The financial advisory industry has remained virtually unchanged for over half a century. Despite the digital revolution, investors are still tethered to a model defined by quarterly phone calls, static portfolios, and generic advice that often ignores individual tax complexities. Today, Autonomous Technologies Group (ATG) is launching to dismantle this status quo.

ATG announced it has raised $15 million in pre-seed funding to launch Autonomous, an AI-native wealth strategist. The round was led by Y Combinator, Box Group, and Collaborative Fund, with participation from the founder of a leading quantitative hedge fund and several high-profile angel investors.

The “Brutal Math” of Modern Investing

The current wealth management landscape leaves investors with two suboptimal choices:

-

Traditional Advisors: Human intermediaries who charge 1–2% of total assets annually to implement strategies that frequently underperform simple index funds.

-

Robo-Advisors: Automated platforms that offer “cookie-cutter” portfolios, failing to adapt to real-time tax situations or complex life changes.

“The math is brutal,” says Daniel Kobran, co-founder of ATG. “A typical investor paying 1–2% in fees annually will surrender nearly half of their potential retirement wealth to the financial services industry over their lifetime. We asked ourselves: what would rebuilding this entire system from first principles look like? Just as software eliminated trading commissions, Autonomous eliminates advisory fees while delivering a superior service.”

Bringing the “Family Office” to the Masses

Until now, sophisticated strategies like strategic tax-loss harvesting, direct indexing, and portfolio-backed borrowing were the exclusive domain of the ultra-wealthy. These methods allow billion-dollar family offices to compound wealth far more efficiently than the average investor.

Autonomous plans to leverage frontier AI to make these elite strategies accessible to everyone. By operating at software economics, ATG can deliver personalized wealth management that is economically impossible for human advisors to provide at scale.

Key Features of the Autonomous Platform:

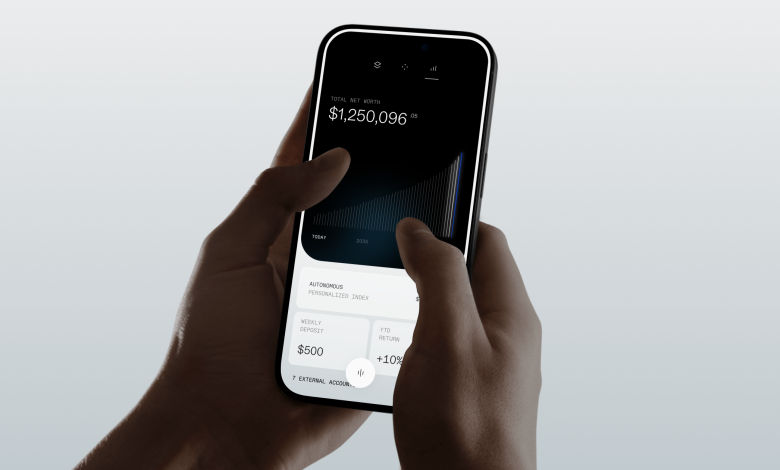

- Conversational Intelligence: Users can engage with Autonomous 24/7. From asking “Should I max out my 401k or pay down my mortgage?” to “How does this job offer change my tax bracket?”, the AI provides immediate, context-aware answers and executes trades instantly.

- The Autonomous Index: Moving beyond generic ETFs, the platform builds a personalized direct index tailored to a user’s specific income, tax bracket, and investment horizon.

- Continuous Optimization: Unlike the traditional quarterly review, Autonomous monitors accounts in real-time. It identifies tax-loss harvesting opportunities, rebalancing needs, and risk adjustments as market conditions shift.

- Elite Strategy Access: The platform provides scenario modeling for major life decisions and dynamic optimization across a user’s entire financial picture—services previously reserved for private bank clients.

A Proven Team for a New Inflection Point

ATG was founded by Dillon Erb and Daniel Kobran, the duo behind Paperspace, a pioneer in GPU cloud computing acquired for $111M by DigitalOcean in 2023. Their background in high-performance computing and AI infrastructure positions them uniquely to tackle the data-heavy world of finance.

“The financial advisory industry is one of the last holdouts where human intermediaries extract massive value without creating it,” said Garry Tan, CEO of Y Combinator. “Dillon and Daniel predicted the meteoric rise of GPUs in 2015. They understand where AI capabilities are heading. This is the right team at the right inflection point.”

“High-quality financial advising shouldn’t be a luxury,” added Dillon Erb, CEO of ATG. “Our mission is to help millions of people double their retirement savings by making elite financial intelligence accessible to everyone.”

Following the “neobank” playbook established by companies like Mercury and Ramp, ATG aims to remove the overhead of brick-and-mortar legacy systems in favor of elegant, AI-driven software. The $15M capital injection will be used to scale the engineering team and accelerate the rollout of the Autonomous platform.

The company plans to launch the platform this year pending regulatory approval. Interested users can join the waitlist at https://becomeautonomous.com/.