Oncology care is complex, often involving multiple providers, treatments, and newly emerging drugs that are added to patient care as cancer science continually advances. The billing process is particularly complicated. As oncology care practice groups enter into fee scale agreements with multiple commercial medical insurance companies, they often have to deal with existing negotiated pricing restrictions based upon Medicare rates and pharmaceutical companies that subsidize certain treatments or drugs.

Many factors, such as practice location and facility type are assessed to determine the appropriate billing amount for medical procedures. Additional factors, including category-based pricing and carve-out pricing, make medical billing and fee schedules very difficult to navigate.

All of these factors make it a challenge for oncology medical groups to identify opportunities where revenue may have been missed, and then recover it.

To address these issues, AC3, a company located in South Bend, Indiana, designed an oncology business intelligence platform to automate billing processes and provide revenue cycle insights to oncology providers. The platform unites practice management, healthcare data, and innovative technology intelligence into a single environment that delivers full transparency and automated actionable insights to simplify workflows, increase efficiency, and secure revenue integrity.

Realizing that current fee schedule management processes can be cumbersome and continued to involve manual tasks that posed some areas of vulnerability, AC3 determined its solution needed increased automation to close the gap and protect against such vulnerabilities. Further, as the company grew its solution, it became clear that certain data management processes were still too restrictive, hindering scalability:

- Labor Intensive Data Entry – The resources needed to manually build and maintain the necessary data and updates for fee schedules were too high, and often left providers exposed to errors caused by manual data entry.

- Missing the Big Picture – Focusing on the claim and fee schedule data that was applicable to immediate patients limited attention to perform analytics on larger trends within the oncology space.

- Batch Processing – Current analytical processes were run in nightly batches inhibiting full transparency that users could gain with real-time data.

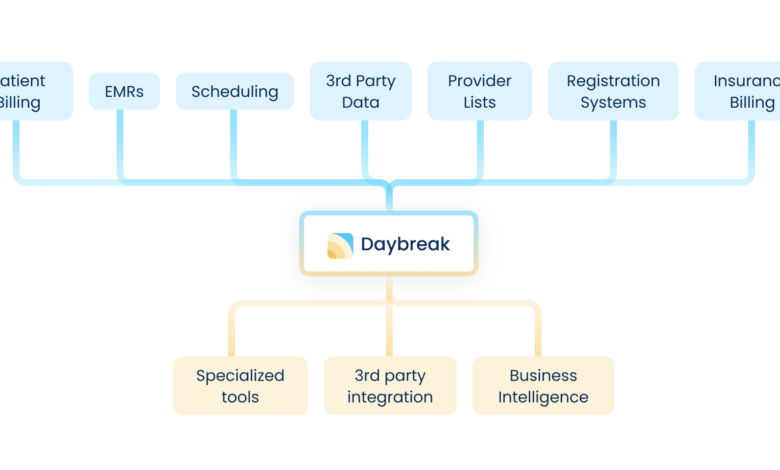

AC3 decided to look for more efficient ways to take charge of data and better prepare it for reporting and analytics. The company selected the Aunalytics Daybreak platform to aggregate data from siloed systems and lay the foundation for their solution that enables healthcare practice groups to avoid manually building billing systems and avoid costly data errors. Aunalytics provides features that enable analytic solutions like fee schedule generation and the ability to build master records of accurate patient data. The platform cleanses data for accuracy and governance and transforms disparate data into a golden record for a single source of truth ready for analytics and reporting.

Developed on AC3’s oncology revenue cycle management data models, Daybreak’s AI-powered analytics revealed actionable business insights, such as underpayments from insurance. Typically, provider fees are adjusted by contracted rates with insurance companies and providers may write-off fees above the combined payment of patient co-pays and insurance reimbursements. Providers typically work with multiple insurers and each insurance company may have multiple different fee agreements. If an insurance company reimburses an amount less than the contracted amount, this underpayment may often go unnoticed and may be written off erroneously.

Keeping track of fee schedules and ever changing contracted fee agreements with multiple insurers to be able to spot underpayment errors and flag them for collection is beyond manual human review capabilities of a provider back-office team. Daybreak analytics combined with AC3’s oncology industry expertise seamlessly flags underpayment, and further actionable insights reveal opportunities for oncology providers to improve revenue collection.

“Partnering with Aunalytics has accelerated the integration and automation of diverse data sources and target systems, elevating transparency and efficiency and allowing for heightened focus on the usage of data and establishing sustainable futures for our clients,” said Corinne Kereszturi, president, AC3.

Additionally, Aunalytic’s enrichment capability automated the generation of detailed fee schedules for private insurance providers based on a set of defined parameters, with references to the public data sets maintained within the platform. “Aunalytics Daybreak’s replication capability created an analytics-ready data stream to the AC3 analytics platform, eliminating outdated processes and preventing vulnerabilities,” Kereszturi added.

As a result, AC3 was able to achieve:

- Automated Data Ingestion – Using the Daybreak platform’s sophisticated plugin architecture, the company automated ingestion of Medicare, Medicaid and other public data sets, along with various internal data sources, and eliminated the need for manual data entry.

- Fee Schedule Generation – Using the platform’s enrichment capabilities, AC3 fed high level oncology industry specific parameters into the Aunalytics platform and generated fee schedules for billing to the multiple commercial insurance companies based upon reference to the Medicare/ Medicaid Golden Record data. This allows the company to more quickly and easily onboard new customers, each having varying fee agreements with multiple commercial insurance companies, regardless of the complexity around Medicare-derived, category-based, and carve-out pricing.

- Seeing the Big Picture – AC3 partnered with Aunalytics to build a real-time oncology revenue cycle management solution. Aunalytics AI powered algorithms expertly analyzed AC3’s oncology data models, and AC3 effectively used its industry expertise to create a powerful provider solution for practice management. Business outcomes were achieved for AC3’s customers, including revealed insurance underpayments ripe for collection.