Stamp duty remains one of the most debated property taxes worldwide.

In this guide, we’ll explain what it is, why governments depend on it, and why it’s unlikely to disappear soon.

What is stamp duty and how does it work?

Stamp duty is a property tax known as Stamp Duty Land Tax (SDLT) in England and Northern Ireland.

You pay stamp duty when purchasing a residential property, freehold property, or a new or existing leasehold over the government’s tax threshold. The amount you pay depends on the purchase price, whether you are a first-time buyer, UK resident, or buying an additional property.

To calculate the stamp duty, you can use calculators from trusted financial providers such as KIS Finance. Current stamp duty rates generally follow this structure:

- No SDLT on properties under £250,000

- Progressive rates on the portion above £250,000

- First-time buyers relief lowers costs for qualifying purchases

Why does stamp duty generate so much revenue?

Stamp duty is one of the largest sources of property-related tax revenue for the UK government.

It provides billions of pounds annually to fund public services, housing, and infrastructure. The tax is simple to collect because it is paid at the time of a property purchase and applies to land transactions that exceed specific thresholds.

UK residents and non-UK residents both contribute through Stamp Duty Land Tax (SDLT) on residential properties and additional properties. The system’s stability and predictability make it a preferred revenue stream compared to recurring property taxes.

| Property Type | Purchase Price | SDLT Rate |

| Up to £250,000 | £0 | 0% |

| £250,001-£925,000 | Portion taxed | 5% |

| £925,001-£1.5 million | Portion taxed | 10% |

| Over £1.5 million | Remaining portion | 12% |

Would removing stamp duty make housing more affordable?

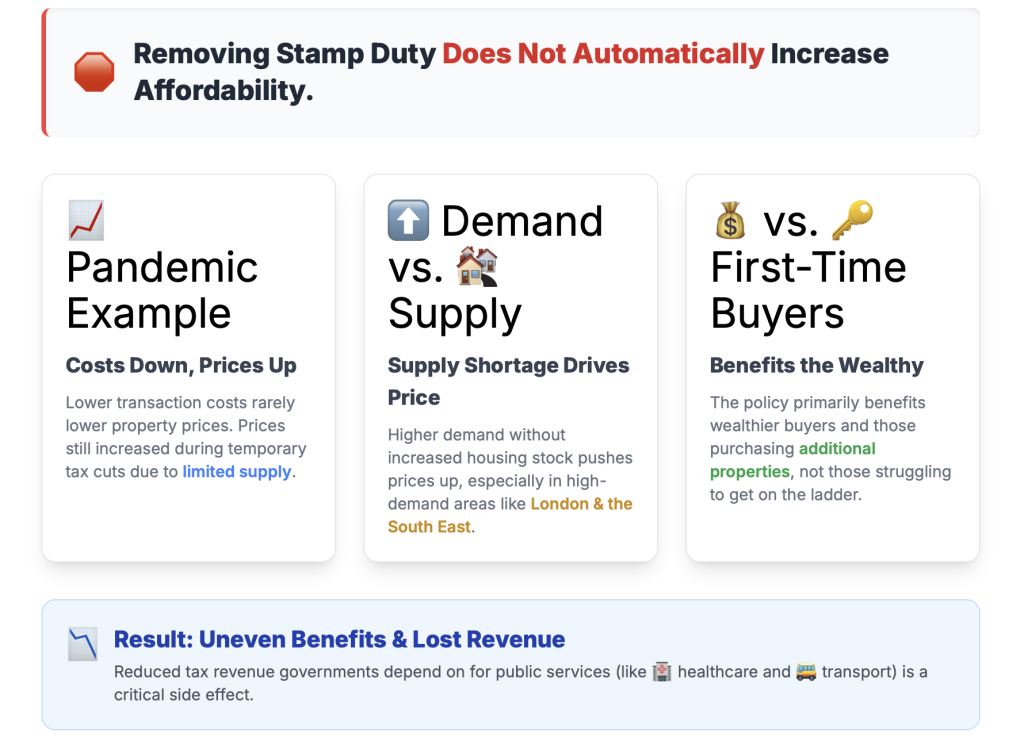

Removing stamp duty would not automatically make housing more affordable.

Economic research shows that lower transaction costs rarely translate into lower property prices. For example, when stamp duty was reduced temporarily during the pandemic, property prices still increased due to limited housing supply. The policy benefited wealthier property buyers and those purchasing additional residential properties, rather than first-time buyers.

Moreover, higher demand without an increase in housing supply often pushes prices upward, especially in London and the South East. The result is uneven benefits and reduced tax revenue that governments depend on for public services.

Moreover, higher demand without an increase in housing supply often pushes prices upward, especially in London and the South East. The result is uneven benefits and reduced tax revenue that governments depend on for public services.

What are the alternatives and why don’t they work better?

Some experts propose replacing stamp duty with an annual property tax or higher council tax based on market value.

These ideas aim to make the system fairer but often create new problems. For example, older UK residents living in high-value residential properties could face unaffordable yearly bills. Political resistance also limits support for such reforms.

Main issues with alternatives are:

- Administrative complexity for frequent property valuations

- Disproportionate impact on low-income or retired homeowners

- Regional inequality between England and Northern Ireland

- Risk of lower government revenue from unpredictable land transactions

Could stamp duty be reformed instead of abolished?

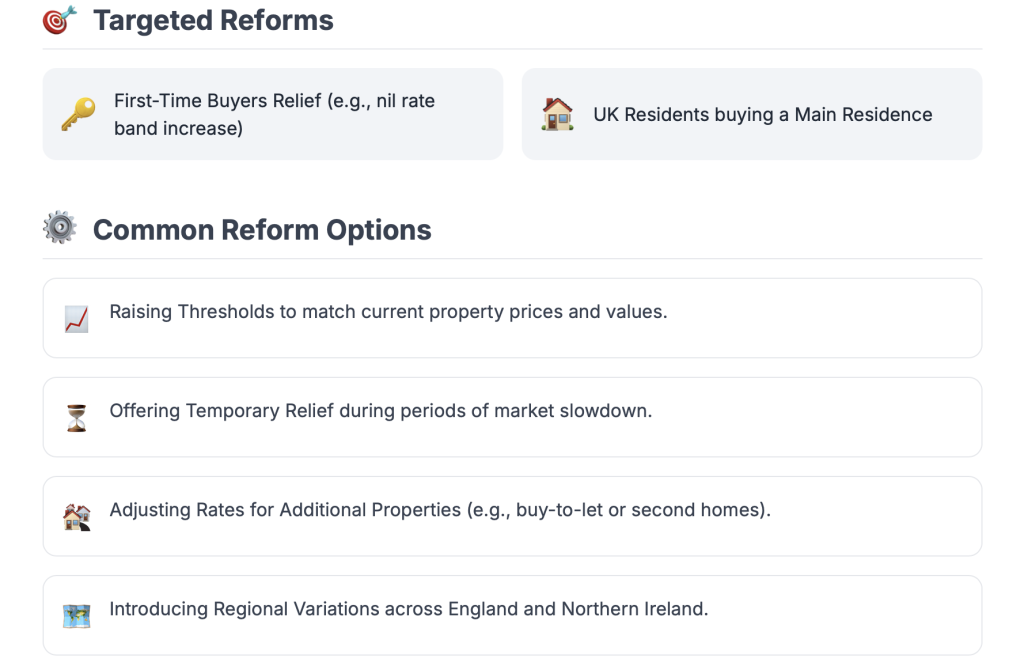

Governments prefer adjusting stamp duty instead of removing it.

Common reform options are:

- Raising thresholds to match current property prices

- Offering temporary relief during market slowdowns

- Adjusting stamp duty rates for additional properties

- Introducing regional variations across England and Northern Ireland

What does the future hold for stamp duty policy?

Most analysts expect stamp duty to remain a stable part of UK tax policy.

The government continues to rely on Stamp Duty Land Tax (SDLT) to support its budget and infrastructure spending. While public debate calls for reform, large-scale abolition appears unlikely without a replacement revenue source.

Summary: Why stamp duty will stay

Stamp duty remains one of the most reliable property taxes in the UK, generating steady revenue for public spending.

The tax is easy to collect, applies to all major land transactions, and covers both residential and additional properties. Replacing it with another system would create financial and political challenges.

In summary, stamp duty will likely continue because:

- It funds essential government services without complex administration

- Alternative tax systems risk higher costs and public resistance

- Adjustments to stamp duty rates and thresholds are simpler than full reform

- The UK property market depends on its predictable structure

FAQs

1. What is stamp duty?

Stamp duty is a property tax charged on most land and property transactions in England and Northern Ireland. Known officially as Stamp Duty Land Tax (SDLT), it applies when the purchase price of a residential property, freehold property, or leasehold sale exceeds the government-set threshold. The amount you pay depends on factors such as property value, whether you are a first-time buyer, a UK resident, or buying an additional property.

2. How much is stamp duty in the UK now?

The current stamp duty rates in England and Northern Ireland start at 0% for properties up to £250,000. Buyers pay 5% on the portion between £250,001 and £925,000, 10% between £925,001 and £1.5 million, and 12% on the remaining amount above that. First-time buyers relief allows eligible first-time buyers to pay no SDLT on properties up to £425,000 and a reduced rate on the next £200,000.

3. Who has to pay stamp duty?

Anyone purchasing a residential property or land above the nil rate band must pay stamp duty. Both UK residentsand non-UK residents are liable, although non-residents pay a 2% higher rate. You must file an SDLT return and pay within 14 days of completion. The buyer, not the seller, is legally responsible for the payment.

4. How do I calculate stamp duty?

You can calculate the stamp duty owed using online calculators from trusted financial providers such as KIS Finance. These calculators take into account your purchase price, residency status, property type, and whether you are a first-time buyer. For example, a UK resident buying a main residence for £300,000 would pay 0% on the first £250,000 and 5% on the remaining £50,000, resulting in an SDLT of £2,500.

5. Do I pay stamp duty on a second home or buy-to-let property?

Yes. Purchases of additional residential properties, such as a second home or buy-to-let investment, incur a 3% higher rate of stamp duty land tax on top of standard rates. This applies to UK residents, non-UK residents, and companies purchasing additional residential properties in England and Northern Ireland.

6. Are there exemptions or reliefs from stamp duty?

Certain groups receive relief from duty land tax (SDLT). First-time buyers receive discounted rates, while some shared ownership schemes allow partial payments. No SDLT applies on properties transferred through divorce settlements or inheritance. Specific leasehold sales and freehold property buy-backs may also qualify for exemptions depending on the market value and ownership structure.