In recent years, the way we manage our money has undergone a quiet revolution. We have moved from physical bank branches and paper ledgers to a world where our financial lives are managed through glass screens and digital signatures. While much of this shift has focused on convenience, a more profound change is happening under the surface. Advanced technology and artificial intelligence are now being used to pull back the curtain on historical lending practices, giving motorists the tools they need to challenge the status quo.

For many UK drivers, the process of financing a vehicle used to be shrouded in mystery. You would sit in a showroom, discuss monthly repayments, and sign a thick stack of documents that few had the time or expertise to fully unpick. Today, that dynamic is shifting. The marriage of data transparency and modern technology is making it easier than ever for individuals to determine if they were treated fairly, sparking a significant rise in car finance claims across the country.

The End of Information Imbalance

Historically, there was a massive gap between what the lender knew and what the customer understood. Finance brokers and dealerships held all the cards, including the details of commission structures that were rarely, if ever, disclosed to the person actually paying the bill. This lack of transparency meant that many people unknowingly entered into agreements where the interest rate had been artificially inflated to boost the seller’s bonus.

Technology is now acting as a leveller. By using sophisticated data analysis, it is possible to scan thousands of historical agreements to identify patterns of unfairness that would have taken a human researcher years to find. This means that if you suspect your past deal was not as honest as it appeared, you no longer have to fight an uphill battle alone. The digital trail left behind by these agreements is finally being used to empower the consumer.

Why Data Transparency Matters for Your PCP Claim

The concept of a PCP claim is rooted in the idea of informed consent. To make a truly fair decision about a loan, you need to have all the facts on the table. If a significant part of your interest rate was actually a hidden kickback to the dealership, you were denied the opportunity to shop around for a better deal.

Modern transparency efforts are designed to highlight these hidden costs. When drivers begin to look into their financial history, they are often looking for specific red flags that technology can now help identify more clearly. These include:

- Undisclosed commission payments that were baked into the monthly interest rate.

- Discretionary models where the salesperson had the power to hike the rate for their own gain.

- A lack of clear comparison between different finance products at the point of sale.

- Complex jargon that intentionally obscured the total cost of the credit over the full term.

- Incentives that prioritised the profit of the lender over the budget of the borrower.

By identifying these markers, drivers can gain a much clearer understanding of their rights. The era of “taking the dealer’s word for it” is ending, replaced by a system where evidence and data lead the way toward a resolution.

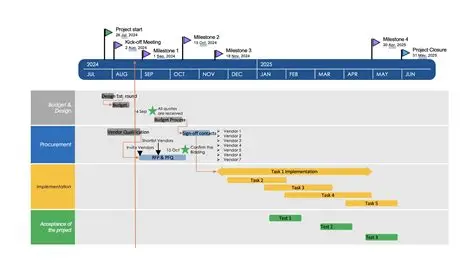

The Importance of the 2007 to 2024 Timeline

One of the most vital aspects of the current landscape is the window of time currently under scrutiny. The practices that have led to the current wave of car finance claims were not isolated incidents; they were part of a widespread industry culture that lasted for nearly two decades. Regulatory bodies and legal experts have focused their investigations on a very specific period.

It has been established that a PCP claim is valid for agreements signed between 2007 and 2024. This seventeen year window covers millions of individual journeys and a vast array of vehicles. Whether you were driving a compact car for city life in 2007 or a family SUV in 2024, the requirement for fairness remained the same. Even if you have long since settled the finance or moved on to a different car, the data from that original transaction still exists. If that deal was flawed at the start, the passage of time does not change the fact that you may be entitled to a refund.

How AI is Humanising the Process

While the mention of artificial intelligence can sometimes feel cold or robotic, its role in the world of finance is actually quite the opposite. By automating the heavy lifting of data retrieval and contract analysis, technology is making the path to justice more human and accessible. It allows ordinary people to stand on equal footing with multi-billion pound financial institutions.

In the past, challenging a major lender felt like a daunting task that required a mountain of paperwork and a background in law. Today, the process is being streamlined. Transparency tools can help you find your old agreement details, verify the commission structures used at the time, and provide a clear picture of what you should have been paying. This reduces the stress and confusion that often prevents people from standing up for their rights.

A Fairer Future for UK Motorists

The fallout from these transparency efforts is already changing the way cars are sold today. We are moving toward a marketplace where honesty is the standard, not an optional extra. Dealerships and lenders are increasingly aware that their historical actions are being brought into the light, and this is encouraging a much more ethical approach to new agreements.

True fairness in finance means that when you sign for a new car, you know exactly where every penny is going. It means that the interest rate you are quoted is based on your creditworthiness, not on how much extra the salesperson wants to earn that month. By looking back at the period between 2007 and 2024, we are not just fixing the mistakes of the past; we are ensuring that the future of car finance is built on a foundation of trust.

Taking the First Step Toward Clarity

If you have a nagging feeling that your past vehicle deal was more expensive than it should have been, you now have the resources to find out the truth. The combination of your rights as a consumer and the power of modern data transparency means that answers are closer than you think.

Gathering your records from any agreements made between 2007 and 2024 is the best way to begin. Lenders have a duty to be transparent about the history of your accounts, and the technology available today makes it simpler to verify the facts. Whether you are still behind the wheel of that car or it is long gone, you have a right to know if you were treated fairly in the showroom.