path to millions of potential users.

10. IBM and Red Hat Marketplace

Hybrid cloud is no longer a buzzword; it is the reality for banks, governments, and any enterprise that mixes on-prem environments with public clouds. Red Hat Marketplace addresses that need. Every listing is containerised, certified for OpenShift, and deployable anywhere the customer runs Kubernetes, from an AWS cluster to a data-centre floor.

Revenue share is negotiated but typically lands under typical app-store rates. IBM strengthens the offer by allowing its own sales teams to include marketplace listings in larger services deals. Your software can ride along in a multimillion-dollar transformation project without starting a new procurement cycle.

The technical bar is higher. You must containerise your app, build an Operator for automated lifecycle management, and pass Red Hat security scans. Yet this effort pays dividends beyond the marketplace because Operator-based deployment is becoming standard for enterprise buyers.

For SaaS vendors with an on-prem or private-cloud narrative, listing here turns hybrid complexity into a competitive edge and connects you to one of the most trusted brands in enterprise IT.

Comparing your options at a glance

You have met each marketplace one by one; now see them side by side. The table below distils the essentials—audience, reach, cost, effort, and standout strength—so you can shortlist the channels that fit your roadmap in seconds.

| Marketplace | Primary audience | Global reach | Commission or margin | Onboarding effort | Standout strength |

| TD SYNNEX StreamOne | Resellers, MSPs | 80+ countries | Wholesale discount | Medium | 30,000 partners ready to bundle your SaaS |

| AWS Marketplace | Enterprise AWS users | 190 countries | 1.5–3 percent | High | Access to committed AWS budgets |

| Microsoft Commercial | Azure and M365 buyers, CSPs | 400,000 partners | 3 percent flat | Medium | Built-in co-sell with Microsoft field reps |

| Google Cloud Marketplace | Developers, data teams | Rapid growth in APAC, EMEA | 1.5–3 percent | Low | Simplicity and partner-friendly economics |

| Ingram Micro Cloud | VARs, SMB-focused MSPs | 60+ countries | Wholesale discount | Medium | Largest seat count in the cloud channel |

| Salesforce AppExchange | Salesforce admins and users | 150,000 customers | 15 percent | Medium | Native install inside Salesforce orgs |

| ArrowSphere | Enterprise VARs and SIs | Strong in EMEA, North America | Wholesale discount | Medium | Deep solution-selling partners |

| Pax8 | Modern MSPs (SMB) | 70+ countries | Wholesale discount | Low | Fast, API-driven provisioning for MSP scale |

| Alibaba Cloud | China and APAC enterprises | Dominant in mainland China | < 10 percent | High | Regulatory path into China’s large market |

| IBM and Red Hat | Hybrid-cloud IT teams | Global Fortune 500 | Negotiated low cut | High | Certified “run anywhere” OpenShift deployments |

Conclusion

Use this cheat sheet to align each marketplace with your audience, resources, and growth targets, then double down where the fit is strongest.

Emerging trends to watch

- Marketplace fees keep falling. Transaction costs that hovered near 20 percent now sit around three percent, and some providers are testing zero-fee promotions to attract fresh SaaS listings.

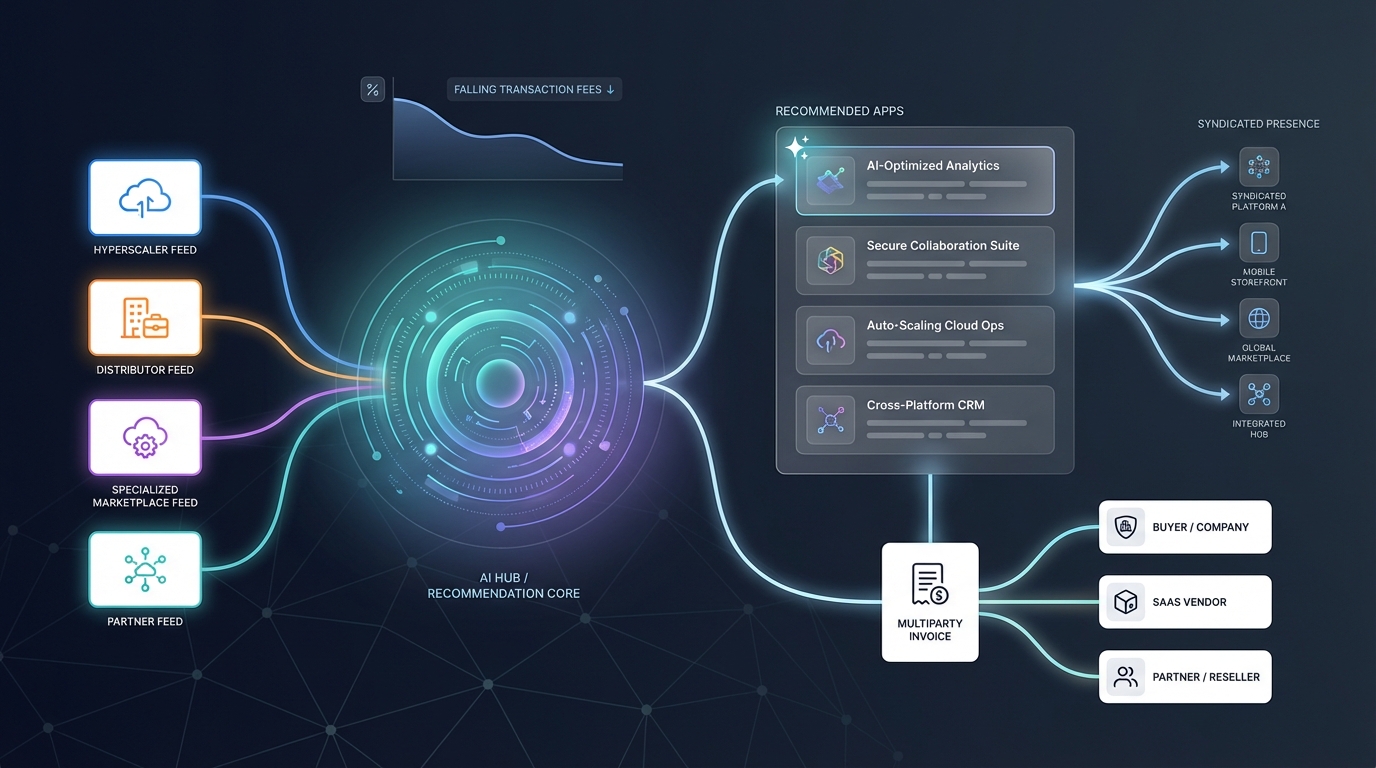

- Private and multiparty offers move mainstream. Field sellers and resellers increasingly close deals inside marketplace rails, giving buyers one invoice while vendors and partners split revenue behind the scenes.

- AI reshapes discovery. Hyperscalers are training recommendation models that suggest adjacent apps (for example, “Customers who deploy Snowflake often add Monte Carlo”). Rich metadata and precise positioning now matter more than ever.

- Aggregation accelerates. Distributors such as Pax8 already pull transactable listings from Microsoft, and CloudBlue is stitching catalogues together in the background. Soon, listing once could syndicate your product across several storefronts, multiplying reach without extra effort.

Quick-fire FAQ

How long does onboarding take?

Distributor platforms such as Pax8 usually need a few weeks, while fully transactable cloud listings on AWS or Azure take one to three months. Most of that time goes into wiring billing and completing security checks.

What does it cost to list?

Hyperscalers charge about three percent per sale, dropping to 1.5 percent on large private offers. Distributors work on wholesale discounts; plan to share 10–20 percent to cover both the distributor and the reseller.

Can we list on more than one marketplace?

Yes. Fast-growing ISVs often list on AWS and Azure for enterprise reach, plus a channel marketplace like Ingram or Pax8 to capture SMB budgets. Keep pricing consistent and automate licence reconciliation.

Will a marketplace cannibalise our direct sales?

No. Sales reps often use the marketplace as a fulfilment option when a deal stalls in procurement. Give reps quota credit for marketplace transactions, and they will see it as an accelerator, not a threat.

Which marketplace should we tackle first?

Follow your customers’ spend. If they already run workloads on AWS, start there. Selling to Microsoft-centric mid-market firms? Go Azure, then add a CSP distributor. Let buyer behaviour, not hype, determine your sequence.