Amid the hustle and bustle that is the stock market, it’s imperative to have access to helpful stock analysis tools, which will amplify your pivot-making. Whether you are a savvy investor trying to improve your trading techniques, a business owner in need of some financial education, or perhaps someone who just wants to learn the stock market as a beginner and make money from it, the right resources can lead to vast profits.

In this article, we introduce the best 8 stock analysis tools for 2025, which have been carefully chosen and evaluated to provide you with the right information so that you can make a smart investment decision. Every possibility has been analyzed in terms of features, price point, user experience and value provided so that you can compare them to find just the right one for your individual investment path. Read on and you will find the tools that will keep you afloat in today’s ever-changing market environment.

Website List

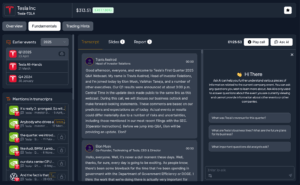

1. BestStock AI

What is BestStock AI

BestStock AI is an artificial intelligence trading analysis platform that makes financial data easier to analyze, enabling investment teams with the confidence to make better decisions faster. By automating financial data processing and understanding, BestStock removes the heavy lifting from monitoring stocks and focuses your time on working for smarter investment strategies. BestStock offers unprecedented market coverage, company research and detailed financials all combined with AI generated daily read reports to improve your research or investment process. It also has an easy dynamic stock average calculator so you can check the average purchase prices, useful for averaging decisions.

Features

AI-driven financial analysis that automates data prep to produce actionable insights without any manual effort

Access to complete US stock financials and daily AI-driven insights that cover nearly 50% of all US equities

Powerful statistical and business-analysis tool for informed decision making and strategic planning.

Multilanguage support: Available in English, Danish, Dutch, Finnish, French, German.

Easy to use system, accommodating both new and experience investors

Automatic reports and charts for easy data visualization and presentation

Pros and Cons

Pros:

- AI-powered automation that streamlines data analysis, saving investment teams from having to do a lot of the work by hand

- Full US stock financials, earnings transcripts and daily insights for smarter investment decisions

- Easy to use interface that provides you with the research flow to access everything required for financial analysis

- Competitive pricing and variety of plan options for different investment objectives

Cons:

- Costs might be higher than other financial analysis alternatives.

- Limited offline access is available for essential functions.

- Proficiency in advanced tools will take time to develop.

2. tipranks

What is tipranks

TipRanks is an A.I and big data financial technology company that offers stock market analytics. In particular, TipRanks allows anyone to see the performance of financial analysts, including their ratings and predictions on various stocks. By exploring the features of its interface and data, users find the ability to check the expert view before investing in the stock to be of particular interest.

Features

- Innovative User Interface

- Strong analytics and reporting for data-centric decision making

- Versatile and scalable pricing packages for businesses of any size

- Extensive list of training resources and teaching materials for smooth onboarding

- Automatic updates to make sure you always have the latest features and optimizations

Pros and Cons

Pros:

- It ranks the millions of expert opinions to provide the most accurate and balanced information.

- Smart Score compiles ratings from a number of analysts, along with a variety of other factors like investor and analyst sentiment as well as fundamentals (earnings, acceleration, and stock price movement).

- Combines analyst commentary, price targets, insider transactions and hedge fund moves in one top-down research dashboard.

- Powerful stock screeners and Top Stocks lists enable you to provide advice that fits your expertise.

- Portfolio tools and options on alerts give users indications as to changes in ratings and signals on watched holdings for quick decisions.

Cons:

- Even users having user friendly UI face Information density which can baffle them and result in Analysis paralaysis.

- It pays more attention to widely followed large caps than it does under-covered small caps.

- There are still (still!) analyst ecosystem biases (few “sell” ratings) that can’t be completely overcome by rankings.

- The free tier is also severely restricted and many features are available only on a paid plan, increasing cost concerns for casual users.

- Smart Score and backtests are in part “black box” and backward-looking; what appears to have worked best doesn’t necessarily translate to the future.

3. marketbeat

What is marketbeat

MarketBeat is everything that investors need to know about financial news, stock recommendations, investment guidance and earning projections. Its mission is to democratize investment, giving individual investors access to the latest stock market news and analysis so they can make informed decisions for themselves. With offerings such as MarketBeat TV and coverage of trending stocks in the news, the website provides information that can help to refine users’ investment strategy and increase their returns.

Features

- Real-Time market thoughts for you to stay on top of trades.

- Professional analysis to unlock high-yielding stocks to help you with investment decisions

- In depth guide to the average index returns following economic indicators that appear in the monthly series of “ECO Key Economic Indicators®”

- Review of key economic data released during the week, along with analysis of what those numbers really mean.

- An understanding of each specific indicator is a positive or negative for the marketAnd whether that indicator is leading, lagging or coincidence that affects present and future investment growth.

- Exclusive reports on emerging technologies and the disruption these promising developments have in potential markets

- Interactive platform for real-time coverage round-ups and community discussions on stock movements

Pros and Cons

Pros:

- Market trends and stock performance with timely commentary.

- A broad array of stocks, from tech to the contrarian.faceVertexUvs

- Insight from numerous market professionals with expertise in a variety of topics

- Market items and significant movements

Cons:

- Content could be too much for new investors

- Too much of a short-term investment emphasis

- Potential criteria overweighting toward momentum instead of fundamentals

4. IG

What is IG

IG is a multiplatform trading and investment platform for the financial market, such as forex, shares and cryptos. It primarily focuses on offering advanced trading features, real-time market data, and education enhancement tools to help both beginning and experienced traders make educated decisions. Through a simplified interface and selection of assets, ig seeks to provide an improved level of satisfaction while users work toward their financial objectives.

Features

- Strong security features that safely valut your data by leading encryption standard

- easy to use interface for navigation and better user-experience

- Full integration with your most used tools (Sketch, Slack, Office and more) for the most holistic flow.

- Collaboration in real-time enabling teams to effectively work together

- Informative analytics dashboard and actionable insights at a glance

Pros and Cons

Pros:

- Extensive product portfolio with CFDs and Spreadbetting available across over 17,000 markets and a range of products including shares, options, ETFs, penny stocks and bonds for all-asset analysis.

- Robust platforms and integrations (IG web, ProRealTime, L2 Dealer/DMA, MT4, TradingView link) facilitate advanced charting as well as Active Trader market access.

- Strong trust profile We recommend this broker as it is well-regulated in a number of jurisdictions and has numerous licences.

- Competitive pricing with tight FX spreads are further enhanced by typically no deposit/withdrawal fees and active trader/DMA prices for high‑volume traders.

- Our best‑in‑class research and education tools (IGTV, newsfeeds, signals, TipRanks, Autochartist and IG Academy) provide you with the answers to your equity analysis questions.

Cons:

- No MetaTrader 5 and fewer MT products (forex, CFDs) than IG’s DMA & proprietary platform offerings.

- No copy trading, so not for people that want an automated social strategy.

- Funding options and availability differ on a regional level, and may seem limited relative to those offered by competitors in some markets.

- There are still some fees (inactivity, overnight financing, guaranteed stops premiums) and the share/DMAs can have more complicated pricing.

- Overwhelming for beginners due to platform setup and product depth of range.

5. tiomarkets

What is tiomarkets

TIOmarkets is a trusted online trading broker offering Forex, Indices, Commodities & CFD stock for trading on the MT4 and the MT5 trading platforms. TIOmarkets is doing just that: empowering traders through three of the highest value-added structures available in today’s FX environment, where 0.0 spreads-based pricing (yeah you’ve read it right), 0-commission trading and limitless leverage are offered against a core background of high-quality customer service to meet every client’s needs. The service is equally efficient for both: beginners and experienced traders, who can easily open the doors to the financial market.

Features

- Trade with spreads from 0.0 pips, no requotes, best possible prices and no restrictions

- Options for zero commission trading for increased profitability

- Get access to unlimited leverage for enhanced trading power

- Receive help anytime you need it with 24/7 customer support

- Create a balanced portfolio and trade major, minor or exotic currency pairs along with FX indices, gold & silver commodities as CFDs

Pros and Cons

Pros:

- Tight competitive spreads, starting from 0.0 pips

- No fees or commission on VIP Black or Standard accounts: maximize your overall profit potential.

- A variety of instruments, such as forex, commodities, crypto currencies and indices

- 7/24 customer support to answer all your questions any time

Cons:

- Not much information on some of the more advanced trading features can result in a learning curve for beginners

- Potentially high levels of volatility and unlimited leverage can add additional risk to less-experienced traders.

- Relative small startup amount of money may discourage more experienced traders thus potentially trading off the overall quality

6. briefing

What is briefing

Briefing.com is a provider of 24/7 real-time economic news analysis for traders and investors. Its primary goal is to provide users with the latest information and tools in order to make decisions for investing in this rapid environment. By providing exhaustive coverage of the factors and forces that influence the market, including analysis techniicals and fundamentals through market eyes, Briefing. com is an essential resource both for individual investors and grizzled market veterans who want to develop a more robust trading or investment performance methodology.

Features

- User-friendly interface for easy routing and quick on-boarding

- Powerful analytics tools to enable actionable insights and informed decisions

- Scalable products designed for businesses that are on the come-up and respond to the changing needs of users

- Complete training curriculum and documentation for ongoing learning

- Pricing plans that can be customized to any size and budget of your business

Pros and Cons

Pros:

- Live market news feed and news alerts enable them to respond swiftly to price-moving events.

- Centralized dashboard for earnings, analyst notes, calendars and economic data saves time on equity research.

- Mod-hotel-plus style summaries lower the noise and bring up the most useful items for stock decision-making.

- Cross asset coverage (stocks, etf’s, macro, options flow) allows for idea generation beyond single names.

- Active traders can keep an eye on prices without staring at the screen all day thanks to mobile and desktop notifications.

Cons:

- No broad historical depth and basic research tools versus full-service trading platforms.

- It can also still be overwhelming for novices to get bombarded with constant stream of headlines.

- Coverage quality is mixed by sector and market-cap where there’s less depth in smaller or illiquid names.

- For those who want full transparency, the use of proprietary signals and curation criteria can sometimes create a sense of opaqueness.

- More advanced features and enriched analysis will usually cost the user by having to pay for premium packages.

7. stocktitan

What is stocktitan

Stock Titan AI Stock Titan is a real-time stock market news and trading tool especially focused on individual stocks. Its goal is essentially to provide traders with ultra-quick breaking news and analysis, winnowing market-moving finance stories down to their most essential, actionable components. Thanks to Rhea-AI, box-traders are enabled with sentiment analysis and critical insights which boosts their trading experience and keeps them ahead in the market.

Features

- Customized real-time stock news and alerts tailored for you on your store positions – the news that matters most to you!

- AI-powered sentiment and impact analysis provide you a trading edge with the most current market expected movement perception

- Up-to-the-second news and trading execution, helping keep you ahead while on the move

- Intuitive interface is engineered to make the trading process smooth and easy with user-friendly customization tools

- Free access to live stock news feed – You can try the premium features for free and see real time market performance.

Pros and Cons

Pros:

- AI-powered real-time stock market updates based on individual stocks

- Curated news feed of only finance-related stories

- Sophisticated tools such as sentiment analysis to improve trading decisions

- Try it out with no commitment using a free version

Cons:

- Users will need to learn new AI-based tools if they haven’t used them before

- Insufficient information is provided about the features and usability of mobile apps

- Depending on internet connection for real-time updates

8. trendlyne

What is trendlyne

Trendlyne is THE world’s best investing community powered by the strengths of India’s most powerful stock screener | Re-invent how you analyze stocks! Its mission is to provide users with the deep understanding of stocks, mutual funds and market trends so that investors make smarter investment decisions. Not only does Trendlyne offer portfolio tracking, it offers insider trades and personalizable watchlists that makes investing even more efficient for you to become aware of the market.

Features

- Market information provided to help you make the best trading decisions in real time

- Complete list of the performance for each major index.

- Intuitive user interface for easy navigation

- Stock analysis tools in app to create your own investment strategy

- Fully customizable alerts to position you ahead in the market

Pros and Cons

Pros:

- Full suite of tools such as alerts, screeners, and reports to make informed decisions

- Deep coverage of multiple markets, such as stocks, futures, and mutual funds

- Investor friendliness tools such as watchlists and insider trades for easy tracking

- Ongoing and dedicated events calendar to keep users engaged

Cons:

- Possible over-complication with the extensive list of features available

- May not have extensive customisation options for power users

- Infrequent data update lags in peak hours

Key Takeaways

- The best way to analyze stocks will vary with your investment strategy and risk tolerance.

- Consideration should not only be based on historical performance but market trend and future potential.

-Integration with Financial Trading Platforms — use our analytical tools and your unique trading strategy to trade an array of financial instruments.

- A good UX and understandable data visualizations is key for being preserved in making investment decisions.

- Timely updates and real-time data accessibility signal a powerful analytical tool that reacts to market shifts.

- Security measures and compliance tools are important to keep sensitive financial data secure and meet regulations.

- Strong community backing and useful learning resources can make you a better stock analyst.

Conclusion

In this top 8 stock analysis solution breakdown, you can see that there are a variety of options on the market for every need and preference. It is all about understanding what your individual investment goals are and then finding the tool that offers the best balance of useful features, ease-of-use, and value for your own trading strategy.

Whether you’re a beginning investor searching for a simple and cost-effective way to invest, or an active trader who wants more sophisticated tools, these resources are the best in class. Every tool has something different to offer, whether it’s lightning-fast real-time information and powerful data analytics or easy-to-understand formats and specialized customer support.

We hope you find this resource helpful as a starting point for your research, but remember that the best decision will be made when these tools are in your hands. The future of stock analysis is bright and getting the right solution in your repertoire today can set you up for successful investing for years to come. So spend some time exploring these online options to see which best fits your financial goals.