In this post, we’re going to look at 3 major ways that AI is used in the financial industry today. Once you’re done with this, you may look at the finance industry and the providers in a different way.

Want to know what we’re going to be looking at? Here’s a topic breakdown of this article:

- Background to AI in the financial industry

- Current statistics and future predictions for AI in the financial market

- Does AI provide a cost-saving for businesses within the financial industry?

- Enhanced customer experience

- Fraud detection

- Lowers a financial providers risk

- What’s your opinion?

Background to how AI is used in the financial industry

How AI is used in the financial industry are always increasing with us being able to apply the technology to areas of business some of us likely thought would never be possible.

It’s reported that 32% of financial service providers are already using AI technologies like Predictive Analytics, Voice Recognition, Automated Payments, among more, according to joint research conducted by the National Business Research Institute and Narrative Science.

For those of you who have ever had to ring a bank to handle a personal or business inquiry, it’s likely you’ll be familiar with the automated service they provide in an attempt to solve your problem without talking to a human advisor or member of the team.

Usually, providing you don’t use or have access to internet banking, you can get your details through using an automated telephone service, all of which use AI to confirm your security answers.

Before we get into the juicy parts about how AI is used in the financial industry, let’s have a look at suggested stats we might expect to see in the future.

Current statistics and future predictions for how AI is used in the financial industry

- In Business Insiders Intelligence’s 2018 Mobile Banking Competitive Edge Study, 89% of respondents said they use mobile banking, up from 83% in 2017

- Former Citigroup chief, Vikram Pandit, predicted 30% of banking jobs could be wiped out by AI in five years

- Mizuho Financial Group in Japan says it will use AI to replace 19,000 people by 2027 – roughly a third of their workforce

- Financial Times reported that a bank predicted that 50-70 percent of jobs could be replaced

- Bloomberg reported that JP Morgan’s facial recognition software does in seconds what took lawyers a combined 360,000 hours

- Business Insider 2019 AI in Banking and Payments report found that the aggregate potential cost savings for banks from AI applications are estimated at $447 billion by 2023

Now we’re armed with credible stats and sources of the potential future of AI in financial services, we can have a look at the different ways banks and businesses are utilising AI in banking and the financial industry.

But first, let’s ask, and attempt to answer, the question…

Does AI provide a cost-saving for businesses within the financial industry?

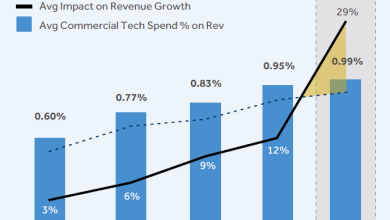

Looking at Business Insiders report, the front-and middle-office AI applications offer the greatest cost-saving opportunities for businesses and banks.

Arguably because these are the highest costing areas in terms of workforce and getting the human labour to do administrative and customer-facing work.

The Financial Brand suggests that AI will save the banking industry upwards of $1 trillion. That’s a lot of cash and your mind is likely already considering all the ways AI is used in the financial industry to add that much value.

They continue to explain that financial institutions should expect a 22% cost reduction in operating expenses due to AI.

Autonomous Next released a report that suggests that a cost exposure of $1 trillion across banking, investment management, and insurance could become a reality by 2030.

To give you an idea of how AI is used in the financial industry, the report goes on to suggest that of this $1 trillion, $350bn will be in the middle office, $200bn in manufacturing, and $490bn in the front office.

In Accenture’s redefining banking report, they note that ‘a bank could expect potential savings of between 20 and 25 percent across IT operations including infrastructure, maintenance, and development costs’.

They also note that because of all the different ways that AI is used in the financial industry it will add upwards of $1.2 trillion in value to the financial industry by 2035.

There are plenty more reports out there outlining how this technology is going to save the financial industry on costs and showing ways of how AI is used in the financial industry for you to consider if you’re keen to spend the time looking after.

But hopefully, you get the point that it looks like how AI is used in the financial industry will bring the benefit of driving down costs rather than increase costs while increasing efficiency or optimising processes, even if the initial up-front investment is expensive.

Enhanced customer experience

Let’s now look at how AI is used in the financial industry to create an exceptional user experience both for personal and business banking.

Think about how you currently do your banking, do you go in-store?

Do you do it over the phone?

Do you do it through a banking mobile app?

Do you get alerts sent to your phone or email?

My guess is you have done more than one of the above, or I’d hope you’ve done at least one of the above for your personal banking, so you know your financial situation.

Ten years ago, you wouldn’t have a banking app where you can automate and do everything you need (within reason) as you can today. Thanks to the introduction of AI in banking, these are now becoming do-able.

You would either ring up or go in-store and talk to an advisor or member of the team. And then you would have to wait until the lines are open or the store is open before being able to do your banking.

Now you can do it anytime, seven days a week, 52 weeks a year, wherever you are in the world, providing you have internet access. This is one of the personal and consumer ways that AI is used in the financial industry. And an aspect that can drive great customer experience at the same time.

It gives you more control over what you can do such as giving you the ability to buy a number of selected financial products without having to speak to anyone, and from nearly anywhere in the world.

Think about switching bank accounts, extending overdrafts, applying for credit cards, and how easy it is to do today. You can get third parties to find the best deals for you to consider before committing.

Touching back to the Competitive Edge Study by Business Insider, 64% of respondents said they would research a bank’s mobile capability before opening an account, and 61% said they would change banks if their bank offered a poor mobile banking experience. Showing just how important mobile customer experience is with banks today.

Bank of America announced the plans of its virtual assistant, Erica, to all of its mobile banking consumers.

Using voice commands, texts, or touch, customers can instruct Erica to give account balances, transfer money, send money, and schedule real-time meetings with representatives.

A popular avenue that AI is used in the financial industry is through the use of speech recognition and chatbots. Banks are making full use of this by trying to make sure customers can use this to handle their enquiries quicker.

Financial businesses are taking full use of AI to identify which clients are most likely to leave them and how soon through using applications including predictive analytics.

Another way AI is used in the finanacial industry is through offering a tailored service that can create offers to particular customers to keep them happy and improve their experience and/or loyalty with that provider.

Forbes explains that although there is a fear of reduced loyalty through AI due to less personal contact, it doesn’t mean a less personalised experience. As banks are using AI to increase client satisfaction, improve efficiency, and maintain customer loyalty in more ways than before.

Fraud detection

This is a big way in which AI can be used in the financial industry. Not only that, it’s an area that is still relatively young and growing on an almost daily basis.

A capability of AI is its ability to predict future outcomes and trends, especially when coupled with machine learning and big data. This doesn’t mean it can predict the future either fortunately or unfortunately, depending on your view of time travel.

It does mean that it gives banks, private investment firms, insurance firms, stockbroking firms, and more different ways of how AI is used in the financial industry that can use this to detect trends and predict user behaviour.

Anti-money laundering (AML) is a major issue within the business to business banking. And as such the workforce needed to stop this happening is relatively large and, as you might have guessed, comes with a big cost to companies, especially financial providers. As you can imagine this is another hot way that AI is used in the financial industry.

AML costs increased by more than 50% between 2015 and 2018. So not something that looks to be a problem of the past anytime soon.

Have you ever had a text come through from your bank when you’ve made a larger than ordinary purchase on your bank card, or bought something while abroad?

That’s likely AI flagging that it might be fraudulent activity. You can get a feel from this how AI is used in the financial industry for both personal and business banking. And why it’s such an effective way to add another layer of safety.

While it’s great on a personal level, it can help businesses on a bigger scale when detecting potential money laundering, investment fraud, insider trading, and insurance fraud, just to name a few.

Let’s look at another way AI is used in the financial industry.

The technology can also scan and understand legal documents such as contracts, which can sometimes take hours to read, and within minutes highlight areas for priority review.

Something that could save all types of businesses costs or exposure to bigger problems further down the line.

Cognizant Digital Business released a case study where they claim the outcome of implementing AI within a bank was a forecasted $20 million reduction in fraudulent transactions while delivering accurate results within 70 milliseconds.

As Fintech News highlights, banks and financial businesses are upgrading from and leaving behind traditional fraud and cybersecurity threat detection systems with AI-based ones.

One reason this might be is due to identifying outliers in a dataset, in turn making it easier to detect fraud while making it more cost-effective.

They no longer need as much human security such as expert coders to find malware or fraud, as AI can find it quicker and in most cases is more accurate.

Lowers a financial providers risk

When a bank is deciding whether to give a customer a new financial product or service or when a trader is deciding whether to make a trade or not, this includes risk.

Of course, different situations carry different risks. So you can probably imagine how this is another way that AI is used in the financial industry.

Please let me ask you which is riskier, a bank accepting a customer for a $2,000 credit card allowance or a trader taking a $50,000 trade?

I’d imagine you’d say the latter, providing we’re not looking at any further details and taking the situation at face value.

Now it might be once we’ve looked at the finer details that the $50,000 trade is not as risky as giving a potential customer a $2,000 credit card allowance.

But this, of course, could take a long time to weigh up and is the sort of situation multiple people might have to consider and authorise before doing either.

Welcome AI. Again we’ve got another way that AI is used in the financial industry.

For both situations, the technology will look at a range of data to establish how much risk is attached to the situation.

What does this mean for the process?

It can speed it up, uncover details humans might have missed, be able to assess previous data and trends in a quick and accurate manner, and much more to give you a probability or percentage of success or risk that comes with that decision.

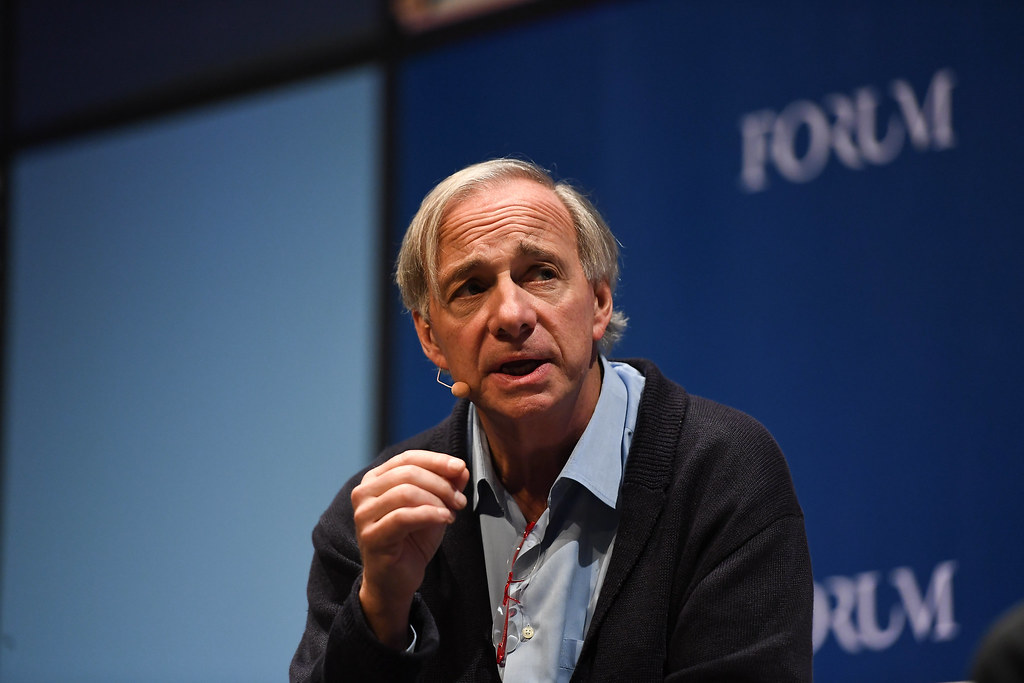

Ray Dalio, a successful billionaire hedge fund owner, tells readers of his book ‘Principle: Life and Work’ how he, and his team, created proprietary algorithms that made financial decisions and Ray attributes the amount of capital managed with a positive return to these algorithms created thanks to AI.

If you go on a website such as Money Super Market you can compare and apply for a range of financial services among others.

It will ask you to fill in some data fields for the product/service your applying for and will be able to give you a range of different options suited to you and your needs and usually with a percentage score of if you will be eligible or not. Again, this is another way that AI is used in the financial industry.

What’s your opinion?

We’ve looked at a number of different ways of how AI is used in the financial industry.

Do you think AI will help or cause problems to financial providers and businesses? Perhaps you think there are more important tasks businesses could be employing AI and technology to do? Have you got more examples of how AI is used in the financial industry?

Whatever you’re thinking, it’s quite clear that how AI is being used in the financial industry is here to stay and is only growing at a quicker rate than ever before.

Be sure to leave a comment, like, and subscribe to make sure you’re the first to know when we’ve released new content. Until next time.